- Joined

- Aug 19, 2017

- Messages

- 2,642 (0.99/day)

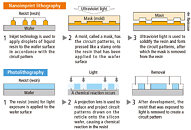

Japanese tech giant Canon hopes to shake up the semiconductor manufacturing industry by shipping new low-cost nanoimprint lithography (NIL) machines as early as this year. The technology, which stamps chip designs onto silicon wafers rather than using more complex light-based etching like market leader ASML's systems, could allow Canon to undercut rivals and democratize leading-edge chip production. "We would like to start shipping this year or next year...while the market is hot. It is a very unique technology that will enable cutting-edge chips to be made simply and at a low cost," said Hiroaki Takeishi, head of Canon's industrial group overseeing nanoimprint lithography technological advancement. Nanoimprint machines target a semiconductor node width of 5 nanometers, aiming to reach 2 nm eventually. Takeishi said the technology has primarily resolved previous defect rate issues, but success will depend on convincing customers that integration into existing fabrication plants is worthwhile.

There is skepticism about Canon's ability to significantly disrupt the market led by ASML's expensive but sophisticated extreme ultraviolet (EUV) lithography tools. However, if nanoimprint can increase yields to nearly 90% at lower costs, it could carve out a niche, especially with EUV supply struggling to meet surging demand. Canon's NIL machines are supposedly 40% the cost of ASML machinery, while operating with up to 90% lower power draw. Initially focusing on 3D NAND memory chips rather than complex processors, Canon must contend with export controls limiting sales to China. But with few options left, Takeishi said Canon will "pay careful attention" to sanctions risks. If successfully deployed commercially after 15+ years in development, Canon's nanoimprint technology could shift the competitive landscape by enabling new players to manufacture leading-edge semiconductors at dramatically lower costs. But it remains to be seen whether the new machines' defect rates, integration challenges, and geopolitical headwinds will allow Canon to disrupt the chipmaking giants it aims to compete with significantly.

View at TechPowerUp Main Site | Source

There is skepticism about Canon's ability to significantly disrupt the market led by ASML's expensive but sophisticated extreme ultraviolet (EUV) lithography tools. However, if nanoimprint can increase yields to nearly 90% at lower costs, it could carve out a niche, especially with EUV supply struggling to meet surging demand. Canon's NIL machines are supposedly 40% the cost of ASML machinery, while operating with up to 90% lower power draw. Initially focusing on 3D NAND memory chips rather than complex processors, Canon must contend with export controls limiting sales to China. But with few options left, Takeishi said Canon will "pay careful attention" to sanctions risks. If successfully deployed commercially after 15+ years in development, Canon's nanoimprint technology could shift the competitive landscape by enabling new players to manufacture leading-edge semiconductors at dramatically lower costs. But it remains to be seen whether the new machines' defect rates, integration challenges, and geopolitical headwinds will allow Canon to disrupt the chipmaking giants it aims to compete with significantly.

View at TechPowerUp Main Site | Source