TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,139 (2.45/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

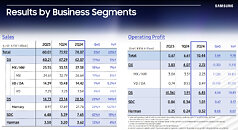

Samsung Electronics today reported financial results for the second quarter ended June 30, 2024. The Company posted KRW 74.07 trillion in consolidated revenue and operating profit of KRW 10.44 trillion as favorable memory market conditions drove higher average sales price (ASP), while robust sales of OLED panels also contributed to the results.

Memory Market Continues To Recover; Solid Second Half Outlook Centered on Server Demand

The DS Division posted KRW 28.56 trillion in consolidated revenue and KRW 6.45 trillion in operating profit for the second quarter. Driven by strong demand for HBM as well as conventional DRAM and server SSDs, the memory market as a whole continued its recovery. This increased demand is a result of the continued AI investments by cloud service providers and growing demand for AI from businesses for their on-premise servers.

PC demand was relatively weak, while demand for mobile products remained solid on the back of increased orders from Chinese original equipment manufacturer (OEM) customers. Demand from server applications continued to be robust, with second quarter results improving significantly from the previous quarter as the Company responded to demand for high-value-added products for generative AI applications.

The Company strengthened its leadership in the DDR5 market through the mass production of a 128 GB product based on 1b nanometer (nm) 32 Gb DDR5, which was developed for the first time in the industry.

In the second half of 2024, AI servers are expected to take up a larger portion of the market as major cloud service providers and enterprises expand their AI investments. As AI servers equipped with HBM also feature high content-per-box with regards to conventional DRAM and SSDs, demand is expected to remain strong across the board from HBM and DDR5 to server SSDs.

With capacity being concentrated on HBM, server DRAMs and server SSDs for AI applications, conventional bit supply of cutting-edge products for PC and mobile is expected to be constrained.

The Company plans to actively respond to the demand for high-value-added products for AI and will expand capacity to increase the portion of HBM3E sales. The Company will also focus on high-density products, such as server modules based on the 1b-nm 32 Gb DDR5 in server DRAM.

For NAND, the Company plans to increase sales by strengthening the supply of triple-level cell (TLC) SSDs, which are still a majority portion of AI demand, and will address customer demand for quad-level cell (QLC) products, which are optimized for all applications, including server PC and mobile.

The System LSI Business posted record-high sales for the first half of the year as it saw earnings improve in the second quarter due to increased supply of key components such as systems on chips (SoCs), image sensors and display driver ICs (DDIs) for major flagship products.

Initial response to the new SoC for wearables, which features the industry's first 3 nm technology, has been favorable and adoption of SoCs featuring this technology by key customers is expected to expand in the second half of the year. The Company also plans to ensure a stable supply of the Exynos 2500 for flagship models.

The System LSI Business will focus on expanding the application of 200-megapixel sensors from main wide camera to tele cameras and plans to expand sales of DDI products with the start of mass production of new models for a customer based in the US.

The Foundry Business saw improved earnings as a result of increased demand across applications. Due to higher orders for sub-5 nm technology, the number of AI and high-performance computing (HPC) customers increased twofold from a year earlier. The Foundry Business also distributed the process development kit (PDK) for 2 nm Gate-All-Around (GAA) technology to customers ahead of mass production in 2025.

In the second half, the Foundry Business expects a rebound in mobile demand and continued high growth in demand for AI/HPC applications. As a result, the foundry market is expected to experience growth overall, particularly in advanced nodes. For 2024, on the back of full-scale mass production of second-generation 3 nm GAA technology, the Company expects growth to outpace the market.

The Foundry Business plans to continue expanding orders for AI/HPC applications and aims to increase the customer number by fourfold and sales by ninefold by 2028 compared to 2023.

SDC Ready To Meet Increased Mobile Demand in H2, Targets Growth in Large Panels

SDC posted KRW 7.65 trillion in consolidated revenue and KRW 1.01 trillion in operating profit for the second quarter.

The mobile display business posted sales growth, driven by solid demand for flagship products, along with effectively supporting new smartphone launches from key customers. Timely response to customer requests with stable supply of IT OLED products also helped higher results.

In the large display business, sales of high-resolution, high-refresh-rate monitor products expanded, mostly in the gaming monitor market, while TVs maintained a stable sales in the high-end segment, driven by increased penetration of OLED panels.

In the second half of the year, the release of new smartphones from major customers and potential replacement demand with the adoption of AI is expected to lead to an increase in mobile display sales. However, competition among panel makers is likely to be more intense than in the first half.

SDC is manufacturing products with improved performance covering power consumption, brightness, slim design and durability, and will continue to expand sales and profitability through continuous quality insurance and enhanced productivity. For the large display business, SDC plans to increase sales and improve profitability by focusing on high-value-added products and introducing new monitors with various refresh rates.

