UMC Reports Fourth Quarter 2022 Results

United Microelectronics Corporation ("UMC" or "The Company"), a leading global semiconductor foundry, today announced its consolidated operating results for the fourth quarter of 2022. Fourth quarter consolidated revenue was NT$67.84 billion, decreasing 10.0% QoQ from NT$75.39 billion in 3Q22. Compared to a year ago, 4Q22 revenue grew 14.8% YoY from NT$59.10 billion in 4Q21. Consolidated gross margin for 4Q22 was 42.9%. Net income attributable to the shareholders of the parent was NT$19.1 billion, with earnings per ordinary share of NT$1.54.

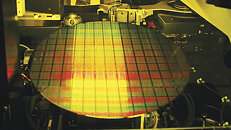

Jason Wang, co-president of UMC, said, "In the fourth quarter, due to a significant slowdown across most of our end markets and inventory correction in the semiconductor industry, our wafer shipments fell 14.8% QoQ while overall fab utilization rate dropped to 90%. Average selling price increased slightly during the quarter as a result of our ongoing product mix optimization efforts, moderating the decline in revenue."

Jason Wang, co-president of UMC, said, "In the fourth quarter, due to a significant slowdown across most of our end markets and inventory correction in the semiconductor industry, our wafer shipments fell 14.8% QoQ while overall fab utilization rate dropped to 90%. Average selling price increased slightly during the quarter as a result of our ongoing product mix optimization efforts, moderating the decline in revenue."