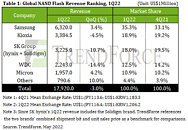

Revenue from Enterprise SSDs Totaled Just US$3.79 Billion for 4Q22 Due to Slumping Demand and Widening Decline in SSD Contract Prices, Says TrendForce

Looking back at 2H22, as server OEMs slowed down the momentum of their product shipments, Chinese server buyers also held a conservative outlook on future demand and focused on inventory reduction. Thus, the flow of orders for enterprise SSDs remained sluggish. However, NAND Flash suppliers had to step up shipments of enterprise SSDs during 2H22 because the demand for storage components equipped in notebook (laptop) computers and smartphones had undergone very large downward corrections. Compared with other categories of NAND Flash products, enterprise SSDs represented the only significant source of bit consumption. Ultimately, due to the imbalance between supply and demand, the QoQ decline in prices of enterprise SSDs widened to 25% for 4Q22. This price plunge, in turn, caused the quarterly total revenue from enterprise SSDs to drop by 27.4% QoQ to around US$3.79 billion. TrendForce projects that the NAND Flash industry will again post a QoQ decline in the revenue from this product category for 1Q23.