TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 18,131 (2.45/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

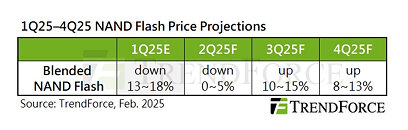

TrendForce's latest findings reveal that the NAND Flash market continues to be plagued by oversupply in the first quarter of 2025, leading to sustained price declines and financial strain for suppliers. However, TrendForce anticipates a significant improvement in the market's supply-demand balance in the second half of the year.

Key factors contributing to this shift include proactive production cuts by manufacturers, inventory reductions in the smartphone sector, and growing demand driven by AI and DeepSeek applications. These elements are expected to alleviate oversupply and support a price rebound for NAND Flash.

TrendForce notes that since 2023, NAND Flash manufacturers have recognized the severe impact of excessive supply on the industry, particularly as annual NAND Flash demand growth rates have been revised down from 30% to 10-15%. Suppliers have had to adjust their production strategies to mitigate prolonged price declines.

Entering 2025, NAND Flash manufacturers have adopted more decisive production cuts, scaling back full-year output to curb bit supply growth. These measures are designed to swiftly alleviate market imbalances and lay the groundwork for a price recovery.

Additionally, China's ongoing trade-in subsidy policies, implemented in 4Q24, have effectively stimulated smartphone sales and accelerated depletion of NAND Flash inventory. As price declines slow, smartphone brands may seize the opportunity in 2Q25 to build low-cost inventories to further drive demand.

On the AI front, NVIDIA is set to ramp up shipments of its Blackwell-series products in the latter half of the year. This expansion is expected to significantly boost enterprise SSD demand. Furthermore, DeepSeek's advancements in reducing AI server deployment costs will empower SMEs to integrate AI more effectively, enhancing their competitiveness. SSDs with capacities exceeding 30 TB are projected to become the preferred storage solution for SMEs due to their superior performance and TCO benefits, thereby driving enterprise SSD demand.

In parallel, NVIDIA's unveiling of Project Digits at CES, featuring 4 TB SSD-equipped systems, is poised to accelerate AI adoption in personal computing and fuel increased demand for higher-capacity PC SSDs. The emergence of AI-powered PCs and workstations is expected to facilitate broader AI integration into everyday applications, potentially driving long-term growth in PC SSD (client SSD) capacities.

Furthermore, DeepSeek's breakthroughs in reducing requirements for computational power are likely to accelerate the adoption of AI-enabled smartphones. Coupled with the increasing penetration of QLC storage technology in mobile devices, AI smartphone storage demand is projected to grow in response to enhanced functionality and performance requirements.

View at TechPowerUp Main Site | Source

Key factors contributing to this shift include proactive production cuts by manufacturers, inventory reductions in the smartphone sector, and growing demand driven by AI and DeepSeek applications. These elements are expected to alleviate oversupply and support a price rebound for NAND Flash.

TrendForce notes that since 2023, NAND Flash manufacturers have recognized the severe impact of excessive supply on the industry, particularly as annual NAND Flash demand growth rates have been revised down from 30% to 10-15%. Suppliers have had to adjust their production strategies to mitigate prolonged price declines.

Entering 2025, NAND Flash manufacturers have adopted more decisive production cuts, scaling back full-year output to curb bit supply growth. These measures are designed to swiftly alleviate market imbalances and lay the groundwork for a price recovery.

Additionally, China's ongoing trade-in subsidy policies, implemented in 4Q24, have effectively stimulated smartphone sales and accelerated depletion of NAND Flash inventory. As price declines slow, smartphone brands may seize the opportunity in 2Q25 to build low-cost inventories to further drive demand.

On the AI front, NVIDIA is set to ramp up shipments of its Blackwell-series products in the latter half of the year. This expansion is expected to significantly boost enterprise SSD demand. Furthermore, DeepSeek's advancements in reducing AI server deployment costs will empower SMEs to integrate AI more effectively, enhancing their competitiveness. SSDs with capacities exceeding 30 TB are projected to become the preferred storage solution for SMEs due to their superior performance and TCO benefits, thereby driving enterprise SSD demand.

In parallel, NVIDIA's unveiling of Project Digits at CES, featuring 4 TB SSD-equipped systems, is poised to accelerate AI adoption in personal computing and fuel increased demand for higher-capacity PC SSDs. The emergence of AI-powered PCs and workstations is expected to facilitate broader AI integration into everyday applications, potentially driving long-term growth in PC SSD (client SSD) capacities.

Furthermore, DeepSeek's breakthroughs in reducing requirements for computational power are likely to accelerate the adoption of AI-enabled smartphones. Coupled with the increasing penetration of QLC storage technology in mobile devices, AI smartphone storage demand is projected to grow in response to enhanced functionality and performance requirements.

View at TechPowerUp Main Site | Source