TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,326 (2.46/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

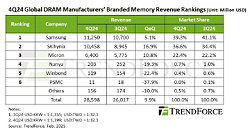

TrendForce's latest research reveals that global DRAM industry revenue surpassed US$28 billion in 4Q24, marking a 9.9% QoQ increase. This growth was primarily driven by rising contract prices for server DDR5 and concentrated shipments of HBM, leading to continued revenue expansion for the top three DRAM suppliers.

Most contract prices across applications were seen to have reversed downward. However, increased procurement of high-capacity server DDR5 by major American CSPs helped sustain price momentum for server DRAM.

Looking ahead to 1Q25, the industry will enter a traditionally slow season, leading to an expected decline in overall bit shipments from DRAM manufacturers. PC OEMs and smartphone vendors are expected to continue efforts to clear inventory, prompting DRAM suppliers to shift DDR4 and some HBM production back to server DDR5. However, as CSP demand weakens, contract prices for conventional DRAM and the combined contract price of conventional DRAM and HBM are projected to decline in 1Q25.

HBM3e expansion strengthens SK hynix's market position, closing in on Samsung

Samsung remained the top DRAM supplier with $11.25 billion in revenue—a 5.1% QoQ increase. However, its market share declined slightly. The company faced a drop in bit shipments due to shrinking LPDDR4 and DDR4 demand, driven by inventory reductions in the PC OEM and smartphone sectors. Additionally, Samsung only began concentrated HBM shipments toward the end of 2024, further impacting bit shipment volumes.

SK Hynix, the second-ranked company, reported $10.46 billion in 4Q24 revenue, growing 16.9% QoQ, with market share rising to 36.6%. The increase in bit shipments was fueled mainly by ramped-up HBM3e shipments, which more than offset declines in LPDDR4 and DDR4 shipments.

Micron secured the third position, with $6.4 billion in revenue, up 10.8% QoQ. Its bit shipments grew due to expanded server DRAM and HBM3e shipments, helping it maintain a stable market share from the previous quarter.

TrendForce notes that Taiwanese DRAM manufacturers saw revenue declines in 4Q24 due to weakening demand for consumer DRAM and intensified competition in the DDR4 market from Chinese suppliers.

Nanya Technology reported $203 million in 4Q24 revenue, down 19.3% QoQ, as demand for consumer DRAM softened and Chinese competitors intensified DDR4 market pressure. Meanwhile, Winbond also experienced a decline in consumer DRAM shipments, leading to $119 million in revenue, a 22.4% QoQ decrease.

PSMC's DRAM revenue, primarily from its consumer DRAM production, fell 37.9% QoQ to $11 million as wafer input volumes shrank. The company's overall revenue dropped 10% QoQ—even when factoring in foundry service revenue—reflecting stable demand from foundry customers.

View at TechPowerUp Main Site | Source

Most contract prices across applications were seen to have reversed downward. However, increased procurement of high-capacity server DDR5 by major American CSPs helped sustain price momentum for server DRAM.

Looking ahead to 1Q25, the industry will enter a traditionally slow season, leading to an expected decline in overall bit shipments from DRAM manufacturers. PC OEMs and smartphone vendors are expected to continue efforts to clear inventory, prompting DRAM suppliers to shift DDR4 and some HBM production back to server DDR5. However, as CSP demand weakens, contract prices for conventional DRAM and the combined contract price of conventional DRAM and HBM are projected to decline in 1Q25.

HBM3e expansion strengthens SK hynix's market position, closing in on Samsung

Samsung remained the top DRAM supplier with $11.25 billion in revenue—a 5.1% QoQ increase. However, its market share declined slightly. The company faced a drop in bit shipments due to shrinking LPDDR4 and DDR4 demand, driven by inventory reductions in the PC OEM and smartphone sectors. Additionally, Samsung only began concentrated HBM shipments toward the end of 2024, further impacting bit shipment volumes.

SK Hynix, the second-ranked company, reported $10.46 billion in 4Q24 revenue, growing 16.9% QoQ, with market share rising to 36.6%. The increase in bit shipments was fueled mainly by ramped-up HBM3e shipments, which more than offset declines in LPDDR4 and DDR4 shipments.

Micron secured the third position, with $6.4 billion in revenue, up 10.8% QoQ. Its bit shipments grew due to expanded server DRAM and HBM3e shipments, helping it maintain a stable market share from the previous quarter.

TrendForce notes that Taiwanese DRAM manufacturers saw revenue declines in 4Q24 due to weakening demand for consumer DRAM and intensified competition in the DDR4 market from Chinese suppliers.

Nanya Technology reported $203 million in 4Q24 revenue, down 19.3% QoQ, as demand for consumer DRAM softened and Chinese competitors intensified DDR4 market pressure. Meanwhile, Winbond also experienced a decline in consumer DRAM shipments, leading to $119 million in revenue, a 22.4% QoQ decrease.

PSMC's DRAM revenue, primarily from its consumer DRAM production, fell 37.9% QoQ to $11 million as wafer input volumes shrank. The company's overall revenue dropped 10% QoQ—even when factoring in foundry service revenue—reflecting stable demand from foundry customers.

View at TechPowerUp Main Site | Source