Apr 16th, 2025 10:07 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- The TPU UK Clubhouse (26117)

- 5070ti overclock...what are your settings? (6)

- Help me identify Chip of this DDR4 RAM (21)

- Last game you purchased? (772)

- Windows 11 fresh install to do list (23)

- How to relubricate a fan and/or service a troublesome/noisy fan. (229)

- GPU Memory Temprature is always high (16)

- Help For XFX RX 590 GME Chinese - Vbios (4)

- PCGH: "hidden site" to see total money spend on steam (3)

- Share your AIDA 64 cache and memory benchmark here (3053)

Popular Reviews

- G.SKILL Trident Z5 NEO RGB DDR5-6000 32 GB CL26 Review - AMD EXPO

- ASUS GeForce RTX 5080 TUF OC Review

- DAREU A950 Wing Review

- The Last Of Us Part 2 Performance Benchmark Review - 30 GPUs Compared

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Thermaltake TR100 Review

- Zotac GeForce RTX 5070 Ti Amp Extreme Review

- TerraMaster F8 SSD Plus Review - Compact and quiet

Controversial News Posts

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (182)

- NVIDIA Sends MSRP Numbers to Partners: GeForce RTX 5060 Ti 8 GB at $379, RTX 5060 Ti 16 GB at $429 (124)

- Nintendo Confirms That Switch 2 Joy-Cons Will Not Utilize Hall Effect Stick Technology (105)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (99)

- Sony Increases the PS5 Pricing in EMEA and ANZ by Around 25 Percent (85)

- NVIDIA PhysX and Flow Made Fully Open-Source (77)

- NVIDIA Pushes GeForce RTX 5060 Ti Launch to Mid-April, RTX 5060 to May (77)

News Posts matching #Nasdaq

Return to Keyword Browsing

Kioxia and Western Digital Could Announce Merger This Month

According to Kyodo News, Japanese chip manufacturer Kioxia and its U.S. counterpart Western Digital are reportedly on the verge of finalizing a merger agreement, aiming to create the world's largest producer of memory chips. The merger plan involves establishing a holding company to consolidate their operations for producing NAND flash memory chips, with the announcement reportedly coming this month. The merged entity is expected to be listed on the Nasdaq stock exchange in the United States. As the global semiconductor market contends with competitive pressures and fluctuating demand, the merger is seen as a strategic move to enhance the combined market position of both companies.

Western Digital shareholders are anticipated to hold a majority stake in the new entity, with Kioxia's shareholders, including Toshiba Corporation, owning the remaining stake. The move is poised to give the newly formed company a combined market share of 35.4 percent in NAND memory chips as of March, surpassing South Korea's Samsung, the current leader, with 34.3 percent. However, the merger's ultimate approval hinges on regulators' decisions, including those in China, as semiconductors have become increasingly integral to global economic security. Major Japanese banks, including MUFG Bank and the state-backed Development Bank of Japan, are contemplating loans of up to approximately 1.9 trillion yen (about $12.7 billion) to facilitate the merger.

Western Digital shareholders are anticipated to hold a majority stake in the new entity, with Kioxia's shareholders, including Toshiba Corporation, owning the remaining stake. The move is poised to give the newly formed company a combined market share of 35.4 percent in NAND memory chips as of March, surpassing South Korea's Samsung, the current leader, with 34.3 percent. However, the merger's ultimate approval hinges on regulators' decisions, including those in China, as semiconductors have become increasingly integral to global economic security. Major Japanese banks, including MUFG Bank and the state-backed Development Bank of Japan, are contemplating loans of up to approximately 1.9 trillion yen (about $12.7 billion) to facilitate the merger.

Nasdaq Set to Remove Activision Blizzard from Stock Exchange Top 100

Nasdaq, the American stock exchange, has revealed that an unnamed company will be replacing Activision Blizzard within its top 100 index. The timing of this development is raising some eyebrows—it is set to occur mere days after the announcement of Microsoft's victory over the US Federal Trade Commission (FTC). The giant American technology corporation is closing in on its proposed acquisition of a games publishing group comprised of Activision, Blizzard Entertainment, and King Digital Entertainment.

