- Joined

- Oct 9, 2007

- Messages

- 47,604 (7.45/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | Gigabyte B550 AORUS Elite V2 |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 16GB DDR4-3200 |

| Video Card(s) | Galax RTX 4070 Ti EX |

| Storage | Samsung 990 1TB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

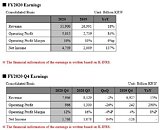

SK hynix Inc. today announced financial results for its fiscal year 2020 ended on December 31, 2020. The consolidated revenue of fiscal year 2020 was 31.9 trillion won while the operating profit amounted to 5.013 trillion won, and the net income 4.759 trillion won. Operating margin of for the year was 16%, and net margin was 15%.

"Due to the global pandemic and the intensifying trade disputes last year, the memory market showed sluggish trend," said Kevin (Jongwon) Noh, Executive Vice President and Head of Corporate Center (CFO) at SK hynix. "In the meantime, the Company stably mass-produced its main products such as 1Znm DRAM and 128-layer NAND Flash." Noh also explained, "The Company expanded its server market share based on its quality competitiveness, which resulted in an increase in the revenue and the operating profit by 18% and 84%, respectively, compared to the previous year."

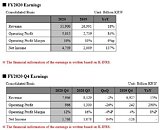

The consolidated revenue of fourth quarter 2020 was 7.966 trillion won while the operating profit amounted to 966 billion won with operating margin of 12%. The Company said, "Despite the decreased revenue due to the falling prices and the weak dollar, the Company achieved an operating profit of 298% YoY by actively responding to the strong mobile demand from the third quarter."

DRAM bit shipment increased by 11% QoQ, but average selling price decreased by 7% QoQ. NAND Flash bit shipment rose 8% QoQ, but average selling price fell 8% QoQ.

For this year's DRAM market, SK hynix estimates that demand for server products will increase due to investment of new data centers by global companies. In addition, 5G smartphones shipments, which had slowed down due to COVID-19, are expected to remain high. On the other hand, it estimates that demands will fall short as industries are expected to see limited increase in supply.

For NAND Flash market, the Company expects that the market trend will recover from the second half of this year, as high inventory levels across eco-system are resolved during the first half, along with the increased adoption of high-capacity products for mobile devices and the strong demand for SSDs.

This year, SK hynix plans to actively respond to this demand and strengthen its technology leadership while increasing the proportion of strategic products revenue. As the high-performance computing (HPC) and artificial intelligence (AI) system market grows, the proportion of high-value-added DRAM products such as HBM2E will be increased. The Company also plans to diversify NAND Flash products, such as pursuing customer certification for 128-layer SSDs for servers.

In addition, it plans to raise cost competitiveness by producing 1Anm DRAM products and 176-layer 4D NAND Flash products that have improved productivity compared to existing products within the year.

At the same time, SK hynix announced the full-scale implementation of 'Financial Story' starting this year. In October last year, the Company stated its financial story, a vision to contribute to humanity and society by promoting balanced growth in DRAM and NAND Flash businesses and strengthening ESG (Environment, Social, and Governance) management.

As the first initiative for the financial story, the Company stressed that it will actively establish the foundation for future growth by smoothly proceeding acquisition of Intel NAND businesses and operating M16 in earnest. In addition, the Company announced that it would establish an ESG management committee to discuss strategies to create new opportunities in this field. SK hynix recently expressed its willingness to strengthen ESG's management by joining RE100 (declaring 100% use of renewable energy by 2050) and issuing green bonds for investment in environmentally friendly businesses.

Meanwhile, SK hynix decided the dividend per share at 1,170 won in accordance with the existing dividend policy of fixing the minimum dividend per share at 1,000 won, and paying out 5% of the annual free cash flow.

View at TechPowerUp Main Site

"Due to the global pandemic and the intensifying trade disputes last year, the memory market showed sluggish trend," said Kevin (Jongwon) Noh, Executive Vice President and Head of Corporate Center (CFO) at SK hynix. "In the meantime, the Company stably mass-produced its main products such as 1Znm DRAM and 128-layer NAND Flash." Noh also explained, "The Company expanded its server market share based on its quality competitiveness, which resulted in an increase in the revenue and the operating profit by 18% and 84%, respectively, compared to the previous year."

The consolidated revenue of fourth quarter 2020 was 7.966 trillion won while the operating profit amounted to 966 billion won with operating margin of 12%. The Company said, "Despite the decreased revenue due to the falling prices and the weak dollar, the Company achieved an operating profit of 298% YoY by actively responding to the strong mobile demand from the third quarter."

DRAM bit shipment increased by 11% QoQ, but average selling price decreased by 7% QoQ. NAND Flash bit shipment rose 8% QoQ, but average selling price fell 8% QoQ.

For this year's DRAM market, SK hynix estimates that demand for server products will increase due to investment of new data centers by global companies. In addition, 5G smartphones shipments, which had slowed down due to COVID-19, are expected to remain high. On the other hand, it estimates that demands will fall short as industries are expected to see limited increase in supply.

For NAND Flash market, the Company expects that the market trend will recover from the second half of this year, as high inventory levels across eco-system are resolved during the first half, along with the increased adoption of high-capacity products for mobile devices and the strong demand for SSDs.

This year, SK hynix plans to actively respond to this demand and strengthen its technology leadership while increasing the proportion of strategic products revenue. As the high-performance computing (HPC) and artificial intelligence (AI) system market grows, the proportion of high-value-added DRAM products such as HBM2E will be increased. The Company also plans to diversify NAND Flash products, such as pursuing customer certification for 128-layer SSDs for servers.

In addition, it plans to raise cost competitiveness by producing 1Anm DRAM products and 176-layer 4D NAND Flash products that have improved productivity compared to existing products within the year.

At the same time, SK hynix announced the full-scale implementation of 'Financial Story' starting this year. In October last year, the Company stated its financial story, a vision to contribute to humanity and society by promoting balanced growth in DRAM and NAND Flash businesses and strengthening ESG (Environment, Social, and Governance) management.

As the first initiative for the financial story, the Company stressed that it will actively establish the foundation for future growth by smoothly proceeding acquisition of Intel NAND businesses and operating M16 in earnest. In addition, the Company announced that it would establish an ESG management committee to discuss strategies to create new opportunities in this field. SK hynix recently expressed its willingness to strengthen ESG's management by joining RE100 (declaring 100% use of renewable energy by 2050) and issuing green bonds for investment in environmentally friendly businesses.

Meanwhile, SK hynix decided the dividend per share at 1,170 won in accordance with the existing dividend policy of fixing the minimum dividend per share at 1,000 won, and paying out 5% of the annual free cash flow.

View at TechPowerUp Main Site