- Joined

- Oct 9, 2007

- Messages

- 47,655 (7.44/day)

- Location

- Dublin, Ireland

| System Name | RBMK-1000 |

|---|---|

| Processor | AMD Ryzen 7 5700G |

| Motherboard | Gigabyte B550 AORUS Elite V2 |

| Cooling | DeepCool Gammax L240 V2 |

| Memory | 2x 16GB DDR4-3200 |

| Video Card(s) | Galax RTX 4070 Ti EX |

| Storage | Samsung 990 1TB |

| Display(s) | BenQ 1440p 60 Hz 27-inch |

| Case | Corsair Carbide 100R |

| Audio Device(s) | ASUS SupremeFX S1220A |

| Power Supply | Cooler Master MWE Gold 650W |

| Mouse | ASUS ROG Strix Impact |

| Keyboard | Gamdias Hermes E2 |

| Software | Windows 11 Pro |

Jon Peddie Research (JPR), the industry's research and consulting firm for graphics and multimedia, today announced estimated graphics chip shipments and suppliers' market share for 2014 2Q in its Market Watch quarterly PC graphics report, an industry reference since 1988.

Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all systems and devices today -- from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables. New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter -- it is the human-machine interface.

The third quarter is typically the big growth quarter, and after the turmoil of the recession, it appears that trends are following the typical seasonality cycles of the past.

Quick report highlights:

GPUs are traditionally a leading indicator of the PC market, since a GPU goes into every system before it is shipped, and most of the vendors are guiding cautiously for Q4 '14.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in Q3. Nvidia's new high-end Maxwell GPUs sales were strong, lifting the ASPs for the discrete GPU market.

Q3 2014 saw a flattening in tablet sales from the first decline in sales last quarter. The CAGR for total PC graphics from 2014 to 2017 is up to almost 3%. We expect the total shipments of graphics chips in 2017 to be 510 million units. In 2013, 454 million GPUs were shipped and the forecast for 2014 is 468 million.

The quarter in general

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.55 GPUs per PC.

For PC and mobile device related companies small and large, new to the industry or established, it is critical to get a proper grip on this highly complex technology and understand its future direction. In this detailed 50-page data-based report, JPR provides all the data, analysis and insight needed to clearly understand where this technology is today and where it's headed. This fact and data-based report does not pull any punches: frankly, some of the analysis and insight may prove to be shocking.

Findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

View at TechPowerUp Main Site

Graphics processors, stand-alone discrete devices, and embedded processor-based GPUs are ubiquitous and essential components in all systems and devices today -- from handheld mobile devices, PCs, and workstations, to TVs, servers, vehicle systems, signage, game consoles, medical equipment, and wearables. New technologies and semiconductor manufacturing processes are taking advantage of the ability of GPU power to scale. The GPU drives the screen of every device we encounter -- it is the human-machine interface.

The third quarter is typically the big growth quarter, and after the turmoil of the recession, it appears that trends are following the typical seasonality cycles of the past.

Quick report highlights:

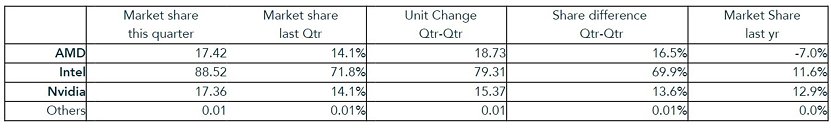

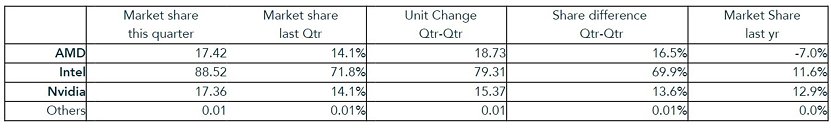

- AMD's overall unit shipments decreased 7% quarter-to-quarter, Intel's total shipments increased 11.6% from last quarter, and Nvidia's jumped 12.9%.

- The attach rate of GPUs (includes integrated and discrete GPUs) to PCs, for the quarter was 155% (up 2%) and 32% of PCs had discrete GPUs, (flat from last quarter), which means 68% of PCs today are using the embedded graphics in the CPU.

- The overall PC market increased 6.9% quarter-to-quarter, and decreased 2.6% year-to-year.

- Desktop graphics add-in boards (AIBs) that use discrete GPUs increased 7.8% from last quarter.

GPUs are traditionally a leading indicator of the PC market, since a GPU goes into every system before it is shipped, and most of the vendors are guiding cautiously for Q4 '14.

The Gaming PC segment, where higher-end GPUs are used, was a bright spot in the market in Q3. Nvidia's new high-end Maxwell GPUs sales were strong, lifting the ASPs for the discrete GPU market.

Q3 2014 saw a flattening in tablet sales from the first decline in sales last quarter. The CAGR for total PC graphics from 2014 to 2017 is up to almost 3%. We expect the total shipments of graphics chips in 2017 to be 510 million units. In 2013, 454 million GPUs were shipped and the forecast for 2014 is 468 million.

The quarter in general

- AMD's shipments of desktop heterogeneous GPU/CPUs, i.e., APUs increased 10.5% from the previous quarter, and decreased 16% in notebooks. AMD's discrete desktop shipments decreased 19% and notebook discrete shipments increased 10%. The company's overall PC graphics shipments decreased 7%.

- Intel's desktop processor embedded graphics (EPGs) shipments decreased from last quarter by 0.3%, and notebooks increased by 18.6%. The company's overall PC graphics shipments increased 11.6%.

- Nvidia's desktop discrete shipments increased 24.3% from last quarter; and the company's notebook discrete shipments increased 3.5%. The company's overall PC graphics shipments increased 12.9%.

- Year-to-year this quarter AMD's overall PC shipments decreased 24%, Intel increased 19%, Nvidia decreased 4%, and the others essentially are too small to measure.

- Total discrete GPU (desktop and notebook) shipments from the last quarter increased 6.6%, and decreased 7.7% from last year. Sales of discrete GPUs fluctuate due to a variety of factors (timing, memory pricing, etc.), new product introductions, and the influence of integrated graphics. Overall, the trend for discrete GPUs has increased with a CAGR from 2014 to 2017 now of 3%.

- Ninety nine percent of Intel's non-server processors have graphics, and over 66% of AMD's non-server processors contain integrated graphics; AMD still ships integrated graphics chipsets (IGPs).

Graphics chips (GPUs) and chips with graphics (IGPs, APUs, and EPGs) are a leading indicator for the PC market. At least one and often two GPUs are present in every PC shipped. It can take the form of a discrete chip, a GPU integrated in the chipset or embedded in the CPU. The average has grown from 1.2 GPUs per PC in 2001 to almost 1.55 GPUs per PC.

For PC and mobile device related companies small and large, new to the industry or established, it is critical to get a proper grip on this highly complex technology and understand its future direction. In this detailed 50-page data-based report, JPR provides all the data, analysis and insight needed to clearly understand where this technology is today and where it's headed. This fact and data-based report does not pull any punches: frankly, some of the analysis and insight may prove to be shocking.

Findings include discrete and integrated graphics (CPU and chipset) for Desktops, Notebooks (and Netbooks), and PC-based commercial (i.e., POS) and industrial/scientific and embedded. This report does not include the x86 game consoles, handhelds (i.e., mobile phones), x86 Servers or ARM-based Tablets (i.e. iPad and Android-based Tablets), or ARM-based Servers. It does include x86-based tablets, Chromebooks, and embedded systems.

View at TechPowerUp Main Site