Prior to the market opening next week (Monday 17th July) Activision Blizzard will be removed from the Nasdaq-100 ESG Index, although the company will remain tradable. An upcoming exit from the US stock exchange could signal that Microsoft and Activision Blizzard have become increasingly confident about the finalization of their merger before a July 18 deadline. The UK's Competition and Markets Authority (CMA) is reported to be engaging in discussions with involved parties, and has paused its legal proceedings. The FTC yesterday filed for an appeal against the California court's verdict, thus immediately annoying the top brass at Microsoft/Xbox—president Brad Smith commented on the situation: "The District Court's ruling makes crystal clear that this acquisition is good for both competition and consumers...We're disappointed that the FTC is continuing to pursue what has become a demonstrably weak case, and we will oppose further efforts to delay the ability to move forward."

Prior to the market opening next week (Monday 17th July) Activision Blizzard will be removed from the Nasdaq-100 ESG Index, although the company will remain tradable. An upcoming exit from the US stock exchange could signal that Microsoft and Activision Blizzard have become increasingly confident about the finalization of their merger before a July 18 deadline. The UK's Competition and Markets Authority (CMA) is reported to be engaging in discussions with involved parties, and has paused its legal proceedings. The FTC yesterday filed for an appeal against the California court's verdict, thus immediately annoying the top brass at Microsoft/Xbox—president Brad Smith commented on the situation: "The District Court's ruling makes crystal clear that this acquisition is good for both competition and consumers...We're disappointed that the FTC is continuing to pursue what has become a demonstrably weak case, and we will oppose further efforts to delay the ability to move forward."

Arm Ltd Files for IPO on Nasdaq, Aiming to Raise $8-10 Billion

According to the latest report from Reuters, Arm Ltd has filled the documents for its initial public offering (IPO) efforts in hopes of getting publically traded later this year. The stock exchange of choice is Nasdaq, where Softbank plans to list Arm's shares publicly. Seeking to raise anywhere between 8-10 billion US Dollars, the company's market capitalization has yet to be determined. If any factor is to go by, NVIDIA tried to acquire Arm Ltd for 40 billion US Dollars, which ultimately failed due to regulators rejecting the deal.

As a reminder, Arm is changing its licensing model to boost royalties, which we reported about here. Goldman Sachs, JPMorgan Chase & Co, Barclays, and Mizuho Financial Group guide the IPO efforts.

As a reminder, Arm is changing its licensing model to boost royalties, which we reported about here. Goldman Sachs, JPMorgan Chase & Co, Barclays, and Mizuho Financial Group guide the IPO efforts.

Asetek Reports its Q4 2022 Financial Results, Running out of Money in May 2023

Asetek reported fourth-quarter revenue of $9.5 million compared with $18.1 million in the same period of 2021. Revenue in the full year 2022 was $50.7 million compared with $79.8 million in the same period last year. The change from prior year for both periods reflects a decline in shipments of liquid cooling products due to the continued challenging business climate.

Gross margin was 41% for the fourth quarter of 2022 compared with 42% in the same period of 2021. The margin in the fourth quarter of 2022 reflects a change in the product mix partly offset by a stronger U.S. dollar, when compared with the same period of prior year. Gross margin for the full year 2022 was 41% compared with 42% in 2021.

Gross margin was 41% for the fourth quarter of 2022 compared with 42% in the same period of 2021. The margin in the fourth quarter of 2022 reflects a change in the product mix partly offset by a stronger U.S. dollar, when compared with the same period of prior year. Gross margin for the full year 2022 was 41% compared with 42% in 2021.

