- Joined

- Oct 9, 2007

- Messages

- 47,244 (7.54/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

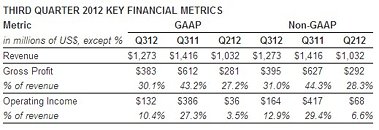

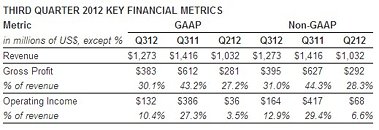

SanDisk Corporation (NASDAQ:SNDK), a global leader in flash memory storage solutions, announced today results for the third quarter ended September 30, 2012. Total third quarter revenue of $1.27 billion declined 10% on a year-over-year basis and increased 23% on a sequential basis.

On a GAAP basis, third quarter net income was $77 million, or $0.31 per diluted share, compared to net income of $233 million, or $0.96 per diluted share, in the third quarter of fiscal 2011 and $13 million, or $0.05 per diluted share, in the second quarter of fiscal 2012.

On a non-GAAP basis, third quarter net income was $118 million, or $0.48 per diluted share, compared to net income of $292 million, or $1.20 per diluted share, in the third quarter of fiscal 2011 and net income of $51 million, or $0.21 per diluted share, in the second quarter of fiscal 2012. For reconciliation of non-GAAP to GAAP results, see accompanying financial tables and footnotes.

"Our retail business delivered strong results in Q3 and we believe we gained share across all major geographies worldwide on the strength of the SanDisk brand," said Sanjay Mehrotra, president and chief executive officer of SanDisk. "Our results also reflect a solid recovery in our mobile embedded business and we made good progress toward expanding our SSD product roadmap. We believe we are well positioned to build on our business momentum and improved industry fundamentals to deliver strong sequential growth in the fourth quarter."

View at TechPowerUp Main Site

On a GAAP basis, third quarter net income was $77 million, or $0.31 per diluted share, compared to net income of $233 million, or $0.96 per diluted share, in the third quarter of fiscal 2011 and $13 million, or $0.05 per diluted share, in the second quarter of fiscal 2012.

On a non-GAAP basis, third quarter net income was $118 million, or $0.48 per diluted share, compared to net income of $292 million, or $1.20 per diluted share, in the third quarter of fiscal 2011 and net income of $51 million, or $0.21 per diluted share, in the second quarter of fiscal 2012. For reconciliation of non-GAAP to GAAP results, see accompanying financial tables and footnotes.

"Our retail business delivered strong results in Q3 and we believe we gained share across all major geographies worldwide on the strength of the SanDisk brand," said Sanjay Mehrotra, president and chief executive officer of SanDisk. "Our results also reflect a solid recovery in our mobile embedded business and we made good progress toward expanding our SSD product roadmap. We believe we are well positioned to build on our business momentum and improved industry fundamentals to deliver strong sequential growth in the fourth quarter."

View at TechPowerUp Main Site