- Joined

- Oct 9, 2007

- Messages

- 47,649 (7.44/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | Gigabyte B550 AORUS Elite V2 |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 16GB DDR4-3200 |

| Video Card(s) | Galax RTX 4070 Ti EX |

| Storage | Samsung 990 1TB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

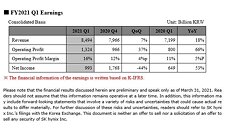

SK hynix Inc. today announced financial results for its first quarter 2021 ended on March 31, 2021. The consolidated revenue of the first quarter 2021 was 8.494 trillion won while the operating profit amounted to 1.324 trillion won, and the net income 993 billion won. Operating margin for the quarter was 16% and net margin was 12%.

The Company made better results both QoQ and YoY in the first quarter as the semiconductor market conditions improved earlier this year. Although the first quarter is usually off-season of the semiconductor industry, the Company said that the market conditions improved as demand for memory products for PCs and mobiles increased. In addition, cost competitiveness has increased as yields of major products have improved. Through this, the revenue and the operating profit increased by 7% and 37%, respectively, compared to the previous quarter.

For DRAM, the Company responded to market condition, and focused on mobiles, PCs, and graphics for sales. As a result, the Company's DRAM bit shipment increased by 4% QoQ.

For NAND Flash, the bit shipment of high-density products for mobile devices have increased by 21% QoQ.

SK hynix is optimistic about the market conditions after the first quarter. The Company expects the inventory of customers to decrease quickly as current stronger-than-expected demand growth in the broader IT market continues. Demand for DRAM is likely to continue to grow, while the NAND Flash market demand is also expected to grow. SK hynix plans to respond to such market conditions proactively.

For DRAM, SK hynix plans to supply high-capacity Multi Chip Package (MCP) based on 12 GB DRAM products from the second quarter. In addition, the Company has decided to increase the production volume of 1Znm DRAM. The Company also announced that it will finish developing the 1Anm technology using EUV equipment within this year and begin mass production of the product as well.

For NAND Flash, SK hynix will increase the 128-layer product mix to increase the sales of enterprise SSDs, and begin mass production of 176-layer products with the accumulated know-hows from the 128-layer technology. The Company will further strengthen technological competitiveness in NAND Flash overall.

SK hynix expressed a strong commitment to ESG management. Kevin (Jongwon) Noh, Executive Vice President and Head of Corporate Center (CFO) at SK hynix, said, "SK hynix has continued ESG management activities since last year by strengthening the responsibility of the board of directors, and participating in the Semiconductor and Display Carbon Neutrality Committee. The Company will make its utmost efforts to help the semiconductor industry lead the ESG management while raising the level of RE100* by actively developing eco-friendly technologies."

View at TechPowerUp Main Site

The Company made better results both QoQ and YoY in the first quarter as the semiconductor market conditions improved earlier this year. Although the first quarter is usually off-season of the semiconductor industry, the Company said that the market conditions improved as demand for memory products for PCs and mobiles increased. In addition, cost competitiveness has increased as yields of major products have improved. Through this, the revenue and the operating profit increased by 7% and 37%, respectively, compared to the previous quarter.

For DRAM, the Company responded to market condition, and focused on mobiles, PCs, and graphics for sales. As a result, the Company's DRAM bit shipment increased by 4% QoQ.

For NAND Flash, the bit shipment of high-density products for mobile devices have increased by 21% QoQ.

SK hynix is optimistic about the market conditions after the first quarter. The Company expects the inventory of customers to decrease quickly as current stronger-than-expected demand growth in the broader IT market continues. Demand for DRAM is likely to continue to grow, while the NAND Flash market demand is also expected to grow. SK hynix plans to respond to such market conditions proactively.

For DRAM, SK hynix plans to supply high-capacity Multi Chip Package (MCP) based on 12 GB DRAM products from the second quarter. In addition, the Company has decided to increase the production volume of 1Znm DRAM. The Company also announced that it will finish developing the 1Anm technology using EUV equipment within this year and begin mass production of the product as well.

For NAND Flash, SK hynix will increase the 128-layer product mix to increase the sales of enterprise SSDs, and begin mass production of 176-layer products with the accumulated know-hows from the 128-layer technology. The Company will further strengthen technological competitiveness in NAND Flash overall.

SK hynix expressed a strong commitment to ESG management. Kevin (Jongwon) Noh, Executive Vice President and Head of Corporate Center (CFO) at SK hynix, said, "SK hynix has continued ESG management activities since last year by strengthening the responsibility of the board of directors, and participating in the Semiconductor and Display Carbon Neutrality Committee. The Company will make its utmost efforts to help the semiconductor industry lead the ESG management while raising the level of RE100* by actively developing eco-friendly technologies."

View at TechPowerUp Main Site