T0@st

News Editor

- Joined

- Mar 7, 2023

- Messages

- 2,204 (3.21/day)

- Location

- South East, UK

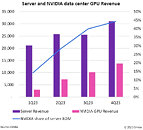

Omdia, an independent analyst and consultancy firm, has bestowed the title of "Kingmaker" on NVIDIA—thanks to impressive 2023 results in the data server market. The research firm predicts very buoyant numbers for the financial year of 2024—their February Cloud and Datacenter Market snapshot/report guesstimates that Team Green's data center GPU business group has the potential to rake in $87 billion of revenue. Omdia's forecast is based on last year's numbers—Jensen & Co. managed to pull in $34 billion, courtesy of an unmatched/dominant position in the AI GPU industry sector. Analysts have estimated a 150% rise in revenues for in 2024—the majority of popular server manufacturers are reliant on NVIDIA's supply of chips. Super Micro Computer Inc. CEO—Charles Liang—disclosed that his business is experiencing strong demand for cutting-edge server equipment, but complications have slowed down production: "once we have more supply from the chip companies, from NVIDIA, we can ship more to customers."

Demand for AI inference in 2023 accounted for 40% of NVIDIA data center GPU revenue—according Omdia's expert analysis—they predict further growth this year. Team Green's comfortable AI-centric business model could expand to a greater extent—2023 market trends indicated that enterprise customers had spent less on acquiring/upgrading traditional server equipment. Instead, they prioritized the channeling of significant funds into "AI heavyweight hardware." Omdia's report discussed these shifted priorities: "This reaffirms our thesis that end users are prioritizing investment in highly configured server clusters for AI to the detriment of other projects, including delaying the refresh of older server fleets." Late February reports suggest that NVIDIA H100 GPU supply issues are largely resolved—with much improved production timeframes. Insiders at unnamed AI-oriented organizations have admitted that leadership has resorted to selling-off of excess stock. The Omdia forecast proposes—somewhat surprisingly—that H100 GPUs will continue to be "supply-constrained" throughout 2024.

View at TechPowerUp Main Site | Source

Demand for AI inference in 2023 accounted for 40% of NVIDIA data center GPU revenue—according Omdia's expert analysis—they predict further growth this year. Team Green's comfortable AI-centric business model could expand to a greater extent—2023 market trends indicated that enterprise customers had spent less on acquiring/upgrading traditional server equipment. Instead, they prioritized the channeling of significant funds into "AI heavyweight hardware." Omdia's report discussed these shifted priorities: "This reaffirms our thesis that end users are prioritizing investment in highly configured server clusters for AI to the detriment of other projects, including delaying the refresh of older server fleets." Late February reports suggest that NVIDIA H100 GPU supply issues are largely resolved—with much improved production timeframes. Insiders at unnamed AI-oriented organizations have admitted that leadership has resorted to selling-off of excess stock. The Omdia forecast proposes—somewhat surprisingly—that H100 GPUs will continue to be "supply-constrained" throughout 2024.

View at TechPowerUp Main Site | Source