Western Digital Reports Fiscal Second Quarter 2023 Financial Results

Western Digital Corp. (Nasdaq: WDC) today reported fiscal second quarter 2023 financial results. "The Western Digital team delivered revenue at the high end of our guidance range, despite a challenging flash price environment and continued cloud inventory digestion," said David Goeckeler, Western Digital CEO. "We continue to take action to reset the business in response to the post-pandemic environment by optimizing our cost structure and strengthening our liquidity.

These actions, including strategically reducing our capital expenditures across both flash and HDD and our operating expenses, as well as amending our financial covenants and securing recent financings, will give us the financial flexibility and optionality to weather this cycle, while also positioning us to continue executing our product roadmap and furthering our technical leadership over the long term."

These actions, including strategically reducing our capital expenditures across both flash and HDD and our operating expenses, as well as amending our financial covenants and securing recent financings, will give us the financial flexibility and optionality to weather this cycle, while also positioning us to continue executing our product roadmap and furthering our technical leadership over the long term."

Turtle Beach Corporation Launches "Play with Purpose" - Establishing the Company's Environmental, Social, and Governance Goals

Leading gaming accessories provider Turtle Beach Corporation today officially announced the Company's Environmental, Social, and Governance (ESG) program, entitled Play with Purpose. The Company's Play with Purpose program, along with its ESG Policy adopted by its Board of Directors, formalizes the Company's ESG initiatives and sets goals that are, and will continue to be, a vital part of Turtle Beach Corporation's business. Available on the Company's corporate website, Play with Purpose highlights Turtle Beach Corporation's current and future initiatives and goals to reduce its carbon footprint, eliminate plastic packaging, reduce packaging size, and add carbon impact labels on select products across its Turtle Beach, ROCCAT, and Neat Microphones brands. Beyond Turtle Beach Corporation's ESG goals, Play with Purpose also provides insight into the Company's diversity and inclusion and community involvement commitments.

"As one of the most well-known brands in gaming for decades, Turtle Beach has had a long-term commitment to ESG initiatives and today's announcement articulates our future goals," said Juergen Stark, Chairman and CEO, Turtle Beach Corporation. "With the guidance of the team at RPS Group, amplified by the energy within the organization to continue to do more and do better, we are excited to share these plans and our goals with the community. We want to ensure that when consumers buy Turtle Beach, ROCCAT, and Neat Microphones products, they have confidence knowing we're focused on minimizing environmental impact, in addition to knowing they're getting the highest-quality product."

"As one of the most well-known brands in gaming for decades, Turtle Beach has had a long-term commitment to ESG initiatives and today's announcement articulates our future goals," said Juergen Stark, Chairman and CEO, Turtle Beach Corporation. "With the guidance of the team at RPS Group, amplified by the energy within the organization to continue to do more and do better, we are excited to share these plans and our goals with the community. We want to ensure that when consumers buy Turtle Beach, ROCCAT, and Neat Microphones products, they have confidence knowing we're focused on minimizing environmental impact, in addition to knowing they're getting the highest-quality product."

Xilinx Reports Fiscal Fourth Quarter and Fiscal Year 2021 Results

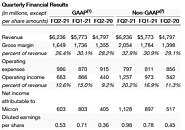

Xilinx, Inc. (Nasdaq: XLNX), the leader in adaptive computing, today announced record revenues of $851 million for the fiscal fourth quarter, up 6% over the previous quarter and an increase of 13% year over year. Fiscal 2021 revenues were $3.15 billion, largely flat from the prior fiscal year. GAAP net income for the fiscal fourth quarter was $188 million, or $0.75 per diluted share. Non-GAAP net income for the quarter was $204 million, or $0.82 per diluted share. GAAP net income for fiscal year 2021 was $647 million, or $2.62 per diluted share. Non-GAAP net income for fiscal year 2021 was $762 million, or $3.08 per diluted share.

Additional fourth quarter of fiscal year 2021 comparisons are provided in the charts below. "We are pleased with our fourth quarter results as we delivered record revenues and double-digit year-over-year growth in the midst of a challenging supply chain environment," said Victor Peng, Xilinx president and CEO. "Xilinx saw further improvement in demand across a majority of our diversified end markets with key strength in our Wireless, Data Center and Automotive markets, the pillars of our growth strategy. Our teams have executed well and we remain focused on continuing to meet customers' critical needs.