MX Business To Focus on Flagship Smartphones and Ecosystem Products for Revenue Growth

The MX and Networks businesses posted KRW 27.38 trillion in consolidated revenue and KRW 2.23 trillion in operating profit for the second quarter.

Overall market demand for smartphones declined sequentially, particularly in the premium segment, as seasonal trends continued in the smartphone market. While the MX Business recorded a sequential decline in revenue, the Galaxy S24 series achieved double-digit year-on-year growth in both shipments and revenue over its predecessor for both the second quarter and the first half of the year, demonstrating the continued success of the series.

Profitability declined slightly compared to the previous quarter, primarily due to increased costs stemming from the rising prices of essential components. Nevertheless, the MX Business recorded double-digit profitability for the entire first half of the year.

In the second half of 2024, overall demand for smartphones is expected to increase year-on-year, with increased demand for premium products being driven by growing demand for AI and the launch of new products with innovative features. In addition, market demand for ecosystem products such as tablets, smartwatches and smart rings is expected to increase. Accordingly, the MX Business expects smartphone shipments to increase in the third quarter, while tablet shipments are expected to sequentially remain consistent.

The MX Business will seek revenue growth by expanding sales of flagship smartphones and ecosystem products, while also continuing to ensure solid profitability by optimizing product specifications, including component standardization and pursuing operational efficiencies.

Visual Display Business To Lead Growth in TV Market by Promoting Unique Competitiveness

The Visual Display and Digital Appliances businesses posted KRW 14.42 trillion in consolidated revenue and KRW 0.49 trillion in operating profit in the second quarter.

Overall TV market demand saw a year-on-year increase—primarily in advanced countries—as well as a quarter-on-quarter increase mainly due to global sporting events. Backed by differentiated launches of new TV models in 2024, the Visual Display Business solidified its leadership in the premium market by focusing on selling strategic products, such as Neo QLED, OLED and Lifestyle screens. However, profitability decreased year-on-year as costs increased, due to higher panel prices and intensified market competition.

In the second half of 2024, overall market demand is expected to recover further due to growing demand for QLED, OLED and larger screen TVs. The Visual Display Business will capitalize on peak season demand by implementing sales programs centered around premium and large-size TVs. Moreover, it will promote competitive features like AI, security and design along with differentiated customer experiences enabled by Samsung SmartThings.

Additionally, the Visual Display Business will seek to reinforce its growth momentum by strengthening its service businesses.

View at TechPowerUp Main Site | Source

Memory Market Continues To Recover; Solid Second Half Outlook Centered on Server Demand

The DS Division posted KRW 28.56 trillion in consolidated revenue and KRW 6.45 trillion in operating profit for the second quarter. Driven by strong demand for HBM as well as conventional DRAM and server SSDs, the memory market as a whole continued its recovery. This increased demand is a result of the continued AI investments by cloud service providers and growing demand for AI from businesses for their on-premise servers.

PC demand was relatively weak, while demand for mobile products remained solid on the back of increased orders from Chinese original equipment manufacturer (OEM) customers. Demand from server applications continued to be robust, with second quarter results improving significantly from the previous quarter as the Company responded to demand for high-value-added products for generative AI applications.

The Company strengthened its leadership in the DDR5 market through the mass production of a 128 GB product based on 1b nanometer (nm) 32 Gb DDR5, which was developed for the first time in the industry.

In the second half of 2024, AI servers are expected to take up a larger portion of the market as major cloud service providers and enterprises expand their AI investments. As AI servers equipped with HBM also feature high content-per-box with regards to conventional DRAM and SSDs, demand is expected to remain strong across the board from HBM and DDR5 to server SSDs.

With capacity being concentrated on HBM, server DRAMs and server SSDs for AI applications, conventional bit supply of cutting-edge products for PC and mobile is expected to be constrained.

The Company plans to actively respond to the demand for high-value-added products for AI and will expand capacity to increase the portion of HBM3E sales. The Company will also focus on high-density products, such as server modules based on the 1b-nm 32 Gb DDR5 in server DRAM.

For NAND, the Company plans to increase sales by strengthening the supply of triple-level cell (TLC) SSDs, which are still a majority portion of AI demand, and will address customer demand for quad-level cell (QLC) products, which are optimized for all applications, including server PC and mobile.

The System LSI Business posted record-high sales for the first half of the year as it saw earnings improve in the second quarter due to increased supply of key components such as systems on chips (SoCs), image sensors and display driver ICs (DDIs) for major flagship products.

