- Joined

- May 21, 2024

- Messages

- 896 (3.36/day)

Intel Corporation today reported third-quarter 2024 financial results.

"Our Q3 results underscore the solid progress we are making against the plan we outlined last quarter to reduce costs, simplify our portfolio and improve organizational efficiency. We delivered revenue above the midpoint of our guidance, and are acting with urgency to position the business for sustainable value creation moving forward," said Pat Gelsinger, Intel CEO. "The momentum we are building across our product portfolio to maximize the value of our x86 franchise, combined with the strong interest Intel 18A is attracting from foundry customers, reflects the impact of our actions and the opportunities ahead."

"Restructuring charges meaningfully impacted Q3 profitability as we took important steps toward our cost reduction goal," said David Zinsner, Intel CFO. "The actions we took this quarter position us for improved profitability and enhanced liquidity as we continue to execute our strategy. We are encouraged by improved underlying trends, reflected in our Q4 guidance."

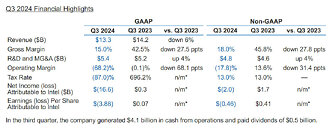

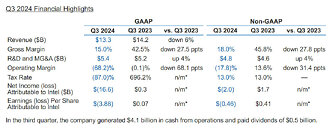

Q3 2024 Financial Highlights

In the third quarter, the company generated $4.1 billion in cash from operations and paid dividends of $0.5 billion.

Q3 2024 Restructuring and Impairment Charges

In the third quarter, the company made significant progress on its $10 billion cost reduction plan. The plan aims to drive operational efficiency and agility, accelerate profitable growth and create capacity for ongoing strategic investment in technology and manufacturing leadership. These initiatives include structural and operating realignment across the company, alongside reductions in headcount, operating expenses and capital expenditures. As a result of these actions, the company recognized $2.8 billion in restructuring charges in Q3 2024, $528 million of which are non-cash charges and $2.2 billion of which will be cash settled in the future.

Intel's third quarter results were also materially impacted by the following charges:

The restructuring charges of $2.8 billion and the asset impairment charges, including the allowance against our deferred tax assets, and accelerated depreciation of $15.9 billion increased GAAP loss per share attributable to Intel by $3.89. The restructuring charges, impairments of goodwill and intangible assets, and deferred tax asset valuation allowance had no impact on non-GAAP loss per share attributable to Intel. The impairment charges and accelerated depreciation for certain manufacturing assets of $3.1 billion increased GAAP and non-GAAP loss per share attributable to Intel by $0.57 and $0.63 per share, respectively. These charges were not incorporated into the guidance Intel provided for the third quarter of 2024.

Business Unit Summary

In October 2022, Intel announced an internal foundry operating model, which took effect in the first quarter of 2024 and created a foundry relationship between its Intel Products business (collectively CCG, DCAI and NEX) and its Intel Foundry business (including Foundry Technology Development, Foundry Manufacturing and Supply Chain and Foundry Services, formerly IFS). The foundry operating model is designed to reshape operational dynamics and drive greater transparency, accountability, and focus on costs and efficiency. In furtherance of Intel's internal foundry operating model, Intel announced in the third quarter of 2024 its intent to establish Intel Foundry as an independent subsidiary. The company also previously announced its intent to operate Altera as a standalone business beginning in the first quarter of 2024. Altera was previously included in DCAI's segment results. As a result of these changes, the company modified its segment reporting in the first quarter of 2024 to align to this new operating model. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally receives information and manages and monitors its operating segment performance starting in fiscal year 2024. There are no changes to Intel's consolidated financial statements for any prior periods.