Additional fourth quarter of fiscal year 2021 comparisons are provided in the charts below. "We are pleased with our fourth quarter results as we delivered record revenues and double-digit year-over-year growth in the midst of a challenging supply chain environment," said Victor Peng, Xilinx president and CEO. "Xilinx saw further improvement in demand across a majority of our diversified end markets with key strength in our Wireless, Data Center and Automotive markets, the pillars of our growth strategy. Our teams have executed well and we remain focused on continuing to meet customers' critical needs.

Turtle Beach Reports Strong First Quarter 2021 Results And Raises Full-Year Outlook

Leading gaming accessory maker Turtle Beach Corporation (Nasdaq: HEAR), reported financial results for the first quarter ended March 31, 2021. "We turned in another stellar performance in the first quarter, with sales, gross margin, net income and adjusted EBITDA all reaching record high levels for the first quarter," said Juergen Stark, CEO, Turtle Beach. "Consumer demand for console headsets and PC gaming accessories remained at elevated levels, our category expansions are going well, and our operational excellence again allowed us to gain market share, leverage operating costs, and deliver better than expected results.

The strong secular trends that make gaming such a great category continue. According to NPD, U.S. retail sales of console headsets in the first quarter continued at record levels. During the quarter, the overall console market in the US rose 60% in dollars while our retail sales exceeded that growth. US sales of PC headsets, keyboards, and mice rose more than 90% and we more than doubled that reflecting the impact of our expanding line of PC accessories.

The strong secular trends that make gaming such a great category continue. According to NPD, U.S. retail sales of console headsets in the first quarter continued at record levels. During the quarter, the overall console market in the US rose 60% in dollars while our retail sales exceeded that growth. US sales of PC headsets, keyboards, and mice rose more than 90% and we more than doubled that reflecting the impact of our expanding line of PC accessories.

Micron Technology Reports Results for the Second Quarter of Fiscal 2021

Micron Technology, Inc. (Nasdaq: MU) today announced results for its second quarter of fiscal 2021, which ended March 4, 2021. "Micron's strong fiscal second quarter performance reflects rapidly improving market conditions and continued solid execution," said Micron Technology President and CEO Sanjay Mehrotra. "Our technology leadership in both DRAM and NAND places Micron in an excellent position to capitalize on the secular demand driven by AI and 5G, and to deliver new levels of user experience and innovation across the data center and intelligent edge."

Corsair Gaming, Inc. Launches Initial Public Offering

Corsair Gaming, Inc. ("Corsair"), a leading global provider and innovator of high-performance gear for gamers and content creators, announced today that it has commenced an initial public offering of 14,000,000 shares of its common stock, approximately 7,500,000 of which are being offered by Corsair and approximately 6,500,000 of which are being offered by a selling stockholder. In connection with the offering, the underwriters will also have a 30-day option to purchase up to an additional 2,100,000 shares of common stock from the selling stockholder. The initial public offering price is estimated to be between $16.00 and $18.00 per share. Corsair has applied to list its common stock on the Nasdaq Global Market under the ticker symbol "CRSR." The offering is subject to market conditions, and there can be no assurance as to whether, or when, the offering may be completed or as to the actual size or terms of the offering.

Goldman Sachs & Co. LLC, Barclays and Credit Suisse are serving as lead book-running managers and as representatives of the underwriters for the proposed offering. Macquarie Capital, Baird, Cowen and Stifel are also acting as book-running managers for the proposed offering. Wedbush Securities and Academy Securities are acting as co-managers for the proposed offering.

Goldman Sachs & Co. LLC, Barclays and Credit Suisse are serving as lead book-running managers and as representatives of the underwriters for the proposed offering. Macquarie Capital, Baird, Cowen and Stifel are also acting as book-running managers for the proposed offering. Wedbush Securities and Academy Securities are acting as co-managers for the proposed offering.

