TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 17,771 (2.42/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

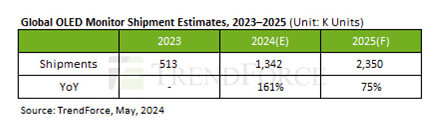

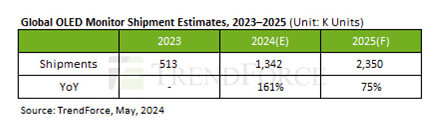

TrendForce's latest report reveals a robust start to 2024 for OLED monitors, with shipments reaching approximately 200,000 units in the first quarter—marking a YoY growth of 121%. The momentum is expected to continue into the second quarter, which is set to see quarterly growth of 52% as new models hit the market, bringing the total for the first half to 500,000 units. With brands ramping up investments and panel makers launching new products alongside aggressive promotions, annual shipments are projected to soar to 1.34 million units, achieving an impressive 161% growth rate.

Samsung leads the market share in the first quarter with 36%, driven by strong sales of its 49-inch models which offer a significant cost-performance advantage—being only 20% more expensive than their LCD counterparts. Notably, Samsung's plan to introduce 27-inch and 31.5-inch models in Q2, which are expected to further boost its OLED shipments.

Dell faced challenges with its 34-inch OLED models in Q1 due to competitive offerings from other brands featuring high quality at lower prices. Nevertheless, Dell's new 27-inch and 31.5-inch OLED monitors launched in the first quarter helped propel its overall OLED shipments to the second position, achieving a 21% market share.

LG Electronics, holding the third spot with a 19% market share, not only continued strong sales in its existing 27-inch, 45-inch, and 48-inch OLED models but also reached new shipments highs with the introduction of 34-inch and 39-inch models in Q1.

ASUS continues to invest significant resources to the high-end monitor market while also actively developing and promoting its OLED products. With a comprehensive OLED lineup ranging from 15.6 inches to 49 inches, ASUS captured about 10% of the market in the first quarter, ranking fourth.

MSI significantly increased its market presence in the first quarter by launching multiple new models in 31.5-inch and 27-inch sizes, as well as competitively priced new 34-inch and 49-inch products. This strategy boosted MSI's market share by 6 percentage points to 7%, placing it fifth. MSI plans to continue launching new models in the second half of the year, anticipating explosive growth in shipments of OLED monitors in 2024.

View at TechPowerUp Main Site | Source

Samsung leads the market share in the first quarter with 36%, driven by strong sales of its 49-inch models which offer a significant cost-performance advantage—being only 20% more expensive than their LCD counterparts. Notably, Samsung's plan to introduce 27-inch and 31.5-inch models in Q2, which are expected to further boost its OLED shipments.

Dell faced challenges with its 34-inch OLED models in Q1 due to competitive offerings from other brands featuring high quality at lower prices. Nevertheless, Dell's new 27-inch and 31.5-inch OLED monitors launched in the first quarter helped propel its overall OLED shipments to the second position, achieving a 21% market share.

LG Electronics, holding the third spot with a 19% market share, not only continued strong sales in its existing 27-inch, 45-inch, and 48-inch OLED models but also reached new shipments highs with the introduction of 34-inch and 39-inch models in Q1.

ASUS continues to invest significant resources to the high-end monitor market while also actively developing and promoting its OLED products. With a comprehensive OLED lineup ranging from 15.6 inches to 49 inches, ASUS captured about 10% of the market in the first quarter, ranking fourth.

MSI significantly increased its market presence in the first quarter by launching multiple new models in 31.5-inch and 27-inch sizes, as well as competitively priced new 34-inch and 49-inch products. This strategy boosted MSI's market share by 6 percentage points to 7%, placing it fifth. MSI plans to continue launching new models in the second half of the year, anticipating explosive growth in shipments of OLED monitors in 2024.

View at TechPowerUp Main Site | Source