TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,452 (2.47/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

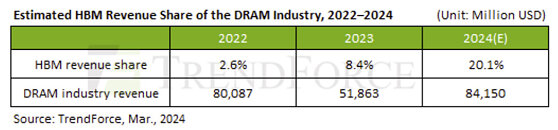

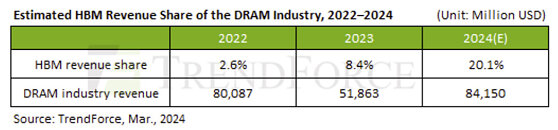

TrendForce reports that significant capital investments have occurred in the memory sector due to the high ASP and profitability of HBM. Senior Vice President Avril Wu notes that by the end of 2024, the DRAM industry is expected to allocate approximately 250K/m (14%) of total capacity to producing HBM TSV, with an estimated annual supply bit growth of around 260%. Additionally, HBM's revenue share within the DRAM industry—around 8.4% in 2023—is projected to increase to 20.1% by the end of 2024.

HBM supply tightens with order volumes rising continuously into 2024

Wu explains that in terms of production differences between HBM and DDR5, the die size of HBM is generally 35-45% larger than DDR5 of the same process and capacity (for example, 24Gb compared to 24Gb). The yield rate (including TSV packaging) for HBM is approximately 20-30% lower than that of DDR5, and the production cycle (including TSV) is 1.5 to 2 months longer than DDR5.

Buyers eager for sufficient supply will need to lock in their orders earlier thanks to HBM's longer production cycle of over two quarters from wafer start to final packaging. TrendForce has learned that most orders for 2024 have already been submitted to suppliers and are non-cancellable unless there are failures in validation.

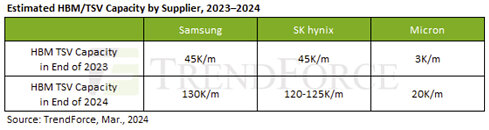

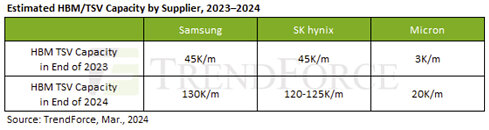

Samsung and SK hynix have the most aggressive HBM production plans by the end of this year. Samsung's total HBM capacity is expected to reach around 130K (including TSV) by year-end; SK hynix is around 120K, though capacity may vary based on validation progress and customer orders. Regarding market share for current mainstream HBM3 products, SK hynix holds over 90% of the HBM3 market, while Samsung is expected to closely follow with the gradual release of AMD's MI300 over the next few quarters.

View at TechPowerUp Main Site | Source

HBM supply tightens with order volumes rising continuously into 2024

Wu explains that in terms of production differences between HBM and DDR5, the die size of HBM is generally 35-45% larger than DDR5 of the same process and capacity (for example, 24Gb compared to 24Gb). The yield rate (including TSV packaging) for HBM is approximately 20-30% lower than that of DDR5, and the production cycle (including TSV) is 1.5 to 2 months longer than DDR5.

Buyers eager for sufficient supply will need to lock in their orders earlier thanks to HBM's longer production cycle of over two quarters from wafer start to final packaging. TrendForce has learned that most orders for 2024 have already been submitted to suppliers and are non-cancellable unless there are failures in validation.

Samsung and SK hynix have the most aggressive HBM production plans by the end of this year. Samsung's total HBM capacity is expected to reach around 130K (including TSV) by year-end; SK hynix is around 120K, though capacity may vary based on validation progress and customer orders. Regarding market share for current mainstream HBM3 products, SK hynix holds over 90% of the HBM3 market, while Samsung is expected to closely follow with the gradual release of AMD's MI300 over the next few quarters.

View at TechPowerUp Main Site | Source