T0@st

News Editor

- Joined

- Mar 7, 2023

- Messages

- 2,727 (3.65/day)

- Location

- South East, UK

| System Name | The TPU Typewriter |

|---|---|

| Processor | AMD Ryzen 5 5600 (non-X) |

| Motherboard | GIGABYTE B550M DS3H Micro ATX |

| Cooling | DeepCool AS500 |

| Memory | Kingston Fury Renegade RGB 32 GB (2 x 16 GB) DDR4-3600 CL16 |

| Video Card(s) | PowerColor Radeon RX 7800 XT 16 GB Hellhound OC |

| Storage | Samsung 980 Pro 1 TB M.2-2280 PCIe 4.0 X4 NVME SSD |

| Display(s) | Lenovo Legion Y27q-20 27" QHD IPS monitor |

| Case | GameMax Spark M-ATX (re-badged Jonsbo D30) |

| Audio Device(s) | FiiO K7 Desktop DAC/Amp + Philips Fidelio X3 headphones, or ARTTI T10 Planar IEMs |

| Power Supply | ADATA XPG CORE Reactor 650 W 80+ Gold ATX |

| Mouse | Roccat Kone Pro Air |

| Keyboard | Cooler Master MasterKeys Pro L |

| Software | Windows 10 64-bit Home Edition |

Inside sources—familiar with goings-ons at leading DRAM manufacturing firms—have predicted the end of DDR3 and DDR4 production lines. According to a DigiTimes Asia report (citing Nikkei), industry observers have noticed that the DRAM market is undergoing a so-called "shift." They believe that pricing trends are decreasing due to weak demand. Samsung Electronics, SK Hynix, and Micron are named as major players; allegedly involved in devising new strategies—in reaction to fluid market circumstances. The DigiTimes insider network proposes that the big three: "may phase out DDR3 and DDR4 by 2025...by the end of 2025...anticipating a future focused on advanced memory technologies." Older standards are falling out of favor, with DDR5 and high-bandwidth memory (HBM) on the ascent. Industry watchdogs reckon that possible DDR3 and DDR4 supply shortages could occur "post-summer 2025."

Taiwan's Nanya Technology has predicted that the overall DRAM market will "bottom out" within the first half of 2025. An eventual recovery is envisioned by the second quarter; AI-related demands could help drive up demand by a large margin. Additionally, Nanya points to improved inventory management and global economic stimulus. Taiwanese DRAM production houses are expected to pick up some slack, but an unnamed "key component distributor" anticipates serious after-effects. An anonymous source believes that the: "anticipated halt in production could lead to significant supply constraints, challenging market dynamics and impacting pricing strategies." Nanya Technology and Winbond Electronics produce specialized DRAM-types; therefore are not touted to be great gap fillers. The latter is reportedly reacting to weak demand for "mature" DDR products—DigiTimes commented on this development: "Winbond Electronics is advancing its manufacturing by transitioning to a 16 nm process in the latter half of 2025. This upgrade from the current 20 nm process, primarily used for 4 Gb DDR3 and DDR4, will enable Winbond to produce 8 Gb DDR memory."

As reported by Tom's Hardware; Changxin Memory Technology (CXMT) and Fujian Jinhua have ramped up DDR4 production and implemented aggressive pricing, thus making it difficult for market leaders to compete. Late last year, the tech news cycle pointed out that Chinese DRAM manufacturers were offering products at half of the price of South Korean-produced equivalents. Constraints, predicted in the second half of 2025, could spell difficult conditions for Chinese DRAM producers. Tom's Hardware believes that: "some industrial customers are unlikely to adopt China-made DRAMs, and are more likely to adopt specialized memory from Nanya and Winbond instead."

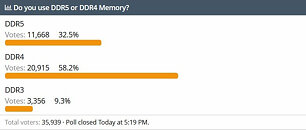

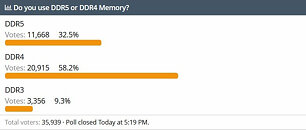

TechPowerUp's news feed history contains a small smattering of new DDR4 products—for example; Biostar launched its Storming V DDR4 memory module design last December, and V-COLOR introduced a TUF Gaming Alliance-themed DDR4 Prism Pro model in November. October's cycle had Lexar lining up its THOR OC DDR4 desktop product line for release. Looking through recent-ish history, there is a lot of silence on the DDR3 front. September 2024 TPU reader poll results led to a headline article, titled "DDR4 remains a popular memory standard." 58.2% of participants registered their utilization of DDR4 parts.

View at TechPowerUp Main Site | Source

Taiwan's Nanya Technology has predicted that the overall DRAM market will "bottom out" within the first half of 2025. An eventual recovery is envisioned by the second quarter; AI-related demands could help drive up demand by a large margin. Additionally, Nanya points to improved inventory management and global economic stimulus. Taiwanese DRAM production houses are expected to pick up some slack, but an unnamed "key component distributor" anticipates serious after-effects. An anonymous source believes that the: "anticipated halt in production could lead to significant supply constraints, challenging market dynamics and impacting pricing strategies." Nanya Technology and Winbond Electronics produce specialized DRAM-types; therefore are not touted to be great gap fillers. The latter is reportedly reacting to weak demand for "mature" DDR products—DigiTimes commented on this development: "Winbond Electronics is advancing its manufacturing by transitioning to a 16 nm process in the latter half of 2025. This upgrade from the current 20 nm process, primarily used for 4 Gb DDR3 and DDR4, will enable Winbond to produce 8 Gb DDR memory."

As reported by Tom's Hardware; Changxin Memory Technology (CXMT) and Fujian Jinhua have ramped up DDR4 production and implemented aggressive pricing, thus making it difficult for market leaders to compete. Late last year, the tech news cycle pointed out that Chinese DRAM manufacturers were offering products at half of the price of South Korean-produced equivalents. Constraints, predicted in the second half of 2025, could spell difficult conditions for Chinese DRAM producers. Tom's Hardware believes that: "some industrial customers are unlikely to adopt China-made DRAMs, and are more likely to adopt specialized memory from Nanya and Winbond instead."

TechPowerUp's news feed history contains a small smattering of new DDR4 products—for example; Biostar launched its Storming V DDR4 memory module design last December, and V-COLOR introduced a TUF Gaming Alliance-themed DDR4 Prism Pro model in November. October's cycle had Lexar lining up its THOR OC DDR4 desktop product line for release. Looking through recent-ish history, there is a lot of silence on the DDR3 front. September 2024 TPU reader poll results led to a headline article, titled "DDR4 remains a popular memory standard." 58.2% of participants registered their utilization of DDR4 parts.

View at TechPowerUp Main Site | Source