- Joined

- Dec 6, 2011

- Messages

- 4,784 (1.00/day)

- Location

- Still on the East Side

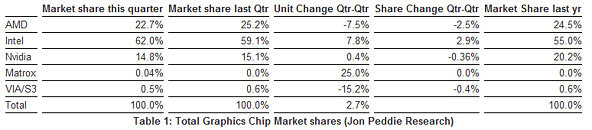

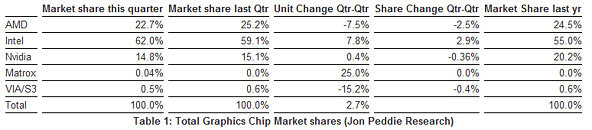

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, announced estimated graphics chip shipments and suppliers' market share for Q2'12.

The news was good, for most. Intel had gains in both desktop (13.6%) and notebook (3.8%) led mostly by Sandy Bridge. Nvidia gained in the notebook discrete segment (6%), and AMD saw gains in the discrete desktop category (2.5%).

This was a good, if not a great quarter for the suppliers. We found that graphics shipments during Q2'12 bucked the downward PC trend and rose 2.7% from last quarter as compared to -1.5% for PCs overall. GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it's shipped.

The turmoil in the PC market has caused us to modify our forecast since the last report; it is less aggressive on both desktops and notebooks. The popularity of tablets, combined with the persistent five-year recession have been contributing factors that have altered the nature of the PC market. Nonetheless, the CAGR for PC graphics from 2011 to 2016 is 6.3%, and we expect the total shipments of graphics chips in 2016 to be 688 million units.

The ten-year average change for this quarter is a growth of 2.27%. This quarter is ahead of the average with a 2.5% increase.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), Smartbooks, or ARM-based Servers.

The quarter in general

● AMD's total shipments of heterogeneous GPU/CPUs, i.e., APUs dropped 13.8% in the desktop from Q1, and 6.7% in notebooks. Ironically the company had a 55.8% increase in notebook IGPs, but it was only 300 k units.

● Intel's desktop processor-graphics EPG shipments increased from last quarter by 6.3%, and Notebooks showed double-digit growth of 13.9%.

● Nvidia's desktop discrete shipments dropped 10.4% from last quarter; however, the company increased mobile discrete shipments 19.2% largely due to share gains on Ivy Bridge which included Ultrabooks. The company will no longer report IGP shipments.

● Year to year this quarter AMD shipments declined 1.6%, Intel shipped almost 20% more parts, Nvidia shipped fewer parts (-22.0%) but that was because they exited the IGP segment and VIA saw their shipments slip by 18.2% over last year.

● Almost 126 million graphics chips shipped, up from 122 million units in Q1 quarter, and up from 118 million units shipped Q2 2011.

● Total discrete GPUs (desktop and notebook) increased a modest 0.5% from the last quarter and were down 7% from last year for the same quarter due to the same problems plaguing the overall PC, continued HDD shortage, macroeconomics, softness in western European market, and the impact of tablets. Overall the trend for discrete GPUs is up with a CAGR to 2015 of 5%.

● Ninety percent of Intel's non-server processors have graphics, and over 68% of AMD's non-server processors contain integrated graphics.

Year to year for the quarter the market increased. Shipments increased to 126 million units, up 7.1 million units from this quarter last year.

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.4 GPUs per PC.

View at TechPowerUp Main Site

The news was good, for most. Intel had gains in both desktop (13.6%) and notebook (3.8%) led mostly by Sandy Bridge. Nvidia gained in the notebook discrete segment (6%), and AMD saw gains in the discrete desktop category (2.5%).

This was a good, if not a great quarter for the suppliers. We found that graphics shipments during Q2'12 bucked the downward PC trend and rose 2.7% from last quarter as compared to -1.5% for PCs overall. GPUs are traditionally a leading indicator of the market, since a GPU goes into every system before it's shipped.

The turmoil in the PC market has caused us to modify our forecast since the last report; it is less aggressive on both desktops and notebooks. The popularity of tablets, combined with the persistent five-year recession have been contributing factors that have altered the nature of the PC market. Nonetheless, the CAGR for PC graphics from 2011 to 2016 is 6.3%, and we expect the total shipments of graphics chips in 2016 to be 688 million units.

The ten-year average change for this quarter is a growth of 2.27%. This quarter is ahead of the average with a 2.5% increase.

Our findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), Smartbooks, or ARM-based Servers.

The quarter in general

● AMD's total shipments of heterogeneous GPU/CPUs, i.e., APUs dropped 13.8% in the desktop from Q1, and 6.7% in notebooks. Ironically the company had a 55.8% increase in notebook IGPs, but it was only 300 k units.

● Intel's desktop processor-graphics EPG shipments increased from last quarter by 6.3%, and Notebooks showed double-digit growth of 13.9%.

● Nvidia's desktop discrete shipments dropped 10.4% from last quarter; however, the company increased mobile discrete shipments 19.2% largely due to share gains on Ivy Bridge which included Ultrabooks. The company will no longer report IGP shipments.

● Year to year this quarter AMD shipments declined 1.6%, Intel shipped almost 20% more parts, Nvidia shipped fewer parts (-22.0%) but that was because they exited the IGP segment and VIA saw their shipments slip by 18.2% over last year.

● Almost 126 million graphics chips shipped, up from 122 million units in Q1 quarter, and up from 118 million units shipped Q2 2011.

● Total discrete GPUs (desktop and notebook) increased a modest 0.5% from the last quarter and were down 7% from last year for the same quarter due to the same problems plaguing the overall PC, continued HDD shortage, macroeconomics, softness in western European market, and the impact of tablets. Overall the trend for discrete GPUs is up with a CAGR to 2015 of 5%.

● Ninety percent of Intel's non-server processors have graphics, and over 68% of AMD's non-server processors contain integrated graphics.

Year to year for the quarter the market increased. Shipments increased to 126 million units, up 7.1 million units from this quarter last year.

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.4 GPUs per PC.

View at TechPowerUp Main Site

with my two graphics card purchases

with my two graphics card purchases