- Joined

- Oct 9, 2007

- Messages

- 47,291 (7.53/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

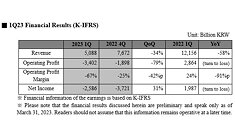

SK hynix Inc. (or "the company", www.skhynix.com) today reported financial results for the first quarter ended March 31, 2023. The company recorded revenues of 5.088 trillion won, operating loss of 3.402 trillion won (with operating margin of negative 67%), and net loss of 2.586 trillion won (with net profit margin of negative 51%) in the first quarter of 2023.

"As the memory chip downturn continued through the first quarter, the company posted a sequential drop in revenues and widened operating loss on sluggish demand and falling products prices," SK hynix said. "But we expect revenues to rebound in the second quarter after bottoming out in the first, driven by a gradual increase in sales volume."

The company forecasts an improvement in market conditions from the second half of 2023, as memory inventory levels at customers declined throughout the first quarter, while inventory across the memory industry is expected to improve from the second quarter, with production cut by suppliers taking into effect.

The company also expects the growing high-performance server market for artificial intelligence including ChatGPT and a wider adoption of high-capacity memory products by customers to have positive impact on the market.

SK hynix, accordingly, plans to focus on the sales of high-performance DRAM products including server DDR5 and HBM, as well as 176-layer SSD and uMCP products in NAND, and plans to maintain investments in high-end memory products that are believed to change the landscape of the memory market, such as chips for AI, even as the company cuts capital expenditure.

Moreover, the company will invest for mass production readiness of 1b nanometer DRAM (the fifth generation of 10 nm technology) and 238-layer NAND to support a quick business turnaround once the market conditions improve.

"With SK hynix having secured a top-notch competitiveness for the lineup of products, of which growth in demand is materializing from this year, such as DDR5/LPDDR5 and HBM3, the company will solidify its leadership in the premium market by increasing the sales volume of such products," said Kim Woohyun, Chief Financial Officer at SK hynix.

"The memory market, which is still under tough conditions, seems to be bottoming out," Kim said. "We will make all efforts to restore the corporate value by focusing on improving profitability and technology development as we believe that the market will soon find a balance."

"These materials are not an offer for sale of the securities of SK hynix Inc. in the United States. The securities may not be offered or sold in the United States absent registration with the U.S. Securities and Exchange Commission or an exemption from registration under the U.S. Securities Act of 1933, as amended. SK hynix Inc. does not intend to register any offering in the United States or to conduct a public offering of securities in the United States."

View at TechPowerUp Main Site

"As the memory chip downturn continued through the first quarter, the company posted a sequential drop in revenues and widened operating loss on sluggish demand and falling products prices," SK hynix said. "But we expect revenues to rebound in the second quarter after bottoming out in the first, driven by a gradual increase in sales volume."

The company forecasts an improvement in market conditions from the second half of 2023, as memory inventory levels at customers declined throughout the first quarter, while inventory across the memory industry is expected to improve from the second quarter, with production cut by suppliers taking into effect.

The company also expects the growing high-performance server market for artificial intelligence including ChatGPT and a wider adoption of high-capacity memory products by customers to have positive impact on the market.

SK hynix, accordingly, plans to focus on the sales of high-performance DRAM products including server DDR5 and HBM, as well as 176-layer SSD and uMCP products in NAND, and plans to maintain investments in high-end memory products that are believed to change the landscape of the memory market, such as chips for AI, even as the company cuts capital expenditure.

Moreover, the company will invest for mass production readiness of 1b nanometer DRAM (the fifth generation of 10 nm technology) and 238-layer NAND to support a quick business turnaround once the market conditions improve.

"With SK hynix having secured a top-notch competitiveness for the lineup of products, of which growth in demand is materializing from this year, such as DDR5/LPDDR5 and HBM3, the company will solidify its leadership in the premium market by increasing the sales volume of such products," said Kim Woohyun, Chief Financial Officer at SK hynix.

"The memory market, which is still under tough conditions, seems to be bottoming out," Kim said. "We will make all efforts to restore the corporate value by focusing on improving profitability and technology development as we believe that the market will soon find a balance."

"These materials are not an offer for sale of the securities of SK hynix Inc. in the United States. The securities may not be offered or sold in the United States absent registration with the U.S. Securities and Exchange Commission or an exemption from registration under the U.S. Securities Act of 1933, as amended. SK hynix Inc. does not intend to register any offering in the United States or to conduct a public offering of securities in the United States."

View at TechPowerUp Main Site