- Joined

- Aug 19, 2017

- Messages

- 2,654 (0.99/day)

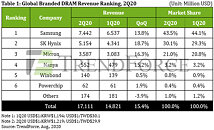

The last cyclical upturn in DRAM contract prices began at the start of 2020 and was led by server DRAM, according to TrendForce's latest investigations. In 2Q20, the emergence of the COVID-19 pandemic shocked the global economy, but OEMs maintained or even stepped up procurement of components because they feared disruptions in the supply chain. As a result, DRAM suppliers' bit shipments surpassed expectations for the quarter, in turn widening the overall increase in DRAM ASP and raising the global DRAM revenue by 15.4% QoQ in 2Q20 to US$17.1 billion.

Nevertheless, TrendForce indicates that server OEMs are now carrying a rather high level of DRAM inventory after aggressively stocking up for two consecutive quarters. At the same time, customers of enterprise servers are holding back on procurement because the economic outlook is getting bleaker and more uncertain. Since server DRAM has the unique role of leading cyclical changes, this category is going to be first to experience price drop in the next downturn and thereby pull prices down for other types of DRAM products. As such, TrendForce forecasts at best a flattening of product shipments and decrease in DRAM prices in 3Q20, with DRAM suppliers suffering a decline in profitability.

Dominant suppliers saw growth in both revenue and profit in 2Q20 as increases in their ASPs widened

All three leading DRAM suppliers, including Samsung, SK Hynix, and Micron, posted strong revenue results for 2Q20, while their respective market shares remained largely unchanged. The DRAM market saw an increase in both prices and bit shipments, leading to a double-digit rise in revenue for the three suppliers. On the other hand, the collective market share of suppliers outside the group of the top three came to just 5%. Regarding the three leading suppliers' revenue performances in 3Q20, TrendForce believes that Micron may be able to slightly raise its market share because it will adopt a more aggressive pricing policy in order to reach the targets for its fiscal year. However, the existing oligopoly in the DRAM market is expected to remain as is without undergoing any significant changes.

On the matter of profitability, all three leading suppliers posted an increase in their operating margins in 2Q20 as the overall ASP rose by around 10% (it should be noted that there are discrepancies in calculation of the leading suppliers' performances since the suppliers have different product mixes as well as different start and end dates for fiscal quarters). Samsung's operating margin surpassed the 40% threshold in 2Q20, reaching 41% from 32% in 1Q20. SK Hynix's operating margin grew to 35% in 2Q20. SK Hynix's ASP rose sharply in 2Q20 because server DRAM comprises a large share of its product mix. This, in turn, led to the considerable growth in its operating margin. As for Micron, its operating margin came to 21% for its fiscal quarter from March to May, up from 16% in its previous fiscal quarter. Micron had the smallest increase in ASP among the top three suppliers, so the gain in its operating margin was relatively modest as well. Looking ahead to 3Q20, the leading suppliers are expected to struggle with profitability. Although they have been optimizing their cost structures, their progress in this area will unlikely be sufficient to compensate for the decline in their ASPs.

Suppliers remain cautious in capacity planning as the COVID-19 pandemic continues to affect demand visibility

Regarding the leading suppliers' technology plans, Samsung kept transferring the wafer capacity of Line 13 away from DRAM and toward CMOS image sensors in 2Q20. At the same time, Samsung was preparing for the activation of P2L in the Pyeongtaek campus. This fab will begin DRAM production in 2H20 to compensate for the production cut at Line 13. On the technology front, Samsung is raising the share of the 1Znm production in its output. SK Hynix reallocated more of the wafer capacity of M10 from DRAM to CMOS image sensors in 2Q20. It also raised DRAM output from M14. Moving into 2H20, SK Hynix will increase the production capacity of the Wuxi base by a modest amount. The growth in its annual total bit output will be primarily driven by the 1Ynm migration.

Micron's main focus this year is on achieving mass production and raising output share for the 1Znm process. Currently, Micron has advanced its 1Znm products to the early part of mass production with a few OEMs still testing samples. Once sample testing is fully completed, Micron is expected to make the 1Znm process its main technology for DRAM production. As for capacity planning, Micron's total DRAM production capacity at the end of 2020 will be relatively the same as at the end of 2019. On the whole, the three leading suppliers have taken a more conservative approach to capacity expansion for the rest of this year since the COVID-19 pandemic continues to sap demand. TrendForce currently estimates that 70% of the increase in the DRAM industry's annual total bit output for 2021 will be attributed to the 1Ynm and 1Znm migrations, whereas capacity expansions will account for only 30%.

Taiwanese suppliers saw an increase in both prices and bit shipments as they continue to focus on advanced process technology development and product improvements

Nanya Tech posted a QoQ rise of around 7% for both its ASP and bit shipments. As a result, its revenue grew by 15% QoQ in 2Q20. Nanya's operating margin went up further on the back of the rising ASP, climbing to 19.6% in 2Q20. The hike in Winbond's DRAM ASP in 2Q20 was limited to 0.5% because a significant portion of the suppliers' sales is realized through long-term contracts. In contrast to its DRAM products, however, Winbond's revenue from Flash products registered a notable growth for 2Q20. As for Powerchip, the calculation of its revenue in this press release covers only the sales of the company's own branded, in-house manufactured PC DRAM products. Powerchip's strategy of focusing on foundry orders for logic products such as PMICs (power management IC) and Driver ICs continued to constrain its DRAM production. Hence, its DRAM revenue for 2Q20 was generally on par with 1Q20.

