- Joined

- Oct 9, 2007

- Messages

- 47,511 (7.49/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

Western Digital Corp. (Nasdaq: WDC) today reported fiscal fourth quarter and fiscal year 2024 financial results. "Our fourth quarter and fiscal year 2024 results are reflective of the diverse and innovative portfolio we have developed in alignment with our strategic roadmap. Together, with the structural changes we have made to strengthen our operations, we are benefitting from the broad recovery we are seeing across our end markets and structurally improving through-cycle profitability for both Flash and HDD," said David Goeckeler, Western Digital CEO.

"The emergence of the AI Data Cycle marks a transformational period within our industry that will drive fundamental shifts across our end markets, increasing the need for storage and creating new demand drivers. As we look ahead, we are confident in our ability to leverage our technology leadership position to capitalize on these exciting growth opportunities and deliver value for our customers," continued David Goeckeler.

Summary

The company had an operating cash inflow of $366 million and ended the quarter with $1.88 billion of total cash and cash equivalents.

Additional details can be found within the company's earnings presentation, which is accessible online here.

In the fiscal fourth quarter:

View at TechPowerUp Main Site

"The emergence of the AI Data Cycle marks a transformational period within our industry that will drive fundamental shifts across our end markets, increasing the need for storage and creating new demand drivers. As we look ahead, we are confident in our ability to leverage our technology leadership position to capitalize on these exciting growth opportunities and deliver value for our customers," continued David Goeckeler.

Summary

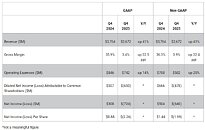

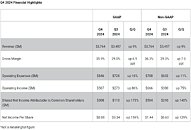

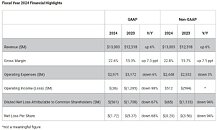

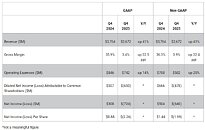

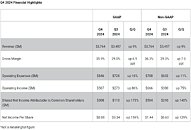

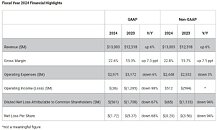

- Fourth quarter revenue was $3.76 billion, up 9% sequentially (QoQ). Cloud revenue increased 21% (QoQ), Client revenue increased 3% (QoQ) and Consumer revenue decreased 7% (QoQ). Fiscal year 2024 revenue was $13.00 billion.

- Fourth quarter GAAP earnings per share (EPS) was $0.88 and Non-GAAP EPS was $1.44. Fiscal year 2024 GAAP EPS was $(1.72) and Non-GAAP EPS was $(0.20).

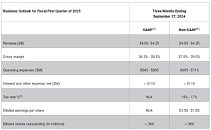

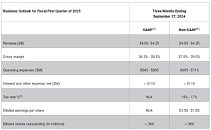

- Expect fiscal first quarter 2025 revenue to be in the range of $4.00 billion to $4.20 billion.

- Expect Non-GAAP EPS in the range of $1.55 to $1.85.

The company had an operating cash inflow of $366 million and ended the quarter with $1.88 billion of total cash and cash equivalents.

Additional details can be found within the company's earnings presentation, which is accessible online here.

In the fiscal fourth quarter:

- Cloud represented 50% of total revenue. The sequential growth is attributed to higher nearline shipments and pricing in HDD, coupled with increased bit shipments and pricing in enterprise SSDs. The year-over-year increase was due to higher shipments and price per unit in nearline HDDs, along with higher enterprise SSD bit shipments.

- Client represented 32% of total revenue. The sequential increase was due to the increase in flash ASPs offsetting a decline in flash bit shipments while HDD revenue decreased slightly. The year-over-year growth was driven by higher flash ASPs.

- Consumer represented 18% of total revenue. Sequentially, the decrease was due to lower flash and HDD bit shipments partially offset by higher ASPs in both flash and HDD. The year-over-year increase was driven by improved flash ASPs and bit shipments.

- Cloud represented 41% of total revenue. The year-over-year increase was due to higher demand for capacity enterprise HDDs and improved pricing.

- Client represented 36% of total revenue. The year-over-year increase was due to higher flash bit shipments.

- Consumer represented 23% of total revenue. The year-over-year increase was due to higher flash bit shipments.

View at TechPowerUp Main Site