- Joined

- Aug 19, 2017

- Messages

- 2,739 (1.01/day)

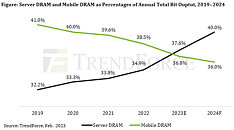

Since 2022, DRAM suppliers have been adjusting their product mixes so as to assign more wafer input to server DRAM products while scaling back the wafer input for mobile DRAM products. This trend is driven by two reasons. First, the demand outlook is bright for the server DRAM segment. Second, the mobile DRAM segment was in significant oversupply during 2022. Moving into 2023, the projections on the growth of smartphone shipments and the increase in the average DRAM content of smartphones remain quite conservative. Therefore, DRAM suppliers intend to keep expanding the share of server DRAM in their product mixes. According to TrendForce's analysis on the distribution of the DRAM industry's total bit output for 2023, server DRAM is estimated to comprise around 37.6%, whereas mobile DRAM is estimated to comprise around 36.8%. Hence, server DRAM will formally surpass mobile DRAM in terms of the portion of the overall supply within this year.

Growth of Average DRAM Content of Smartphones Will Become More Limited, and Mobile DRAM Will Account for Shrinking Share of Entire DRAM Market

The growth of the average DRAM content of smartphones began to slow down noticeably in 2022. A major reason behind this development was the huge inventory pressure that smartphone brands were experiencing during that year. When developing devices slated for release during 2022, brands mainly stayed with the hardware specifications that could be provided by the components within their existing inventories. This approach thus constrained the DRAM content growth. Now, in 2023, smartphone brands' efforts to reduce their stockpiles are gradually yielding a positive result. Furthermore, Apple will bump up the capacity and specifications of the DRAM solutions featured in the next generation of the iPhone that is scheduled for release this year. Taking these latest factors into consideration, TrendForce estimates that the YoY growth rate of the average DRAM content of smartphones will reach around 6.7% for 2023. This projection is a significant improvement compared with the YoY growth rate of 3.9% for 2022. However, TrendForce also forecasts that the YoY growth rate will stay under 10% in the next several years.

Turning to servers, their DRAM content growth has been spurred by newly emerged applications related to artificial intelligence (AI) and high-performance computing (HPC). Going forward, servers will surpass smartphones with respect to shipments of whole devices and memory content per box. Hence, server DRAM will represent the largest portion of the overall bit output from the DRAM industry in the next several years. TrendForce also points out that server DRAM products have a certain degree of price elasticity of demand, and their contract prices have undergone significant reductions since 3Q22. On account of these aforementioned factors, TrendForce projects that the average DRAM content of servers will increase by 12.1% YoY for 2023.

Enterprise SSDs Will Become Largest Application Segment of NAND Flash Market by 2025

Owing to the influence of the COVID-19 pandemic, the market for cloud services has expanded considerably and thereby caused a sharp increase in both server shipments and the average memory content of servers. Also, because of this development, enterprise SSDs constitute a growing portion of the entire NAND Flash demand. Moving into 2023, with the arrival of the post-pandemic period, the demand bits growth related to client SSDs has decelerated due to the significant contraction of notebook computer shipments. However, the sharp slide of NAND Flash prices has also galvanized the demand from the smartphone and server industries. Owing the effect of the price elasticity of demand, growth of NAND Flash content per box will reach a YoY rate of more than 20% for both smartphones and enterprise SSDs.

It is also worth noting that services that are powered by AI-related technologies will proliferate over the next few years. And because of the rising demand for high-speed data storage and HPC, enterprise SSDs are expected to surpass other categories of NAND Flash products in terms of order volume. TrendForce currently forecasts that enterprise SSDs will become the largest application segment of the NAND Flash market in terms of demand bits by 2025.

View at TechPowerUp Main Site

Growth of Average DRAM Content of Smartphones Will Become More Limited, and Mobile DRAM Will Account for Shrinking Share of Entire DRAM Market

The growth of the average DRAM content of smartphones began to slow down noticeably in 2022. A major reason behind this development was the huge inventory pressure that smartphone brands were experiencing during that year. When developing devices slated for release during 2022, brands mainly stayed with the hardware specifications that could be provided by the components within their existing inventories. This approach thus constrained the DRAM content growth. Now, in 2023, smartphone brands' efforts to reduce their stockpiles are gradually yielding a positive result. Furthermore, Apple will bump up the capacity and specifications of the DRAM solutions featured in the next generation of the iPhone that is scheduled for release this year. Taking these latest factors into consideration, TrendForce estimates that the YoY growth rate of the average DRAM content of smartphones will reach around 6.7% for 2023. This projection is a significant improvement compared with the YoY growth rate of 3.9% for 2022. However, TrendForce also forecasts that the YoY growth rate will stay under 10% in the next several years.

Turning to servers, their DRAM content growth has been spurred by newly emerged applications related to artificial intelligence (AI) and high-performance computing (HPC). Going forward, servers will surpass smartphones with respect to shipments of whole devices and memory content per box. Hence, server DRAM will represent the largest portion of the overall bit output from the DRAM industry in the next several years. TrendForce also points out that server DRAM products have a certain degree of price elasticity of demand, and their contract prices have undergone significant reductions since 3Q22. On account of these aforementioned factors, TrendForce projects that the average DRAM content of servers will increase by 12.1% YoY for 2023.

Enterprise SSDs Will Become Largest Application Segment of NAND Flash Market by 2025

Owing to the influence of the COVID-19 pandemic, the market for cloud services has expanded considerably and thereby caused a sharp increase in both server shipments and the average memory content of servers. Also, because of this development, enterprise SSDs constitute a growing portion of the entire NAND Flash demand. Moving into 2023, with the arrival of the post-pandemic period, the demand bits growth related to client SSDs has decelerated due to the significant contraction of notebook computer shipments. However, the sharp slide of NAND Flash prices has also galvanized the demand from the smartphone and server industries. Owing the effect of the price elasticity of demand, growth of NAND Flash content per box will reach a YoY rate of more than 20% for both smartphones and enterprise SSDs.

It is also worth noting that services that are powered by AI-related technologies will proliferate over the next few years. And because of the rising demand for high-speed data storage and HPC, enterprise SSDs are expected to surpass other categories of NAND Flash products in terms of order volume. TrendForce currently forecasts that enterprise SSDs will become the largest application segment of the NAND Flash market in terms of demand bits by 2025.

View at TechPowerUp Main Site