- Joined

- Aug 19, 2017

- Messages

- 2,915 (1.05/day)

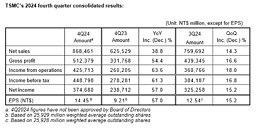

TSMC (TWSE: 2330, NYSE: TSM) today announced consolidated revenue of NT$868.46 billion, net income of NT$374.68 billion, and diluted earnings per share of NT$14.45 (US$2.24 per ADR unit) for the fourth quarter ended December 31, 2024. Year-over-year, fourth quarter revenue increased 38.8% while net income and diluted EPS both increased 57.0%. Compared to third quarter 2024, fourth quarter results represented a 14.3% increase in revenue and a 15.2% increase in net income. All figures were prepared in accordance with TIFRS on a consolidated basis.

In US dollars, fourth quarter revenue was $26.88 billion, which increased 37.0% year-over-year and increased 14.4% from the previous quarter. Gross margin for the quarter was 59.0%, operating margin was 49.0%, and net profit margin was 43.1%. In the fourth quarter, shipments of 3-nanometer accounted for 26% of total wafer revenue; 5-nanometer accounted for 34%; 7-nanometer accounted for 14%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 74% of total wafer revenue.

"Our business in the fourth quarter was supported by strong demand for our industry-leading 3 nm and 5 nm technologies," said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. "Moving into first quarter 2025, we expect our business to be impacted by smartphone seasonality, partially offset by continued growth in AI-related demand."

Based on the Company's current business outlook, management expects the overall performance for first quarter 2025 to be as follows:

View at TechPowerUp Main Site

In US dollars, fourth quarter revenue was $26.88 billion, which increased 37.0% year-over-year and increased 14.4% from the previous quarter. Gross margin for the quarter was 59.0%, operating margin was 49.0%, and net profit margin was 43.1%. In the fourth quarter, shipments of 3-nanometer accounted for 26% of total wafer revenue; 5-nanometer accounted for 34%; 7-nanometer accounted for 14%. Advanced technologies, defined as 7-nanometer and more advanced technologies, accounted for 74% of total wafer revenue.

"Our business in the fourth quarter was supported by strong demand for our industry-leading 3 nm and 5 nm technologies," said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. "Moving into first quarter 2025, we expect our business to be impacted by smartphone seasonality, partially offset by continued growth in AI-related demand."

Based on the Company's current business outlook, management expects the overall performance for first quarter 2025 to be as follows:

- Revenue is expected to be between US$25.0 billion and US$25.8 billion;

- And, based on the exchange rate assumption of 1 US dollar to 32.8 NT dollars,

- Gross profit margin is expected to be between 57% and 59%;

- Operating profit margin is expected to be between 46.5% and 48.5%.

- The management further expects the 2025 capital budget to be between US$38 billion and US$42 billion.

View at TechPowerUp Main Site