TheLostSwede

News Editor

- Joined

- Nov 11, 2004

- Messages

- 17,653 (2.41/day)

- Location

- Sweden

| System Name | Overlord Mk MLI |

|---|---|

| Processor | AMD Ryzen 7 7800X3D |

| Motherboard | Gigabyte X670E Aorus Master |

| Cooling | Noctua NH-D15 SE with offsets |

| Memory | 32GB Team T-Create Expert DDR5 6000 MHz @ CL30-34-34-68 |

| Video Card(s) | Gainward GeForce RTX 4080 Phantom GS |

| Storage | 1TB Solidigm P44 Pro, 2 TB Corsair MP600 Pro, 2TB Kingston KC3000 |

| Display(s) | Acer XV272K LVbmiipruzx 4K@160Hz |

| Case | Fractal Design Torrent Compact |

| Audio Device(s) | Corsair Virtuoso SE |

| Power Supply | be quiet! Pure Power 12 M 850 W |

| Mouse | Logitech G502 Lightspeed |

| Keyboard | Corsair K70 Max |

| Software | Windows 10 Pro |

| Benchmark Scores | https://valid.x86.fr/yfsd9w |

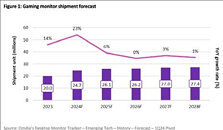

New insights from Omdia's Desktop Monitor Intelligence Service show the gaming monitor market, featuring refresh rates over 120 Hz, is expected to grow by 9% YoY to 24.7 million units in 2024. Meanwhile, the smart monitor market, equipped with operating systems and streaming service portals, is projected to expand by 63% YoY to 1.2 million units.

In 1Q24, desktop monitor shipments hit 30.7 million units, a 5% increase year-on-year (YoY). The industry has been growing steadily since 3Q23, overcoming post-pandemic logistical disruptions. Notably, the gaming monitor market and smart monitors are expanding rapidly. This growth is driven by added value and high functionality, particularly in both monitor categories.

Amid this, the market for gaming monitors with refresh rates exceeding 120 Hz and smart monitors equipped with OS and streaming service portal apps like TVs has been expanding rapidly.

According to Hidetoshi Himuro, Senior Principal Analyst at Omdia, "Monitors are following the same trajectory as TVs in becoming smarter. The focus is on maximizing the content they can handle and broadening the user experience in the B2C market for gaming and smart monitors."

Samsung and LGE from South Korea currently dominate smart monitor shipments. Acer is following, with other brands from Taiwan, the US, and China expected to enter the market soon. In the gaming monitor sector, there is potential for non- gaming monitors to emerge featuring refresh rates exceeding 120 Hz. Consequently, the shipment performance of gaming monitors, defined by their maximum refresh rates, is anticipated to rise.

Omdia forecasts that the gaming monitor market will expand to 27.4 million units by 2028, and the smart monitor market will grow to 2.1 million units, including demand from B2B applications.

In 2024, the smart monitor market is projected to reach 1.2 million units in 2024 driven primarily by TV system-on-chip due to the integrated operating systems, setting them apart from traditional desktop monitors. MediaTek, Novatek, and Realtek were the leading TV SoC vendors in 2023. Their combined market share is expected to rise to 84% in 2024, up from 83% in 2023.

"There are distinct issues in the smart monitor market depending on the vendor type. We anticipate that four operating systems - Tizen, WebOS, AOSP China, and Google will become key players in 2024-25. Additionally, Wi-Fi experience and new user interfaces, such as remote control, are crucial factors in this evolving market," concludes Himuro.

View at TechPowerUp Main Site | Source

In 1Q24, desktop monitor shipments hit 30.7 million units, a 5% increase year-on-year (YoY). The industry has been growing steadily since 3Q23, overcoming post-pandemic logistical disruptions. Notably, the gaming monitor market and smart monitors are expanding rapidly. This growth is driven by added value and high functionality, particularly in both monitor categories.

Amid this, the market for gaming monitors with refresh rates exceeding 120 Hz and smart monitors equipped with OS and streaming service portal apps like TVs has been expanding rapidly.

According to Hidetoshi Himuro, Senior Principal Analyst at Omdia, "Monitors are following the same trajectory as TVs in becoming smarter. The focus is on maximizing the content they can handle and broadening the user experience in the B2C market for gaming and smart monitors."

Samsung and LGE from South Korea currently dominate smart monitor shipments. Acer is following, with other brands from Taiwan, the US, and China expected to enter the market soon. In the gaming monitor sector, there is potential for non- gaming monitors to emerge featuring refresh rates exceeding 120 Hz. Consequently, the shipment performance of gaming monitors, defined by their maximum refresh rates, is anticipated to rise.

Omdia forecasts that the gaming monitor market will expand to 27.4 million units by 2028, and the smart monitor market will grow to 2.1 million units, including demand from B2B applications.

In 2024, the smart monitor market is projected to reach 1.2 million units in 2024 driven primarily by TV system-on-chip due to the integrated operating systems, setting them apart from traditional desktop monitors. MediaTek, Novatek, and Realtek were the leading TV SoC vendors in 2023. Their combined market share is expected to rise to 84% in 2024, up from 83% in 2023.

"There are distinct issues in the smart monitor market depending on the vendor type. We anticipate that four operating systems - Tizen, WebOS, AOSP China, and Google will become key players in 2024-25. Additionally, Wi-Fi experience and new user interfaces, such as remote control, are crucial factors in this evolving market," concludes Himuro.

View at TechPowerUp Main Site | Source