Apple is Preparing its Own Search Engine

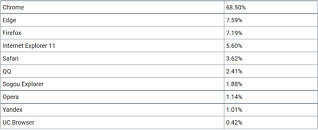

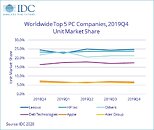

In the past few years, Google has been paying Apple billions of dollars just for the company to keep Google as the default search engine in every aspect of the company's products. Starting from iOS up to macOS, they included Google as the default search engine. However, the deal between two companies might be coming to an end. In July this year, a UK Competition and Markets Authority took a shot at a deal claiming that the companies imposed a barrier on any market competition in the search engine space. Constant pressure from regulators and the fact that Apple doesn't want to be reliant on any company is possibly giving Apple ideas to launch its own search engine.

Recent changes in the spotlight search on iOS 14 and iPad OS 14 beta is making the software bypass Google search engine completely. As shown below (search and direct results), the company implemented a feature that makes the spotlight search go directly to search results instead of going to Google. The Applebot web crawler has seen some changes so it now renders pages in a similar way Google does and not just filter HTML. The web crawler also is updated to rank web pages just like it is made for a search engine. All of this is supposed to give Apple enough material so it can build something similar to a search engine. It is believed that the search engine wouldn't look like any classical one, but rather be embedded in Apple products and serve as a personalized search hub.

Recent changes in the spotlight search on iOS 14 and iPad OS 14 beta is making the software bypass Google search engine completely. As shown below (search and direct results), the company implemented a feature that makes the spotlight search go directly to search results instead of going to Google. The Applebot web crawler has seen some changes so it now renders pages in a similar way Google does and not just filter HTML. The web crawler also is updated to rank web pages just like it is made for a search engine. All of this is supposed to give Apple enough material so it can build something similar to a search engine. It is believed that the search engine wouldn't look like any classical one, but rather be embedded in Apple products and serve as a personalized search hub.