Intel Products Highlights

Intel Foundry Highlights

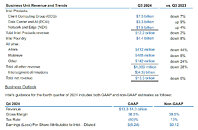

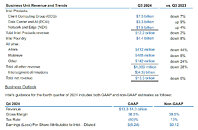

Business Outlook

Intel's guidance for the fourth quarter of 2024 includes both GAAP and non-GAAP estimates as follows:

Q4 2024 / GAAP / Non-GAAP

Revenue $13.3-14.3 billion

Gross Margin 36.5% / 39.5%

Tax Rate (50)% / 13%

Earnings (Loss) Per Share Attributable to Intel—Diluted $(0.24) $0.12

Reconciliations between GAAP and non-GAAP financial measures are included below. Actual results may differ materially from Intel's business outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below. The gross margin and EPS outlook are based on the mid-point of the revenue range.

View at TechPowerUp Main Site | Source

"Our Q3 results underscore the solid progress we are making against the plan we outlined last quarter to reduce costs, simplify our portfolio and improve organizational efficiency. We delivered revenue above the midpoint of our guidance, and are acting with urgency to position the business for sustainable value creation moving forward," said Pat Gelsinger, Intel CEO. "The momentum we are building across our product portfolio to maximize the value of our x86 franchise, combined with the strong interest Intel 18A is attracting from foundry customers, reflects the impact of our actions and the opportunities ahead."

"Restructuring charges meaningfully impacted Q3 profitability as we took important steps toward our cost reduction goal," said David Zinsner, Intel CFO. "The actions we took this quarter position us for improved profitability and enhanced liquidity as we continue to execute our strategy. We are encouraged by improved underlying trends, reflected in our Q4 guidance."

Q3 2024 Financial Highlights

In the third quarter, the company generated $4.1 billion in cash from operations and paid dividends of $0.5 billion.

Q3 2024 Restructuring and Impairment Charges

In the third quarter, the company made significant progress on its $10 billion cost reduction plan. The plan aims to drive operational efficiency and agility, accelerate profitable growth and create capacity for ongoing strategic investment in technology and manufacturing leadership. These initiatives include structural and operating realignment across the company, alongside reductions in headcount, operating expenses and capital expenditures. As a result of these actions, the company recognized $2.8 billion in restructuring charges in Q3 2024, $528 million of which are non-cash charges and $2.2 billion of which will be cash settled in the future.

Intel's third quarter results were also materially impacted by the following charges:

- $3.1 billion of charges, substantially all of which were recognized in cost of sales, related to non-cash impairments and the acceleration of depreciation for certain manufacturing assets, a substantial majority of which related to the Intel 7 process node, based upon an evaluation of current process technology node capacities relative to projected market demand for Intel products and services;

- $2.9 billion of non-cash charges associated with the impairment of goodwill for certain reporting units - primarily the Mobileye reporting unit - as well as certain acquired intangible assets; and

- $9.9 billion of non-cash charges related to the establishment of a valuation allowance against U.S. deferred tax assets.

The restructuring charges of $2.8 billion and the asset impairment charges, including the allowance against our deferred tax assets, and accelerated depreciation of $15.9 billion increased GAAP loss per share attributable to Intel by $3.89. The restructuring charges, impairments of goodwill and intangible assets, and deferred tax asset valuation allowance had no impact on non-GAAP loss per share attributable to Intel. The impairment charges and accelerated depreciation for certain manufacturing assets of $3.1 billion increased GAAP and non-GAAP loss per share attributable to Intel by $0.57 and $0.63 per share, respectively. These charges were not incorporated into the guidance Intel provided for the third quarter of 2024.

Business Unit Summary

In October 2022, Intel announced an internal foundry operating model, which took effect in the first quarter of 2024 and created a foundry relationship between its Intel Products business (collectively CCG, DCAI and NEX) and its Intel Foundry business (including Foundry Technology Development, Foundry Manufacturing and Supply Chain and Foundry Services, formerly IFS). The foundry operating model is designed to reshape operational dynamics and drive greater transparency, accountability, and focus on costs and efficiency. In furtherance of Intel's internal foundry operating model, Intel announced in the third quarter of 2024 its intent to establish Intel Foundry as an independent subsidiary. The company also previously announced its intent to operate Altera as a standalone business beginning in the first quarter of 2024. Altera was previously included in DCAI's segment results. As a result of these changes, the company modified its segment reporting in the first quarter of 2024 to align to this new operating model. All prior-period segment data has been retrospectively adjusted to reflect the way the company internally receives information and manages and monitors its operating segment performance starting in fiscal year 2024. There are no changes to Intel's consolidated financial statements for any prior periods.

