- Joined

- Oct 9, 2007

- Messages

- 47,290 (7.53/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

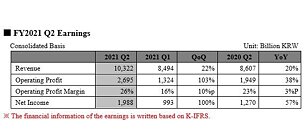

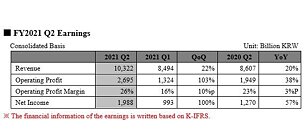

SK hynix Inc. today announced financial results for its second quarter 2021 ended on June 30, 2021. The consolidated revenue of the second quarter 2021 was 10.322 trillion won, while the operating profit amounted to 2.695 trillion won and the net income 1.988 trillion won. Operating margin for the quarter was 26% and net margin was 19%.

It was the first time in three years that SK hynix recorded the quarterly revenue of more than 10 trillion won as the memory market condition, which began to recover earlier this year, continued to improve in the second quarter. The company last logged more than 10 trillion won in the third quarter of 2018 when the memory market was booming.

The Company explained that memory demand for PCs, graphics, and consumers surged rapidly, while that for servers recovered during the April-June period, leading to an improvement in the business performance. In addition, an increase in the sales of the advanced process products like 1ynm, 1znm DRAM and 128-layer NAND Flash helped improve cost competitiveness and increase both the revenue and the operating profit by 22% and 103% QoQ respectively.

SK hynix expects the favorable memory market conditions to continue into the second half of 2021, partly helped by seasonal demand. Specifically, the Company anticipates the demand for NAND Flash products will grow amid increasing adoption of high capacity storage in mobile devices, while that for enterprise solid state drives (SSDs) is also expected to increase.

SK hynix will maintain its DRAM technology competitiveness, while focusing on enhancing profitability for NAND Flash.

For DRAM, SK hynix plans to increase the sales of its high-capacity server DRAMs larger than 64 Gigabyte (GB). Additionally, the Company disclosed that it would begin supplying its 1a nm DRAMs, which are mass-produced via EUV) equipment, and mass production of DDR5 DRAM within the second half of this year.

For NAND Flash, SK hynix aims to turn around in the third quarter by expanding the sales of 128-layer based mobile solution products and enterprise SSDs, and plans to mass-produce 176-layer NAND Flash later this year.

SK hynix also disclosed its achievement in ESG activities. The Company was recognized for its outstanding response to climate change and water resource management capability. As a result, Carbon Disclosure Project) (CDP) Korea committee nominated SK hynix in Hall of Fame of "Carbon Management" section for eight consecutive years. In addition, SK hynix was also nominated as the best company in "Water Management" section.

Kevin (Jongwon) Noh, Executive Vice President and Head of Corporate Center (CFO) at SK hynix, said, "SK hynix will do its best efforts to not only improve its earnings performance, but also proactively engage in ESG activities and external communications, in order to achieve sustainable growth of the Company."

View at TechPowerUp Main Site

It was the first time in three years that SK hynix recorded the quarterly revenue of more than 10 trillion won as the memory market condition, which began to recover earlier this year, continued to improve in the second quarter. The company last logged more than 10 trillion won in the third quarter of 2018 when the memory market was booming.

The Company explained that memory demand for PCs, graphics, and consumers surged rapidly, while that for servers recovered during the April-June period, leading to an improvement in the business performance. In addition, an increase in the sales of the advanced process products like 1ynm, 1znm DRAM and 128-layer NAND Flash helped improve cost competitiveness and increase both the revenue and the operating profit by 22% and 103% QoQ respectively.

SK hynix expects the favorable memory market conditions to continue into the second half of 2021, partly helped by seasonal demand. Specifically, the Company anticipates the demand for NAND Flash products will grow amid increasing adoption of high capacity storage in mobile devices, while that for enterprise solid state drives (SSDs) is also expected to increase.

SK hynix will maintain its DRAM technology competitiveness, while focusing on enhancing profitability for NAND Flash.

For DRAM, SK hynix plans to increase the sales of its high-capacity server DRAMs larger than 64 Gigabyte (GB). Additionally, the Company disclosed that it would begin supplying its 1a nm DRAMs, which are mass-produced via EUV) equipment, and mass production of DDR5 DRAM within the second half of this year.

For NAND Flash, SK hynix aims to turn around in the third quarter by expanding the sales of 128-layer based mobile solution products and enterprise SSDs, and plans to mass-produce 176-layer NAND Flash later this year.

SK hynix also disclosed its achievement in ESG activities. The Company was recognized for its outstanding response to climate change and water resource management capability. As a result, Carbon Disclosure Project) (CDP) Korea committee nominated SK hynix in Hall of Fame of "Carbon Management" section for eight consecutive years. In addition, SK hynix was also nominated as the best company in "Water Management" section.

Kevin (Jongwon) Noh, Executive Vice President and Head of Corporate Center (CFO) at SK hynix, said, "SK hynix will do its best efforts to not only improve its earnings performance, but also proactively engage in ESG activities and external communications, in order to achieve sustainable growth of the Company."

View at TechPowerUp Main Site