TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 17,758 (2.42/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

TrendForce reports that the US Department of Commerce recently released details regarding its CHIPS and Science Act, which stipulates that beneficiaries of the act will be restricted in their investment activities—for more advanced and mature processes—in China, North Korea, Iran, and Russia for the next ten years. The scope of restrictions in this updated legislation will be far more extensive than the previous export ban, further reducing the willingness of multinational semiconductor companies to invest in China for the next decade.

CHIPS Act will mainly impact TSMC; and as the decoupling of the supply chain continues, VIS and PSMC capture orders rerouted from Chinese foundries

In recent years, the US has banned semiconductor exports and passed the CHIPS Act, all to ensure supply chains decoupling from China. Initially, bans on exports were primarily focused on non-planar transistor architecture (16/14 nm and more advanced processes). However, Japan and the Netherlands have also announced that they intend to join the sanctions, which means key DUV immersion systems, used for producing both sub-16 nm and 40/28 nm mature processes, are likely to be included within the scope of the ban as well. These developments, in conjunction with the CHIPS Act, mean that the expansion of both Chinese foundries and multinational foundries in China will be suppressed to varying degrees—regardless of whether they are advanced or mature processes.

TrendForce points out that since 1H23, there is a trend occurring where IC design companies are shifting existing and new orders to Taiwanese foundries under pressure from clients as well as their own need to minimize risks. Tier-2 and -3 companies such as VIS and PSMC, which mainly focus on mature processes, have benefited greatly. TrendForce believes that this shift in orders will undoubtedly ensure major recovery for foundries currently impacted by inventory adjustment and low capacity utilization rates, especially from 2H23 until 2024.

TrendForce points that TSMC has been the most affected by this updated legislation, mostly due to their plans to expand into both China and the U.S. TSCM's current expansion into China, which began in 2022, has been focused on 28 nm processes at Fab 16. The company has been continuously moving expansion-related equipment into China, and in October 2022, it obtained a one-year import permit. The expansion is scheduled to be completed by mid-2023. However, based on the new CHIPS Act, TSMC's further expansions for 16/12 nm and 28/22 nm processes at Fab 16 are limited for the next decade upon receiving the US subsidies. Furthermore, 85% of the output must meet local market demand in China. US export regulations require multinational foundries to apply for equipment import permits, which will reduce TSMC's willingness to continue investing in China.

Plans to expand memory production will focus on South Korea and the US, and China's share of global DRAM capacity will decline YoY

The new CHIPS Act mainly applies to processes more advanced than 18 nm, which is equivalent to 1Xnm for major suppliers. However, mainstream DRAM processes have already been upgraded to above 1Znm, and customers are gradually transitioning under encouragement from suppliers; only a small portion of consumer DRAM products continue to remain below 1Xnm. However, consumer DRAM products only account for 8% of total capacity. SK hynix is the only major supplier to have a fab in Wuxi, China, but factors such as oversupply and geopolitics have caused DRAM output at the Wuxi fab to drop four percentage points from 48% to 44%, and their new fab is set to be located in South Korea. Meanwhile, Samsung and Micron have no DRAM capacity in China and their plans for future expansion will focus on South Korea and the US, respectively. TrendForce estimates, based on the plans of these three suppliers, that South Korea's share of global DRAM capacity will continue to rise while China's will decline YoY, dropping from 14% to 12% by 2025.

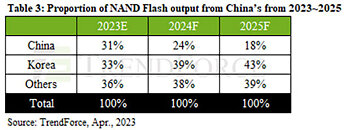

When it comes to the supply of NAND Flash, the US has stated that restrictions on expansion mainly apply to processes with fewer than 128 layers. Samsung's Xi'an fab continues to focus on 128-layer processes and accounts for approximately 17% of global NAND Flash capacity; the Intel fab in Dalian, which was acquired by SK hynix, accounts for 9% of global NAND Flash capacity. However, Samsung and SK Hynix are unlikely to expand their old production lines as 128-layer products will clearly be unable to compete with more advanced ones. The plans involving upgrading process technology and raising production capacity at manufacturing operations in China will be severely limited. All in all, China's share of global NAND Flash capacity is expected to drop from 31% to 18% by 2025.

