- Joined

- Oct 9, 2007

- Messages

- 47,241 (7.55/day)

- Location

- Hyderabad, India

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | ASUS ROG Strix B450-E Gaming |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 8GB G.Skill Sniper X |

| Video Card(s) | Palit GeForce RTX 2080 SUPER GameRock |

| Storage | Western Digital Black NVMe 512GB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

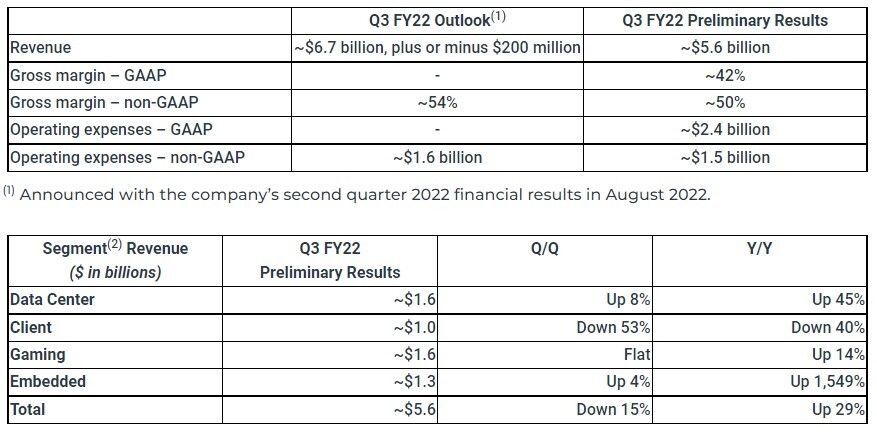

AMD (NASDAQ:AMD) today announced selected preliminary financial results for the third quarter of 2022. Third quarter revenue is expected to be approximately $5.6 billion, an increase of 29% year-over-year. AMD previously expected revenue to increase approximately 55% year-over-year at the mid-point of guidance. Preliminary results reflect lower than expected Client segment revenue resulting from reduced processor shipments due to a weaker than expected PC market and significant inventory correction actions across the PC supply chain.

Revenue for the Data Center, Gaming, and Embedded segments each increased significantly year-over-year in-line with the company's expectations. Gross margin is expected to be approximately 42% and non-GAAP(*) gross margin is expected to be approximately 50%. AMD previously expected non-GAAP gross margin to be approximately 54%. The gross margin shortfall to expectations was primarily due to lower revenue driven by lower Client processor unit shipments and average selling price (ASP). In addition, the third quarter results are expected to include approximately $160 million of charges primarily for inventory, pricing, and related reserves in the graphics and client businesses.

Third quarter operating expenses are expected to be approximately $2.4 billion and non-GAAP operating expenses are expected to be approximately $1.5 billion. Non-GAAP operating expenses are lower than previous expectations of $1.6 billion driven by lower variable compensation expenses in the quarter.

"The PC market weakened significantly in the quarter," said AMD Chair and CEO Dr. Lisa Su. "While our product portfolio remains very strong, macroeconomic conditions drove lower than expected PC demand and a significant inventory correction across the PC supply chain. As we navigate the current market conditions, we are pleased with the performance of our Data Center, Embedded, and Gaming segments and the strength of our diversified business model and balance sheet. We remain focused on delivering our leadership product roadmap and look forward to launching our next-generation 5 nm data center and graphics products later this quarter."

This update does not present all necessary information for an understanding of AMD's financial condition as of the date of this release, or its results of operations for the third quarter of 2022. As AMD completes its quarter-end financial close process and finalizes its financial statements for the quarter, it will be required to make judgments in a number of areas. It is possible that AMD may identify items that require it to make adjustments to the preliminary financial information set forth above and those adjustments could be material. AMD does not intend to update any financial information prior to release of its final third quarter financial statement information, which is currently scheduled for Nov. 1, 2022.

AMD Q3'22 Earnings Conference Call

AMD will hold a conference call for the financial community at 2:00 p.m. PT (5:00 p.m. ET) on Nov. 1, 2022 to discuss its third quarter 2022 financial results. AMD will provide a real-time audio broadcast of the teleconference on the Investor Relations page of its website at www.amd.com.

View at TechPowerUp Main Site

Revenue for the Data Center, Gaming, and Embedded segments each increased significantly year-over-year in-line with the company's expectations. Gross margin is expected to be approximately 42% and non-GAAP(*) gross margin is expected to be approximately 50%. AMD previously expected non-GAAP gross margin to be approximately 54%. The gross margin shortfall to expectations was primarily due to lower revenue driven by lower Client processor unit shipments and average selling price (ASP). In addition, the third quarter results are expected to include approximately $160 million of charges primarily for inventory, pricing, and related reserves in the graphics and client businesses.

Third quarter operating expenses are expected to be approximately $2.4 billion and non-GAAP operating expenses are expected to be approximately $1.5 billion. Non-GAAP operating expenses are lower than previous expectations of $1.6 billion driven by lower variable compensation expenses in the quarter.

"The PC market weakened significantly in the quarter," said AMD Chair and CEO Dr. Lisa Su. "While our product portfolio remains very strong, macroeconomic conditions drove lower than expected PC demand and a significant inventory correction across the PC supply chain. As we navigate the current market conditions, we are pleased with the performance of our Data Center, Embedded, and Gaming segments and the strength of our diversified business model and balance sheet. We remain focused on delivering our leadership product roadmap and look forward to launching our next-generation 5 nm data center and graphics products later this quarter."

This update does not present all necessary information for an understanding of AMD's financial condition as of the date of this release, or its results of operations for the third quarter of 2022. As AMD completes its quarter-end financial close process and finalizes its financial statements for the quarter, it will be required to make judgments in a number of areas. It is possible that AMD may identify items that require it to make adjustments to the preliminary financial information set forth above and those adjustments could be material. AMD does not intend to update any financial information prior to release of its final third quarter financial statement information, which is currently scheduled for Nov. 1, 2022.

AMD Q3'22 Earnings Conference Call

AMD will hold a conference call for the financial community at 2:00 p.m. PT (5:00 p.m. ET) on Nov. 1, 2022 to discuss its third quarter 2022 financial results. AMD will provide a real-time audio broadcast of the teleconference on the Investor Relations page of its website at www.amd.com.

View at TechPowerUp Main Site