- Joined

- Dec 6, 2011

- Messages

- 4,784 (1.00/day)

- Location

- Still on the East Side

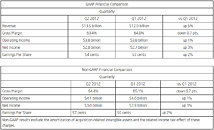

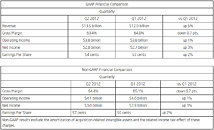

Intel Corporation today reported quarterly revenue of $13.5 billion, operating income of $3.8 billion, net income of $2.8 billion and EPS of $0.54. The company generated approximately $4.7 billion in cash from operations, paid dividends of $1.1 billion and used $1.1 billion to repurchase stock.

"The second quarter was highlighted by solid execution with continued strength in the data center and multiple product introductions in Ultrabooks and smartphones," said Paul Otellini, Intel president and CEO. "As we enter the third quarter, our growth will be slower than we anticipated due to a more challenging macroeconomic environment. With a rich mix of Ultrabook and Intel-based tablet and phone introductions in the second half, combined with the long-term investments we're making in our product and manufacturing areas, we are well positioned for this year and beyond."

Business Outlook

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures or other investments that may be completed after July 17.

Q3 2012 (GAAP, unless otherwise stated)

● Revenue: $14.3 billion, plus or minus $500 million.

● Gross margin percentage: 63 percent and 64 percent Non-GAAP (excluding amortization of acquisition-related intangibles), both plus or minus a couple of percentage points.

● R&D plus MG&A spending: approximately $4.6 billion.

● Amortization of acquisition-related intangibles: approximately $80 million.

● Impact of equity investments and interest and other: approximately zero.

● Depreciation: approximately $1.6 billion.

Full-Year 2012 (GAAP, unless otherwise stated)

● Revenue up between 3 percent and 5 percent year over year, down from the prior expectation for high single-digit growth.

● Gross margin percentage: 64 percent and 65 percent Non-GAAP (excluding amortization of acquisition-related intangibles), both plus or minus a couple points.

● Spending (R&D plus MG&A): $18.2 billion, plus or minus $200 million, down $100 million from prior expectations.

● Amortization of acquisition-related intangibles: approximately $300 million, unchanged.

● Depreciation: $6.3 billion, plus or minus $100 million, down $100 million from prior expectations.

● Tax Rate: approximately 28 percent, unchanged.

● Full-year capital spending: $12.5 billion, plus or minus $400 million, unchanged.

View at TechPowerUp Main Site

"The second quarter was highlighted by solid execution with continued strength in the data center and multiple product introductions in Ultrabooks and smartphones," said Paul Otellini, Intel president and CEO. "As we enter the third quarter, our growth will be slower than we anticipated due to a more challenging macroeconomic environment. With a rich mix of Ultrabook and Intel-based tablet and phone introductions in the second half, combined with the long-term investments we're making in our product and manufacturing areas, we are well positioned for this year and beyond."

Business Outlook

Intel's Business Outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures or other investments that may be completed after July 17.

Q3 2012 (GAAP, unless otherwise stated)

● Revenue: $14.3 billion, plus or minus $500 million.

● Gross margin percentage: 63 percent and 64 percent Non-GAAP (excluding amortization of acquisition-related intangibles), both plus or minus a couple of percentage points.

● R&D plus MG&A spending: approximately $4.6 billion.

● Amortization of acquisition-related intangibles: approximately $80 million.

● Impact of equity investments and interest and other: approximately zero.

● Depreciation: approximately $1.6 billion.

Full-Year 2012 (GAAP, unless otherwise stated)

● Revenue up between 3 percent and 5 percent year over year, down from the prior expectation for high single-digit growth.

● Gross margin percentage: 64 percent and 65 percent Non-GAAP (excluding amortization of acquisition-related intangibles), both plus or minus a couple points.

● Spending (R&D plus MG&A): $18.2 billion, plus or minus $200 million, down $100 million from prior expectations.

● Amortization of acquisition-related intangibles: approximately $300 million, unchanged.

● Depreciation: $6.3 billion, plus or minus $100 million, down $100 million from prior expectations.

● Tax Rate: approximately 28 percent, unchanged.

● Full-year capital spending: $12.5 billion, plus or minus $400 million, unchanged.

View at TechPowerUp Main Site

x86 ruling the world!!!

x86 ruling the world!!!