Intel Considering Semiconductor Fab in India

Back in December, we reported that Tower Semiconductor was one of several semiconductor manufacturers that was considering building a fab in India, largely due to government subsidies. Since then, Intel has stepped in and bought Tower Semiconductor and has taken over the negotiations with the Indian government. What has also come to light is that Tower Semiconductor has been in discussions with the Indian government for over a decade, but apparently the two parties have been unable to come up with a suitable agreement. Tower Semiconductor was apparently ready to cancel any plans on building in India as late as September 2021, but the more recent government initiative renewed their interest.

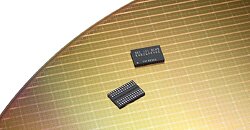

As to exactly what kind of fab Intel would build, is unclear at this point in time, but it might still be a MEMS fab or it could simply be a testing and packaging plant. Regardless of what kind of facility it'll be, it's interesting that Intel decided to keep the ongoing plans from Tower Semiconductor going. Tower Semiconductor mostly manufactured for fabless companies and were producing some two million wafers a year. It's likely that Intel will carry on producing for the same companies at the same terms for now, although as Tower Semiconductor gets integrated closer with the Intel foundry, things could change.

As to exactly what kind of fab Intel would build, is unclear at this point in time, but it might still be a MEMS fab or it could simply be a testing and packaging plant. Regardless of what kind of facility it'll be, it's interesting that Intel decided to keep the ongoing plans from Tower Semiconductor going. Tower Semiconductor mostly manufactured for fabless companies and were producing some two million wafers a year. It's likely that Intel will carry on producing for the same companies at the same terms for now, although as Tower Semiconductor gets integrated closer with the Intel foundry, things could change.