Demand for DRAM and NAND Flash are in the same boat; many US companies have begun restricting production regions for memory and storage products or are requiring foundries to move their production facilities out of China to avoid geopolitical conflicts. TrendForce predicts the formation of two distinctive production regions: Chinese factories that primarily focus on meeting domestic demand, and factories outside China that will serve other markets.

View at TechPowerUp Main Site | Source

CHIPS Act will mainly impact TSMC; and as the decoupling of the supply chain continues, VIS and PSMC capture orders rerouted from Chinese foundries

In recent years, the US has banned semiconductor exports and passed the CHIPS Act, all to ensure supply chains decoupling from China. Initially, bans on exports were primarily focused on non-planar transistor architecture (16/14 nm and more advanced processes). However, Japan and the Netherlands have also announced that they intend to join the sanctions, which means key DUV immersion systems, used for producing both sub-16 nm and 40/28 nm mature processes, are likely to be included within the scope of the ban as well. These developments, in conjunction with the CHIPS Act, mean that the expansion of both Chinese foundries and multinational foundries in China will be suppressed to varying degrees—regardless of whether they are advanced or mature processes.

TrendForce points out that since 1H23, there is a trend occurring where IC design companies are shifting existing and new orders to Taiwanese foundries under pressure from clients as well as their own need to minimize risks. Tier-2 and -3 companies such as VIS and PSMC, which mainly focus on mature processes, have benefited greatly. TrendForce believes that this shift in orders will undoubtedly ensure major recovery for foundries currently impacted by inventory adjustment and low capacity utilization rates, especially from 2H23 until 2024.

TrendForce points that TSMC has been the most affected by this updated legislation, mostly due to their plans to expand into both China and the U.S. TSCM's current expansion into China, which began in 2022, has been focused on 28 nm processes at Fab 16. The company has been continuously moving expansion-related equipment into China, and in October 2022, it obtained a one-year import permit. The expansion is scheduled to be completed by mid-2023. However, based on the new CHIPS Act, TSMC's further expansions for 16/12 nm and 28/22 nm processes at Fab 16 are limited for the next decade upon receiving the US subsidies. Furthermore, 85% of the output must meet local market demand in China. US export regulations require multinational foundries to apply for equipment import permits, which will reduce TSMC's willingness to continue investing in China.

Plans to expand memory production will focus on South Korea and the US, and China's share of global DRAM capacity will decline YoY

The new CHIPS Act mainly applies to processes more advanced than 18 nm, which is equivalent to 1Xnm for major suppliers. However, mainstream DRAM processes have already been upgraded to above 1Znm, and customers are gradually transitioning under encouragement from suppliers; only a small portion of consumer DRAM products continue to remain below 1Xnm. However, consumer DRAM products only account for 8% of total capacity. SK hynix is the only major supplier to have a fab in Wuxi, China, but factors such as oversupply and geopolitics have caused DRAM output at the Wuxi fab to drop four percentage points from 48% to 44%, and their new fab is set to be located in South Korea. Meanwhile, Samsung and Micron have no DRAM capacity in China and their plans for future expansion will focus on South Korea and the US, respectively. TrendForce estimates, based on the plans of these three suppliers, that South Korea's share of global DRAM capacity will continue to rise while China's will decline YoY, dropping from 14% to 12% by 2025.

When it comes to the supply of NAND Flash, the US has stated that restrictions on expansion mainly apply to processes with fewer than 128 layers. Samsung's Xi'an fab continues to focus on 128-layer processes and accounts for approximately 17% of global NAND Flash capacity; the Intel fab in Dalian, which was acquired by SK hynix, accounts for 9% of global NAND Flash capacity. However, Samsung and SK Hynix are unlikely to expand their old production lines as 128-layer products will clearly be unable to compete with more advanced ones. The plans involving upgrading process technology and raising production capacity at manufacturing operations in China will be severely limited. All in all, China's share of global NAND Flash capacity is expected to drop from 31% to 18% by 2025.

Demand for DRAM and NAND Flash are in the same boat; many US companies have begun restricting production regions for memory and storage products or are requiring foundries to move their production facilities out of China to avoid geopolitical conflicts. TrendForce predicts the formation of two distinctive production regions: Chinese factories that primarily focus on meeting domestic demand, and factories outside China that will serve other markets.

View at TechPowerUp Main Site | Source