- Joined

- Oct 9, 2007

- Messages

- 47,306 (7.52/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

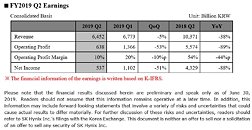

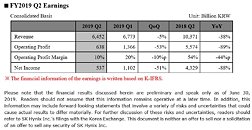

SK hynix Inc. today announced financial results for its second quarter 2019 ended on June 30, 2019. The consolidated second quarter revenue was 6.45 trillion won while the operating profit amounted to 638 billion won and the net income 537 billion won. Operating margin for the quarter was 10% and net margin was 8%.

As demand recovery did not meet expectations and price declines were steeper than expected, the revenue and the operating profit in the second quarter fell by 5% and 53%, respectively, quarter-over-quarter (QoQ). DRAM bit shipments increased by 13% QoQ as the Company actively responded to the mobile and PC DRAM markets, where demand growth was relatively high. However, DRAM prices remained weak and the average selling price dropped by 24%. For NAND Flash, the bit shipments increased by 40% QoQ because of demand recovery due to price declines, while the average selling price decreased by 25%.

SK hynix plans to adjust production and investment flexibly to respond to the market conditions.

The Company will cut its DRAM production capacity from the fourth quarter and will convert part of the DRAM production lines of its M10 FAB in Icheon, Korea, to CMOS image sensor (CIS) mass production lines from the second half. This is to reduce DRAM wafer capacity considering the DRAM demand environment and to strengthen the competitiveness of its CIS business. In addition, with the capacity decrease due to DRAM tech migration, DRAM capacity is likely to continue to decrease until next year.

SK hynix added that it will also increase the NAND wafer input reduction this year to more than 15%. The Company announced last semester that it would decrease the NAND wafer input this year by more than 10% compared to last year.

In addition, SK hynix plans to review, assessing the demand situation, the timing of securing additional clean room space at its M15 FAB in Cheongju, Korea, and installing equipment at the M16 FAB in Icheon, which is expected to be completed in the second half of next year. As a result, the amount of investment next year is expected to be significantly lower than this year.

SK hynix will continue to focus on technology migration and high-density, high-value-added products.

The Company intends to increase the proportion of 1Xnm and 1Y nm DRAM to 80% by the end of this year and start selling 1Y nm computing products from the second half of this year.

For NAND Flash, SK hynix will focus on its 72-layer NAND but also plans to target the high-end smartphones and SSD market by increasing the proportion of 96-layer 4D NAND from the second half. The Company will prepare for mass production and sales of the 128-layer 1 Tb (Terabit) TLC (Triple Level Cell) 4D NAND Flash.

SK hynix will continue to strengthen its competitiveness in preparation for mid- to long-term memory growth.

View at TechPowerUp Main Site

As demand recovery did not meet expectations and price declines were steeper than expected, the revenue and the operating profit in the second quarter fell by 5% and 53%, respectively, quarter-over-quarter (QoQ). DRAM bit shipments increased by 13% QoQ as the Company actively responded to the mobile and PC DRAM markets, where demand growth was relatively high. However, DRAM prices remained weak and the average selling price dropped by 24%. For NAND Flash, the bit shipments increased by 40% QoQ because of demand recovery due to price declines, while the average selling price decreased by 25%.

SK hynix plans to adjust production and investment flexibly to respond to the market conditions.

The Company will cut its DRAM production capacity from the fourth quarter and will convert part of the DRAM production lines of its M10 FAB in Icheon, Korea, to CMOS image sensor (CIS) mass production lines from the second half. This is to reduce DRAM wafer capacity considering the DRAM demand environment and to strengthen the competitiveness of its CIS business. In addition, with the capacity decrease due to DRAM tech migration, DRAM capacity is likely to continue to decrease until next year.

SK hynix added that it will also increase the NAND wafer input reduction this year to more than 15%. The Company announced last semester that it would decrease the NAND wafer input this year by more than 10% compared to last year.

In addition, SK hynix plans to review, assessing the demand situation, the timing of securing additional clean room space at its M15 FAB in Cheongju, Korea, and installing equipment at the M16 FAB in Icheon, which is expected to be completed in the second half of next year. As a result, the amount of investment next year is expected to be significantly lower than this year.

SK hynix will continue to focus on technology migration and high-density, high-value-added products.

The Company intends to increase the proportion of 1Xnm and 1Y nm DRAM to 80% by the end of this year and start selling 1Y nm computing products from the second half of this year.

For NAND Flash, SK hynix will focus on its 72-layer NAND but also plans to target the high-end smartphones and SSD market by increasing the proportion of 96-layer 4D NAND from the second half. The Company will prepare for mass production and sales of the 128-layer 1 Tb (Terabit) TLC (Triple Level Cell) 4D NAND Flash.

SK hynix will continue to strengthen its competitiveness in preparation for mid- to long-term memory growth.

View at TechPowerUp Main Site