Intel Products Highlights

- Intel announced plans with AMD to create the x86 Ecosystem Advisory Group, bringing together leaders from across the industry to help shape the future of x86. The Ecosystem Advisory Group is focused on simplifying software development, ensuring interoperability and interface consistency across vendors and providing developers with standard architectural tools and instructions. Broadcom, Dell, Google, HPE, HP Inc., Lenovo, Meta, Microsoft, Oracle, Red Hat have signed on as founding members.

- CCG: Intel continues to lead the AI PC category and is on track to ship more than 100 million AI PCs by the end of 2025. In September, Intel launched its Intel Core Ultra 200V series processors, code-named Lunar Lake, delivering several more hours of battery life and gains in performance, graphics and AI. This month, Intel launched the new Intel Core Ultra 200S processors, code-named Arrow Lake, that will scale AI PC capabilities to desktop platforms and usher in the first enthusiast desktop AI PCs.

- DCAI: Intel launched Intel Xeon, doubling the performance of the prior generation with increased core counts, memory bandwidth, and embedded AI acceleration. Intel also launched its Intel Gaudi 3 AI accelerators, delivering twice the networking bandwidth and 1.5x the memory bandwidth of its predecessor for large language model efficiency. IBM and Intel announced a global collaboration to deploy Intel Gaudi 3 AI accelerators as a service on IBM Cloud, aiming to help more cost-effectively scale enterprise AI and drive innovation underpinned with security and resiliency.

- NEX: Intel achieved a significant design win earlier this month with KDDI, a major global telecom, announcing its selection of Samsung's vRAN 3.0 solution powered by 4th Gen Intel Xeon Scalable processors with Intel vRAN Boost.

Intel Foundry Highlights

- Intel's fifth node in four years, Intel 18A, will complete a historic pace of design and process innovation, returning Intel to process leadership. Intel 18A is healthy and continues to progress well, and the company's two lead products, Panther Lake for client and Clearwater Forest for servers, have met early Intel 18A milestones ahead of next year's launches.

- Intel and Amazon Web Services (AWS) are finalizing a multi-year, multi-billion-dollar commitment to expand the companies' existing partnership to include a new custom Xeon 6 chip for AWS on Intel 3 and a new AI fabric chip for AWS on Intel 18A.

- The Biden-Harris Administration announced that Intel was awarded up to $3 billion in direct funding under the CHIPS and Science Act for the Secure Enclave program. The program is designed to expand the trusted manufacturing of leading-edge semiconductors for the U.S. government and fortify the domestic semiconductor supply chain.

- Intel announced its intention to establish Intel Foundry as an independent subsidiary. This structure provides clearer separation for external foundry customers and suppliers between Intel Foundry and Intel Products. It also gives Intel future flexibility to evaluate independent sources of funding and optimize the capital structure of Intel Foundry and Intel Products.

Business Outlook

Intel's guidance for the fourth quarter of 2024 includes both GAAP and non-GAAP estimates as follows:

Q4 2024 / GAAP / Non-GAAP

Revenue $13.3-14.3 billion

Gross Margin 36.5% / 39.5%

Tax Rate (50)% / 13%

Earnings (Loss) Per Share Attributable to Intel—Diluted $(0.24) $0.12

Reconciliations between GAAP and non-GAAP financial measures are included below. Actual results may differ materially from Intel's business outlook as a result of, among other things, the factors described under "Forward-Looking Statements" below. The gross margin and EPS outlook are based on the mid-point of the revenue range.

View at TechPowerUp Main Site | Source