TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,112 (2.45/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

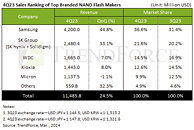

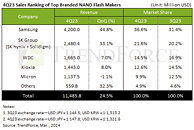

TrendForce reports a substantial 24.5% QoQ increase in NAND Flash industry revenue, hitting US$11.49 billion in 4Q23. This surge is attributed to a stabilization in end-demand spurred by year-end promotions, along with an expansion in component market orders driven by price chasing, leading to robust bit shipments compared to the same period last year. Additionally, the corporate sector's continued positive outlook for 2024 demand—compared to 2023—and strategic stockpiling have further fueled this growth.

Looking ahead to 1Q24, despite it traditionally being an off-season, the NAND Flash industry is expected to see a continued increase in revenue by another 20%. This anticipation is underpinned by significant improvements in supply chain inventory levels and ongoing price rises, with clients ramping up their orders to sidestep potential supply shortages and escalating costs. The ongoing expansion of order sizes is expected to drive NAND Flash contract prices up by an average of 25%.

Samsung stole the spotlight in Q4, primarily due to substantial growth fueled by a sharp rise in demand across servers, notebooks, and smartphones. Despite not fully meeting customer orders, Samsung's bit shipment volume surged by 35% QoQ, coupled with a 12% increase in ASP, boosting its revenue to $4.2 billion—a significant 44.8% QoQ growth. SK Group trailed behind Samsung, enjoying a 33.1% revenue jump to $2.48 billion thanks to significant price recoveries.

Western Digital saw a slight 2% dip in shipment volume but a 10% increase in ASP, leading to a 7% revenue increase to $1.67 billion for its NAND Flash division. The retail SSD market witnessed a substantial boost in shipments due to a price rebound, dropping inventory levels to a four-year low. Kioxia, boosted by PC and smartphone client orders, reported a modest shipment growth and an 8% revenue increase to $1.44 billion in Q4.

Facing the most severe oversupply situation in 2023, the industry saw prices climb nearly 10% in Q4. However, Micron reduced its supply significantly to improve profitability, leading to a more than 10% QoQ decrease in bit shipments and a 1.1% decrease in revenue to $1.14 billion. Furthermore, Micron anticipates a 15-20% annual increase in NAND Flash demand bit growth for the year, emphasizing the need for ongoing capacity adjustments to achieve a balance between supply and demand for potential profitability in the industry.

View at TechPowerUp Main Site | Source

Looking ahead to 1Q24, despite it traditionally being an off-season, the NAND Flash industry is expected to see a continued increase in revenue by another 20%. This anticipation is underpinned by significant improvements in supply chain inventory levels and ongoing price rises, with clients ramping up their orders to sidestep potential supply shortages and escalating costs. The ongoing expansion of order sizes is expected to drive NAND Flash contract prices up by an average of 25%.

Samsung stole the spotlight in Q4, primarily due to substantial growth fueled by a sharp rise in demand across servers, notebooks, and smartphones. Despite not fully meeting customer orders, Samsung's bit shipment volume surged by 35% QoQ, coupled with a 12% increase in ASP, boosting its revenue to $4.2 billion—a significant 44.8% QoQ growth. SK Group trailed behind Samsung, enjoying a 33.1% revenue jump to $2.48 billion thanks to significant price recoveries.

Western Digital saw a slight 2% dip in shipment volume but a 10% increase in ASP, leading to a 7% revenue increase to $1.67 billion for its NAND Flash division. The retail SSD market witnessed a substantial boost in shipments due to a price rebound, dropping inventory levels to a four-year low. Kioxia, boosted by PC and smartphone client orders, reported a modest shipment growth and an 8% revenue increase to $1.44 billion in Q4.

Facing the most severe oversupply situation in 2023, the industry saw prices climb nearly 10% in Q4. However, Micron reduced its supply significantly to improve profitability, leading to a more than 10% QoQ decrease in bit shipments and a 1.1% decrease in revenue to $1.14 billion. Furthermore, Micron anticipates a 15-20% annual increase in NAND Flash demand bit growth for the year, emphasizing the need for ongoing capacity adjustments to achieve a balance between supply and demand for potential profitability in the industry.

View at TechPowerUp Main Site | Source