- Joined

- Oct 9, 2007

- Messages

- 47,599 (7.45/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | Gigabyte B550 AORUS Elite V2 |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 16GB DDR4-3200 |

| Video Card(s) | Galax RTX 4070 Ti EX |

| Storage | Samsung 990 1TB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

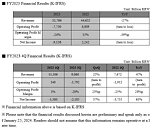

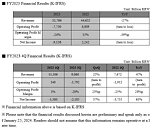

SK hynix Inc. announced today that it recorded an operating profit of 346 billion won in the fourth quarter of last year amid a recovery of the memory chip market, marking the first quarter of profit following four straight quarters of losses. The company posted revenues of 11.31 trillion won, operating profit of 346 billion won (operating profit margin at 3%), and net loss of 1.38 trillion won (net profit margin at negative 12%) for the three months ended December 31, 2023. (Based on K-IFRS)

SK hynix said that the overall memory market conditions improved in the last quarter of 2023 with demand for AI server and mobile applications increasing and average selling price (ASP) rising. "We recorded the first quarterly profit in a year following efforts to focus on profitability," it said. The financial results of the last quarter helped narrow the operating loss for the entire year to 7.73 trillion won (operating profit margin at negative 24%) and net loss to 9.14 trillion won (with net profit margin at negative 28%). The revenues were 32.77 trillion won.

SK hynix said that sales of its main products, DDR5 and HBM3, increased by more than four and five times, respectively, compared with a year earlier, as the company took advantage of its market-leading technology in the DRAM space to actively respond to customer demand. In the NAND space, where a recovery is relatively slow, the company prioritized streamlining investments and costs.

SK hynix will now proceed with mass production of HBM3E, a main AI memory product, and ongoing development of HBM4 smoothly, while supplying high-performance, high-capacity products such as DDR5 and LPDDR5T to server and mobile markets in a timely manner, to meet increasing demand for high-performance DRAM.

The company also plans to make its technological leadership stronger by preparing high-capacity server module MCRDIMM and mobile module LPCAMM2 to respond to ever-increasing demand for AI server and on-device AI adoption.

For NAND, the company aims to continue to improve profitability and stabilize the business by expanding sales of premium products such as eSSD.

For the year of 2024, SK hynix will focus on improving profitability and efficiency through sales of value-added products, while minimizing an increase in capital expenditure for a stable operation of the business.

"We achieved a remarkable turnaround, marking the first operating profit in the fourth quarter following a protracted downturn, thanks to our technological leadership in the AI memory space," said Kim Woohyun, Vice President and Chief Financial Officer (CFO) at SK hynix. "We are now ready to grow into a total AI memory provider by leading changes and presenting customized solutions as we enter an era for a new leap forward."

View at TechPowerUp Main Site

SK hynix said that the overall memory market conditions improved in the last quarter of 2023 with demand for AI server and mobile applications increasing and average selling price (ASP) rising. "We recorded the first quarterly profit in a year following efforts to focus on profitability," it said. The financial results of the last quarter helped narrow the operating loss for the entire year to 7.73 trillion won (operating profit margin at negative 24%) and net loss to 9.14 trillion won (with net profit margin at negative 28%). The revenues were 32.77 trillion won.

SK hynix said that sales of its main products, DDR5 and HBM3, increased by more than four and five times, respectively, compared with a year earlier, as the company took advantage of its market-leading technology in the DRAM space to actively respond to customer demand. In the NAND space, where a recovery is relatively slow, the company prioritized streamlining investments and costs.

SK hynix will now proceed with mass production of HBM3E, a main AI memory product, and ongoing development of HBM4 smoothly, while supplying high-performance, high-capacity products such as DDR5 and LPDDR5T to server and mobile markets in a timely manner, to meet increasing demand for high-performance DRAM.

The company also plans to make its technological leadership stronger by preparing high-capacity server module MCRDIMM and mobile module LPCAMM2 to respond to ever-increasing demand for AI server and on-device AI adoption.

For NAND, the company aims to continue to improve profitability and stabilize the business by expanding sales of premium products such as eSSD.

For the year of 2024, SK hynix will focus on improving profitability and efficiency through sales of value-added products, while minimizing an increase in capital expenditure for a stable operation of the business.

"We achieved a remarkable turnaround, marking the first operating profit in the fourth quarter following a protracted downturn, thanks to our technological leadership in the AI memory space," said Kim Woohyun, Vice President and Chief Financial Officer (CFO) at SK hynix. "We are now ready to grow into a total AI memory provider by leading changes and presenting customized solutions as we enter an era for a new leap forward."

View at TechPowerUp Main Site