Initial response to the new SoC for wearables, which features the industry's first 3 nm technology, has been favorable and adoption of SoCs featuring this technology by key customers is expected to expand in the second half of the year. The Company also plans to ensure a stable supply of the Exynos 2500 for flagship models.

The System LSI Business will focus on expanding the application of 200-megapixel sensors from main wide camera to tele cameras and plans to expand sales of DDI products with the start of mass production of new models for a customer based in the US.

The Foundry Business saw improved earnings as a result of increased demand across applications. Due to higher orders for sub-5 nm technology, the number of AI and high-performance computing (HPC) customers increased twofold from a year earlier. The Foundry Business also distributed the process development kit (PDK) for 2 nm Gate-All-Around (GAA) technology to customers ahead of mass production in 2025.

In the second half, the Foundry Business expects a rebound in mobile demand and continued high growth in demand for AI/HPC applications. As a result, the foundry market is expected to experience growth overall, particularly in advanced nodes. For 2024, on the back of full-scale mass production of second-generation 3 nm GAA technology, the Company expects growth to outpace the market.

The Foundry Business plans to continue expanding orders for AI/HPC applications and aims to increase the customer number by fourfold and sales by ninefold by 2028 compared to 2023.

SDC Ready To Meet Increased Mobile Demand in H2, Targets Growth in Large Panels

SDC posted KRW 7.65 trillion in consolidated revenue and KRW 1.01 trillion in operating profit for the second quarter.

The mobile display business posted sales growth, driven by solid demand for flagship products, along with effectively supporting new smartphone launches from key customers. Timely response to customer requests with stable supply of IT OLED products also helped higher results.

In the large display business, sales of high-resolution, high-refresh-rate monitor products expanded, mostly in the gaming monitor market, while TVs maintained a stable sales in the high-end segment, driven by increased penetration of OLED panels.

In the second half of the year, the release of new smartphones from major customers and potential replacement demand with the adoption of AI is expected to lead to an increase in mobile display sales. However, competition among panel makers is likely to be more intense than in the first half.

SDC is manufacturing products with improved performance covering power consumption, brightness, slim design and durability, and will continue to expand sales and profitability through continuous quality insurance and enhanced productivity. For the large display business, SDC plans to increase sales and improve profitability by focusing on high-value-added products and introducing new monitors with various refresh rates.

MX Business To Focus on Flagship Smartphones and Ecosystem Products for Revenue Growth

The MX and Networks businesses posted KRW 27.38 trillion in consolidated revenue and KRW 2.23 trillion in operating profit for the second quarter.

Overall market demand for smartphones declined sequentially, particularly in the premium segment, as seasonal trends continued in the smartphone market. While the MX Business recorded a sequential decline in revenue, the Galaxy S24 series achieved double-digit year-on-year growth in both shipments and revenue over its predecessor for both the second quarter and the first half of the year, demonstrating the continued success of the series.

Profitability declined slightly compared to the previous quarter, primarily due to increased costs stemming from the rising prices of essential components. Nevertheless, the MX Business recorded double-digit profitability for the entire first half of the year.

In the second half of 2024, overall demand for smartphones is expected to increase year-on-year, with increased demand for premium products being driven by growing demand for AI and the launch of new products with innovative features. In addition, market demand for ecosystem products such as tablets, smartwatches and smart rings is expected to increase. Accordingly, the MX Business expects smartphone shipments to increase in the third quarter, while tablet shipments are expected to sequentially remain consistent.

The MX Business will seek revenue growth by expanding sales of flagship smartphones and ecosystem products, while also continuing to ensure solid profitability by optimizing product specifications, including component standardization and pursuing operational efficiencies.

Visual Display Business To Lead Growth in TV Market by Promoting Unique Competitiveness

The Visual Display and Digital Appliances businesses posted KRW 14.42 trillion in consolidated revenue and KRW 0.49 trillion in operating profit in the second quarter.

Overall TV market demand saw a year-on-year increase—primarily in advanced countries—as well as a quarter-on-quarter increase mainly due to global sporting events. Backed by differentiated launches of new TV models in 2024, the Visual Display Business solidified its leadership in the premium market by focusing on selling strategic products, such as Neo QLED, OLED and Lifestyle screens. However, profitability decreased year-on-year as costs increased, due to higher panel prices and intensified market competition.

In the second half of 2024, overall market demand is expected to recover further due to growing demand for QLED, OLED and larger screen TVs. The Visual Display Business will capitalize on peak season demand by implementing sales programs centered around premium and large-size TVs. Moreover, it will promote competitive features like AI, security and design along with differentiated customer experiences enabled by Samsung SmartThings.

Additionally, the Visual Display Business will seek to reinforce its growth momentum by strengthening its service businesses.

View at TechPowerUp Main Site | Source