- Joined

- Dec 6, 2011

- Messages

- 4,784 (1.01/day)

- Location

- Still on the East Side

Solid manufacturing and strong pricing allowed Micron Technology Inc. and Hynix Semiconductor Inc. to post strong performances in the global NAND flash business in the fourth quarter, allowing them to narrow the gap in market share between them and the industry leaders, and setting the stage for further advances in 2012.

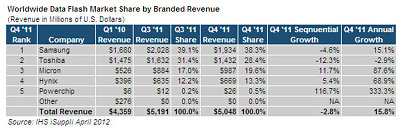

No. 3-ranked Micron Technology Inc. of the United States achieved 11.7 percent revenue growth in the fourth quarter compared to the third, according to a new IHS iSuppli Data Flash Market Tracker report from information and analytics provider IHS. Meanwhile, fourth-placed Hynix Semiconductor Inc. of South Korea expanded its revenue by 5.4 percent, as presented in the table below.

These strong performances contrasted sharply with the overall market's 2.8 percent contraction. The results from Micron and Hynix were even more remarkable when compared to the 4.6 percent decline for market leader Samsung Electronics Co. Ltd., also of South Korea; and a 12.3 percent decrease for second-ranked Toshiba Corp of Japan.

"Both Micron and Hynix managed to avoid any production issues in the fourth quarter, allowing them to keep their NAND flash production at high levels," said Michael Yang, senior principal analyst for memory and storage at IHS. "This allowed them to keep their average selling prices high. On the other hand, Samsung and Toshiba decided to throttle back production arising from concerns relating to oversupply. We believe that Micron and Hynix will continue to gain share in 2012."

Hynix, in particular, is expected to increase its share as the company engages in capital spending at a higher rate than the industry average.

Overall, Micron's NAND market share in the fourth quarter rose to 19.6 percent, up from 17 percent in the third quarter. For its part, Hynix saw its portion of market revenue increase to 13.3 percent, up from 12.2 percent.

The fourth-quarter performance of Micron and Hynix were also notable when compared to the same period in 2011. Revenue for Micron surged by 88 percent compared to a year earlier, while that of Hynix increased 69 percent.

Toshiba suffered the largest sequential decline of all of the NAND flash suppliers. However, the decrease was unrelated to the Japanese earthquake disaster, with the company having already recovered from the catastrophe before the fourth quarter. Instead, the company made a conscious decision to reduce production in the face of oversupplied market conditions.

View at TechPowerUp Main Site

No. 3-ranked Micron Technology Inc. of the United States achieved 11.7 percent revenue growth in the fourth quarter compared to the third, according to a new IHS iSuppli Data Flash Market Tracker report from information and analytics provider IHS. Meanwhile, fourth-placed Hynix Semiconductor Inc. of South Korea expanded its revenue by 5.4 percent, as presented in the table below.

These strong performances contrasted sharply with the overall market's 2.8 percent contraction. The results from Micron and Hynix were even more remarkable when compared to the 4.6 percent decline for market leader Samsung Electronics Co. Ltd., also of South Korea; and a 12.3 percent decrease for second-ranked Toshiba Corp of Japan.

"Both Micron and Hynix managed to avoid any production issues in the fourth quarter, allowing them to keep their NAND flash production at high levels," said Michael Yang, senior principal analyst for memory and storage at IHS. "This allowed them to keep their average selling prices high. On the other hand, Samsung and Toshiba decided to throttle back production arising from concerns relating to oversupply. We believe that Micron and Hynix will continue to gain share in 2012."

Hynix, in particular, is expected to increase its share as the company engages in capital spending at a higher rate than the industry average.

Overall, Micron's NAND market share in the fourth quarter rose to 19.6 percent, up from 17 percent in the third quarter. For its part, Hynix saw its portion of market revenue increase to 13.3 percent, up from 12.2 percent.

The fourth-quarter performance of Micron and Hynix were also notable when compared to the same period in 2011. Revenue for Micron surged by 88 percent compared to a year earlier, while that of Hynix increased 69 percent.

Toshiba suffered the largest sequential decline of all of the NAND flash suppliers. However, the decrease was unrelated to the Japanese earthquake disaster, with the company having already recovered from the catastrophe before the fourth quarter. Instead, the company made a conscious decision to reduce production in the face of oversupplied market conditions.

View at TechPowerUp Main Site