TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,438 (2.47/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

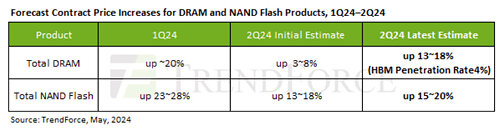

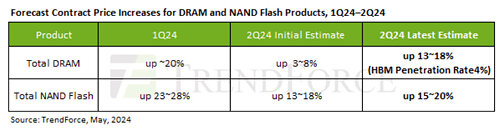

TrendForce's latest forecasts reveal contract prices for DRAM in the second quarter are expected to increase by 13-18%, while NAND Flash contract prices have been adjusted to a 15-20% Only eMMC/UFS will be seeing a smaller price increase of about 10%.

Before the 4/03 earthquake, TrendForce had initially predicted that DRAM contract prices would see a seasonal rise of 3-8% and NAND Flash 13-18%, significantly tapering from Q1 as seen from spot price indicators which showed weakening price momentum and reduced transaction volumes. This was primarily due to subdued demand outside of AI applications, particularly with no signs of recovery in demand for notebooks and smartphones. Inventory levels were gradually increasing, especially among PC OEMs. Additionally, with DRAM and NAND Flash prices having risen for 2-3 consecutive quarters, the willingness of buyers to accept further substantial price increases had diminished.

Post-earthquake, the market heard scattered reports of PC OEM suppliers accepting significant increases in DRAM and NAND Flash contract prices due to special considerations, but these were isolated transactions. By late April—after a new round of contract price negotiations were completed—the increases were larger than initially expected. This pushed TrendForce to revise upward Q2 contract price increases for both DRAM and NAND Flash, reflecting not only the buyers' desire to support the value of their inventories but also considerations of supply and demand prospects for the AI market.

TrendForce reports that manufacturers are wary of potential crowding out effects on HBM capacity. Specifically, Samsung's HBM3e products, which utilize the 1alpha process node, are projected to use about 60% of this capacity by the end of 2024. This substantial allocation is expected to constrict DDR5 suppliers, particularly as HBM3e production significantly increases in Q3. In response, buyers are strategically increasing their stock in Q2 to prepare for anticipated HBM shortages beginning in the third quarter.

As energy efficiency becomes increasingly crucial for AI inference servers, North American CSPs are adopting QLC enterprise SSDs as their preferred storage solutions. This shift is boosting demand for QLC enterprise SSDs causing rapid inventory depletion among some suppliers and making them hesitant to sell. Additionally, due to the uncertain recovery in consumer product demand, suppliers are generally conservative about capital investments in non-HBM wafer capacities, particularly for NAND Flash, which is currently priced at the breakeven point.

View at TechPowerUp Main Site | Source

Before the 4/03 earthquake, TrendForce had initially predicted that DRAM contract prices would see a seasonal rise of 3-8% and NAND Flash 13-18%, significantly tapering from Q1 as seen from spot price indicators which showed weakening price momentum and reduced transaction volumes. This was primarily due to subdued demand outside of AI applications, particularly with no signs of recovery in demand for notebooks and smartphones. Inventory levels were gradually increasing, especially among PC OEMs. Additionally, with DRAM and NAND Flash prices having risen for 2-3 consecutive quarters, the willingness of buyers to accept further substantial price increases had diminished.

Post-earthquake, the market heard scattered reports of PC OEM suppliers accepting significant increases in DRAM and NAND Flash contract prices due to special considerations, but these were isolated transactions. By late April—after a new round of contract price negotiations were completed—the increases were larger than initially expected. This pushed TrendForce to revise upward Q2 contract price increases for both DRAM and NAND Flash, reflecting not only the buyers' desire to support the value of their inventories but also considerations of supply and demand prospects for the AI market.

TrendForce reports that manufacturers are wary of potential crowding out effects on HBM capacity. Specifically, Samsung's HBM3e products, which utilize the 1alpha process node, are projected to use about 60% of this capacity by the end of 2024. This substantial allocation is expected to constrict DDR5 suppliers, particularly as HBM3e production significantly increases in Q3. In response, buyers are strategically increasing their stock in Q2 to prepare for anticipated HBM shortages beginning in the third quarter.

As energy efficiency becomes increasingly crucial for AI inference servers, North American CSPs are adopting QLC enterprise SSDs as their preferred storage solutions. This shift is boosting demand for QLC enterprise SSDs causing rapid inventory depletion among some suppliers and making them hesitant to sell. Additionally, due to the uncertain recovery in consumer product demand, suppliers are generally conservative about capital investments in non-HBM wafer capacities, particularly for NAND Flash, which is currently priced at the breakeven point.

View at TechPowerUp Main Site | Source