T0@st

News Editor

- Joined

- Mar 7, 2023

- Messages

- 2,700 (3.63/day)

- Location

- South East, UK

| System Name | The TPU Typewriter |

|---|---|

| Processor | AMD Ryzen 5 5600 (non-X) |

| Motherboard | GIGABYTE B550M DS3H Micro ATX |

| Cooling | DeepCool AS500 |

| Memory | Kingston Fury Renegade RGB 32 GB (2 x 16 GB) DDR4-3600 CL16 |

| Video Card(s) | PowerColor Radeon RX 7800 XT 16 GB Hellhound OC |

| Storage | Samsung 980 Pro 1 TB M.2-2280 PCIe 4.0 X4 NVME SSD |

| Display(s) | Lenovo Legion Y27q-20 27" QHD IPS monitor |

| Case | GameMax Spark M-ATX (re-badged Jonsbo D30) |

| Audio Device(s) | FiiO K7 Desktop DAC/Amp + Philips Fidelio X3 headphones, or ARTTI T10 Planar IEMs |

| Power Supply | ADATA XPG CORE Reactor 650 W 80+ Gold ATX |

| Mouse | Roccat Kone Pro Air |

| Keyboard | Cooler Master MasterKeys Pro L |

| Software | Windows 10 64-bit Home Edition |

Analyst firm Yole Group has predicted that SSD sales revenues will grow to $67 billion in the year 2028, generated by 472 million unit sales - indicating a very healthy outlook in the long term. However, their predictions for market performance in 2023 appear to be less cheerful for manufacturers of NAND flash memory. The SSD market dynamic was positive in 2021 and the starting months of 2022, but demand has dropped sharply since then due to a number of factors including global inflation, geopolitical tensions, and inventory digestion at electronics manufacturers. Sales revenues in 2022 totaled $29 billion (352 million units), down from $34 billion (400 million units) in 2021 - demonstrating a 14% year-to-year decline.

The continued weakening of global demand in 2023 will have an effect on SSD sales revenues, and the Yole Group has foreseen troublesome outcomes for manufacturers. The average selling price of NAND memory and solid-state drive units has been on the decline in the recent quarters, caused by sluggish demand and a surplus of stock. Despite the grim outlook in the short term, the research body is predicting a compounded annual growth rate (CAGR) of about 15% between 2022 and 2028 for the overall size of the SSD market.

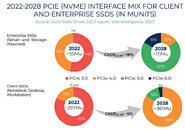

The Yole Group is citing possible shifts in userbase trends and technological improvement within the market sector for the healthier long term numbers. The uptake of the fairly new PCIe 5.0 bus standard will increase over the years - the end user will ultimately require an upgrade to meet modernized data transfer performance requirements. The future adoption rate of the PCIe 6.0 standard will only really matter nearer to 2028, but it is predicted to contribute, on a much smaller scale, to the overall growth of SSD sales revenues. It is anticipated that the market for enterprise-type SSD technology will grow, but the one for client SSDs will shrink. The Yole Group is predicting that the datacenter market segment will drive an increase in demand for enterprise storage, where advanced tasks and workloads require the means of low-latency storage.

View at TechPowerUp Main Site | Source

The continued weakening of global demand in 2023 will have an effect on SSD sales revenues, and the Yole Group has foreseen troublesome outcomes for manufacturers. The average selling price of NAND memory and solid-state drive units has been on the decline in the recent quarters, caused by sluggish demand and a surplus of stock. Despite the grim outlook in the short term, the research body is predicting a compounded annual growth rate (CAGR) of about 15% between 2022 and 2028 for the overall size of the SSD market.

The Yole Group is citing possible shifts in userbase trends and technological improvement within the market sector for the healthier long term numbers. The uptake of the fairly new PCIe 5.0 bus standard will increase over the years - the end user will ultimately require an upgrade to meet modernized data transfer performance requirements. The future adoption rate of the PCIe 6.0 standard will only really matter nearer to 2028, but it is predicted to contribute, on a much smaller scale, to the overall growth of SSD sales revenues. It is anticipated that the market for enterprise-type SSD technology will grow, but the one for client SSDs will shrink. The Yole Group is predicting that the datacenter market segment will drive an increase in demand for enterprise storage, where advanced tasks and workloads require the means of low-latency storage.

View at TechPowerUp Main Site | Source