- Joined

- May 21, 2024

- Messages

- 935 (3.38/day)

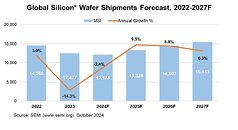

Global shipments of silicon wafers are projected to decline 2% in 2024 to 12,174 million square inches (MSI) with a strong rebound of 10% delayed until 2025 to reach 13,328 MSI as wafer demand continues to recover from the downcycle, SEMI reported today in its annual silicon shipment forecast.

Strong silicon wafer shipment growth is expected to continue through 2027 to meet increasing demand related to AI and advanced processing, driving improved fab utilization rate for global semiconductor production capacity. Moreover, new applications in advanced packaging and high-bandwidth memory (HBM) production, which require additional wafers, are contributing to the rising need for silicon wafers. Such applications include temporary or permanent carrier wafers, interposers, device separation into chiplets, and memory/logic array separation.

Silicon wafers are the fundamental building material for the majority of semiconductors, which are vital components of all electronic devices. The highly engineered thin disks, produced in diameters of up to 300 mm, serve as the substrate material on which most semiconductor devices, or chips, are fabricated.

All data cited in this release include polished silicon wafers and epitaxial silicon wafers shipped by wafer manufacturers to end users. The data does not include non-polished or reclaimed wafers.

The SEMI annual silicon shipment forecast is developed based on input from the members of the Silicon Manufacturers Group (SMG). The SMG is a sub-committee of the SEMI Electronic Materials Group (EMG) and is open to SEMI members involved in manufacturing polycrystalline silicon, monocrystalline silicon or silicon wafers (e.g., as cut, polished, epi). The SMG facilitates collective efforts on issues related to the silicon industry including the development of market information and statistics about the silicon and semiconductor industries.

View at TechPowerUp Main Site | Source

Strong silicon wafer shipment growth is expected to continue through 2027 to meet increasing demand related to AI and advanced processing, driving improved fab utilization rate for global semiconductor production capacity. Moreover, new applications in advanced packaging and high-bandwidth memory (HBM) production, which require additional wafers, are contributing to the rising need for silicon wafers. Such applications include temporary or permanent carrier wafers, interposers, device separation into chiplets, and memory/logic array separation.

Silicon wafers are the fundamental building material for the majority of semiconductors, which are vital components of all electronic devices. The highly engineered thin disks, produced in diameters of up to 300 mm, serve as the substrate material on which most semiconductor devices, or chips, are fabricated.

All data cited in this release include polished silicon wafers and epitaxial silicon wafers shipped by wafer manufacturers to end users. The data does not include non-polished or reclaimed wafers.

The SEMI annual silicon shipment forecast is developed based on input from the members of the Silicon Manufacturers Group (SMG). The SMG is a sub-committee of the SEMI Electronic Materials Group (EMG) and is open to SEMI members involved in manufacturing polycrystalline silicon, monocrystalline silicon or silicon wafers (e.g., as cut, polished, epi). The SMG facilitates collective efforts on issues related to the silicon industry including the development of market information and statistics about the silicon and semiconductor industries.

View at TechPowerUp Main Site | Source