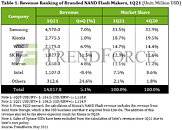

NAND Flash Revenue Rises by 15% QoQ for 3Q21 Thanks to Demand from Smartphone and Data Center Markets, Says TrendForce

The growth of the NAND Flash market in 3Q21 was primarily driven by strong demand from the data center and smartphone industries, according to TrendForce's latest investigations. More specifically, NAND Flash suppliers' hyperscaler and enterprise clients kept up their procurement activities that began in 2Q21 in order to deploy products based on new processor platforms. Major smartphone brands, on the other hand, likewise expanded their NAND Flash procurement activities during the quarter as they prepared to release their new flagship models. As such, clients in both server and smartphone industries made significant contributions to the revenue growth of the NAND Flash industry for 3Q21. At the same time, however, suppliers also warned that orders from PC OEMs began showing signs of decline. On the whole, the industry's quarterly total NAND Flash bit shipment increased by nearly 11% QoQ for 3Q21, and the overall NAND Flash ASP rose by nearly 4% QoQ for the same quarter. Thanks to rising prices and expanding shipments, the quarterly total NAND Flash revenue increased by 15% QoQ to a new record high of US$18.8 billion in 3Q21.