Despite their varying revenue performances for 2Q20, the three Taiwanese suppliers will be concentrating on their next-generation processes. Nanya is working to have its 1Anm and 1Bnm processes enter pilot run as soon as possible. Winbond is raising the yield rate of its new 25 nm process, but its capacity expansion is mainly for raising Flash production. Lastly, Powerchip continues to improve the manufacturing of its 25 nm DDR4 chips. Nevertheless, foundry orders for logic products remain the core part of its operational strategy.

View at TechPowerUp Main Site

Nevertheless, TrendForce indicates that server OEMs are now carrying a rather high level of DRAM inventory after aggressively stocking up for two consecutive quarters. At the same time, customers of enterprise servers are holding back on procurement because the economic outlook is getting bleaker and more uncertain. Since server DRAM has the unique role of leading cyclical changes, this category is going to be first to experience price drop in the next downturn and thereby pull prices down for other types of DRAM products. As such, TrendForce forecasts at best a flattening of product shipments and decrease in DRAM prices in 3Q20, with DRAM suppliers suffering a decline in profitability.

Dominant suppliers saw growth in both revenue and profit in 2Q20 as increases in their ASPs widened

All three leading DRAM suppliers, including Samsung, SK Hynix, and Micron, posted strong revenue results for 2Q20, while their respective market shares remained largely unchanged. The DRAM market saw an increase in both prices and bit shipments, leading to a double-digit rise in revenue for the three suppliers. On the other hand, the collective market share of suppliers outside the group of the top three came to just 5%. Regarding the three leading suppliers' revenue performances in 3Q20, TrendForce believes that Micron may be able to slightly raise its market share because it will adopt a more aggressive pricing policy in order to reach the targets for its fiscal year. However, the existing oligopoly in the DRAM market is expected to remain as is without undergoing any significant changes.

On the matter of profitability, all three leading suppliers posted an increase in their operating margins in 2Q20 as the overall ASP rose by around 10% (it should be noted that there are discrepancies in calculation of the leading suppliers' performances since the suppliers have different product mixes as well as different start and end dates for fiscal quarters). Samsung's operating margin surpassed the 40% threshold in 2Q20, reaching 41% from 32% in 1Q20. SK Hynix's operating margin grew to 35% in 2Q20. SK Hynix's ASP rose sharply in 2Q20 because server DRAM comprises a large share of its product mix. This, in turn, led to the considerable growth in its operating margin. As for Micron, its operating margin came to 21% for its fiscal quarter from March to May, up from 16% in its previous fiscal quarter. Micron had the smallest increase in ASP among the top three suppliers, so the gain in its operating margin was relatively modest as well. Looking ahead to 3Q20, the leading suppliers are expected to struggle with profitability. Although they have been optimizing their cost structures, their progress in this area will unlikely be sufficient to compensate for the decline in their ASPs.

Suppliers remain cautious in capacity planning as the COVID-19 pandemic continues to affect demand visibility

Regarding the leading suppliers' technology plans, Samsung kept transferring the wafer capacity of Line 13 away from DRAM and toward CMOS image sensors in 2Q20. At the same time, Samsung was preparing for the activation of P2L in the Pyeongtaek campus. This fab will begin DRAM production in 2H20 to compensate for the production cut at Line 13. On the technology front, Samsung is raising the share of the 1Znm production in its output. SK Hynix reallocated more of the wafer capacity of M10 from DRAM to CMOS image sensors in 2Q20. It also raised DRAM output from M14. Moving into 2H20, SK Hynix will increase the production capacity of the Wuxi base by a modest amount. The growth in its annual total bit output will be primarily driven by the 1Ynm migration.

Micron's main focus this year is on achieving mass production and raising output share for the 1Znm process. Currently, Micron has advanced its 1Znm products to the early part of mass production with a few OEMs still testing samples. Once sample testing is fully completed, Micron is expected to make the 1Znm process its main technology for DRAM production. As for capacity planning, Micron's total DRAM production capacity at the end of 2020 will be relatively the same as at the end of 2019. On the whole, the three leading suppliers have taken a more conservative approach to capacity expansion for the rest of this year since the COVID-19 pandemic continues to sap demand. TrendForce currently estimates that 70% of the increase in the DRAM industry's annual total bit output for 2021 will be attributed to the 1Ynm and 1Znm migrations, whereas capacity expansions will account for only 30%.

Taiwanese suppliers saw an increase in both prices and bit shipments as they continue to focus on advanced process technology development and product improvements

Nanya Tech posted a QoQ rise of around 7% for both its ASP and bit shipments. As a result, its revenue grew by 15% QoQ in 2Q20. Nanya's operating margin went up further on the back of the rising ASP, climbing to 19.6% in 2Q20. The hike in Winbond's DRAM ASP in 2Q20 was limited to 0.5% because a significant portion of the suppliers' sales is realized through long-term contracts. In contrast to its DRAM products, however, Winbond's revenue from Flash products registered a notable growth for 2Q20. As for Powerchip, the calculation of its revenue in this press release covers only the sales of the company's own branded, in-house manufactured PC DRAM products. Powerchip's strategy of focusing on foundry orders for logic products such as PMICs (power management IC) and Driver ICs continued to constrain its DRAM production. Hence, its DRAM revenue for 2Q20 was generally on par with 1Q20.

Despite their varying revenue performances for 2Q20, the three Taiwanese suppliers will be concentrating on their next-generation processes. Nanya is working to have its 1Anm and 1Bnm processes enter pilot run as soon as possible. Winbond is raising the yield rate of its new 25 nm process, but its capacity expansion is mainly for raising Flash production. Lastly, Powerchip continues to improve the manufacturing of its 25 nm DDR4 chips. Nevertheless, foundry orders for logic products remain the core part of its operational strategy.

View at TechPowerUp Main Site

..

.. ..

..