Micron Technology, Inc. today announced results for its first quarter of fiscal 2025, which ended November 28, 2024.

Fiscal Q1 2025 highlights

"Micron delivered a record quarter, and our data center revenue surpassed 50% of our total revenue for the first time," said Sanjay Mehrotra, President and CEO of Micron Technology. "While consumer-oriented markets are weaker in the near term, we anticipate a return to growth in the second half of our fiscal year. We continue to gain share in the highest margin and strategically important parts of the market and are exceptionally well positioned to leverage AI-driven growth to create substantial value for all stakeholders."

Investments in capital expenditures, net were $3.13 billion for the first quarter of 2025, which resulted in adjusted free cash flows of $112 million for the first quarter of 2025. Micron ended the quarter with cash, marketable investments, and restricted cash of $8.75 billion. On December 18, 2024, Micron's Board of Directors declared a quarterly dividend of $0.115 per share, payable in cash on January 15, 2025, to shareholders of record as of the close of business on December 30, 2024.

Business Outlook

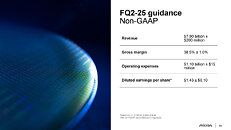

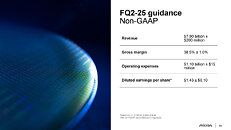

The following table presents Micron's guidance for the second quarter of 2025:

Further information regarding Micron's business outlook is included in the prepared remarks and slides, which have been posted at investors.micron.com.

View at TechPowerUp Main Site | Source

Fiscal Q1 2025 highlights

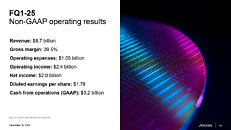

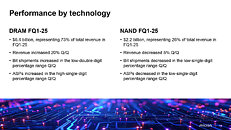

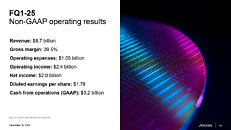

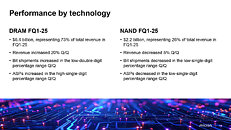

- Revenue of $8.71 billion versus $7.75 billion for the prior quarter and $4.73 billion for the same period last year

- GAAP net income of $1.87 billion, or $1.67 per diluted share

- Non-GAAP net income of $2.04 billion, or $1.79 per diluted share

- Operating cash flow of $3.24 billion versus $3.41 billion for the prior quarter and $1.40 billion for the same period last year

"Micron delivered a record quarter, and our data center revenue surpassed 50% of our total revenue for the first time," said Sanjay Mehrotra, President and CEO of Micron Technology. "While consumer-oriented markets are weaker in the near term, we anticipate a return to growth in the second half of our fiscal year. We continue to gain share in the highest margin and strategically important parts of the market and are exceptionally well positioned to leverage AI-driven growth to create substantial value for all stakeholders."

Investments in capital expenditures, net were $3.13 billion for the first quarter of 2025, which resulted in adjusted free cash flows of $112 million for the first quarter of 2025. Micron ended the quarter with cash, marketable investments, and restricted cash of $8.75 billion. On December 18, 2024, Micron's Board of Directors declared a quarterly dividend of $0.115 per share, payable in cash on January 15, 2025, to shareholders of record as of the close of business on December 30, 2024.

Business Outlook

The following table presents Micron's guidance for the second quarter of 2025:

Further information regarding Micron's business outlook is included in the prepared remarks and slides, which have been posted at investors.micron.com.

View at TechPowerUp Main Site | Source