Thursday, August 6th 2015

NVIDIA Announces Financial Results for Second Quarter Fiscal 2016

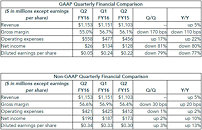

NVIDIA today reported revenue for the second quarter ended July 26, 2015, of $1.153 billion, up 5 percent from $1.103 billion a year earlier, and up marginally from $1.151 billion the previous quarter.

GAAP earnings per diluted share for the quarter were $0.05. This includes a charge of $0.19 per diluted share in connection with the company's decision to wind down its Icera modem operations, after a viable buyer failed to emerge. It also includes a charge of $0.02 per diluted share related to the NVIDIA SHIELD tablet recall. Non-GAAP earnings per diluted share were $0.34, up 13 percent from $0.30 a year earlier, and up 3 percent from $0.33 in the previous quarter."Our strong performance in a challenging environment reflects NVIDIA's success in creating specialized visual computing platforms targeted at important growth markets," said Jen-Hsun Huang, president and chief executive officer of NVIDIA.

"Our gaming platforms continue to be fueled by growth in multiple vectors -- new technologies like 4K and VR, blockbuster games with amazing production values, and increasing worldwide fan engagement in e-sports. We're working with more than 50 companies that are exploring NVIDIA DRIVE to enable self-driving cars. And our GPU-accelerated data center platform continues to make great strides in some of today's most important computing initiatives -- cloud-based virtualization and high performance computing applications like deep learning."

"Visual computing continues to grow in importance, making our growth opportunities more exciting than ever," he said.

Capital Return

During the second quarter, NVIDIA paid $52 million in cash dividends and $400 million in share repurchases -- returning an aggregate of $452 million to shareholders. In the year's first half, the company returned an aggregate of $551 million to shareholders.

NVIDIA will pay its next quarterly cash dividend of $0.0975 per share on September 11, 2015, to all shareholders of record on August 20, 2015.

NVIDIA's outlook for the third quarter of fiscal 2016 is as follows:

During the second quarter, NVIDIA achieved progress in each of its platforms.

Gaming:

GAAP earnings per diluted share for the quarter were $0.05. This includes a charge of $0.19 per diluted share in connection with the company's decision to wind down its Icera modem operations, after a viable buyer failed to emerge. It also includes a charge of $0.02 per diluted share related to the NVIDIA SHIELD tablet recall. Non-GAAP earnings per diluted share were $0.34, up 13 percent from $0.30 a year earlier, and up 3 percent from $0.33 in the previous quarter."Our strong performance in a challenging environment reflects NVIDIA's success in creating specialized visual computing platforms targeted at important growth markets," said Jen-Hsun Huang, president and chief executive officer of NVIDIA.

"Our gaming platforms continue to be fueled by growth in multiple vectors -- new technologies like 4K and VR, blockbuster games with amazing production values, and increasing worldwide fan engagement in e-sports. We're working with more than 50 companies that are exploring NVIDIA DRIVE to enable self-driving cars. And our GPU-accelerated data center platform continues to make great strides in some of today's most important computing initiatives -- cloud-based virtualization and high performance computing applications like deep learning."

"Visual computing continues to grow in importance, making our growth opportunities more exciting than ever," he said.

Capital Return

During the second quarter, NVIDIA paid $52 million in cash dividends and $400 million in share repurchases -- returning an aggregate of $452 million to shareholders. In the year's first half, the company returned an aggregate of $551 million to shareholders.

NVIDIA will pay its next quarterly cash dividend of $0.0975 per share on September 11, 2015, to all shareholders of record on August 20, 2015.

NVIDIA's outlook for the third quarter of fiscal 2016 is as follows:

- Revenue is expected to be $1.18 billion, plus or minus two percent.

- GAAP and non-GAAP gross margins are expected to be 56.2 percent and 56.5 percent, respectively, plus or minus 50 basis points.

- GAAP operating expenses are expected to be approximately $484 million. Non-GAAP operating expenses are expected to be approximately $435 million.

- GAAP and non-GAAP tax rates for the third quarter of fiscal 2016 are expected to be 22 percent and 20 percent, respectively, plus or minus one percent.

- The above GAAP outlook amounts exclude additional restructuring charges, which are expected to be in the range of $15 million to $25 million, in the second half of fiscal 2016.

- Capital expenditures are expected to be approximately $25 million to $35 million.

During the second quarter, NVIDIA achieved progress in each of its platforms.

Gaming:

- Continued strong demand for GeForce GTX GPUs, driven by advanced new games and growth in competitive e-sports, which now have an estimated 130 million viewers.

- Unveiled the flagship GeForce GTX 980 Ti GPU, with the power to drive 4K and VR gaming.

- Increased users of the GeForce Experience PC gaming platform to 65 million, from 38 million a year earlier.

- Launched the NVIDIA SHIELD Android TV device, the most advanced smart TV platform, which connects TVs to a world of entertainment apps and services.

- Continued strong momentum for NVIDIA GRID graphics virtualization, which more than tripled its customer base to over 300 enterprises from a year earlier.

- Engaged with more than 3,300 companies exploring the use of deep learning in areas such as speech recognition, image analysis and translation capabilities.

- Shipped cuDNN 3.0, which doubles the performance of deep learning training on GPUs and enables the training of more sophisticated neural networks. cuDNN has been downloaded by more than 9,000 researchers worldwide.

- Working with more than 50 companies to use the NVIDIA DRIVE PX platform in their autonomous driving efforts.

2 Comments on NVIDIA Announces Financial Results for Second Quarter Fiscal 2016

Jokes aside, they are not doing bad at all.