Corsair Files For $100 Million Initial Public Offering

Corsair Gaming was founded as Corsair Microsystems in 1994 originally selling cache modules before switching to DRAM after the incorporation of L2 cache in processors, since then Corsair has continued to expand its product lineup now offering a wide range of PC components and peripherals. In 2017 private equity firm EagleTree Capital acquired a majority stake of the company in a deal valued at $525 million. In recent years Corsair has been acquiring various gaming brands such as Elgato, ORIGIN PC, and SCUF Gaming, these acquisitions have likely left the company with significant loans to repay.

Corsair Gaming has recently filed an initial public offering with a target price of $100 million and will be treated as an emerging growth company. The company intends to list on the Nasdaq under the CRSR symbol. The IPO filing offers some insight into the financial position of Corsair however, many exact dollar values have been withheld in the public filing. Corsair Gaming has sold over 190 million products since 1998 with 85 million of those being sold in the last five years.

Corsair Gaming has recently filed an initial public offering with a target price of $100 million and will be treated as an emerging growth company. The company intends to list on the Nasdaq under the CRSR symbol. The IPO filing offers some insight into the financial position of Corsair however, many exact dollar values have been withheld in the public filing. Corsair Gaming has sold over 190 million products since 1998 with 85 million of those being sold in the last five years.

Micron Technology Reports Results for the Third Quarter of Fiscal 2020

Micron Technology, Inc. (Nasdaq: MU) today announced results for its third quarter of fiscal 2020, which ended May 28, 2020. "Micron's exceptional execution in the fiscal third quarter drove strong sequential revenue and EPS growth, despite challenges in the macro environment," said Micron Technology President and CEO Sanjay Mehrotra. "We are ramping the industry's most advanced DRAM technology into production and have delivered more than 75% of our NAND volume as high-value solutions, supported by record SSD revenue in the quarter. Our portfolio momentum positions us exceedingly well to leverage the long-term growth across our end markets."

AMD Joins NVIDIA in the Nasdaq-100 Index

AMD will join the coveted Nasdaq-100 index at opening-bell on December 24. With a market-capitalization of $17.72 billion, AMD will join the list of 100 of the largest companies by market-cap listed on Nasdaq that includes non-financial companies. AMD peaked $33.2 billion market-cap in September, but fell 46% due to the cryptocurrency crash that affected sales of GPUs. It still grew 57.23% year-over-year, and hence fared relatively better than NVIDIA, which fell from $289.36 per share as on October 1, to around $135.1 as of now, a 53% decline, but a roughly $150 billion erosion in value over a span of just 3 months.

Apr 16th, 2025 10:07 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- The TPU UK Clubhouse (26117)

- 5070ti overclock...what are your settings? (6)

- Help me identify Chip of this DDR4 RAM (21)

- Last game you purchased? (772)

- Windows 11 fresh install to do list (23)

- How to relubricate a fan and/or service a troublesome/noisy fan. (229)

- GPU Memory Temprature is always high (16)

- Help For XFX RX 590 GME Chinese - Vbios (4)

- PCGH: "hidden site" to see total money spend on steam (3)

- Share your AIDA 64 cache and memory benchmark here (3053)

Popular Reviews

- G.SKILL Trident Z5 NEO RGB DDR5-6000 32 GB CL26 Review - AMD EXPO

- ASUS GeForce RTX 5080 TUF OC Review

- DAREU A950 Wing Review

- The Last Of Us Part 2 Performance Benchmark Review - 30 GPUs Compared

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Thermaltake TR100 Review

- Zotac GeForce RTX 5070 Ti Amp Extreme Review

- TerraMaster F8 SSD Plus Review - Compact and quiet

Controversial News Posts

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (182)

- NVIDIA Sends MSRP Numbers to Partners: GeForce RTX 5060 Ti 8 GB at $379, RTX 5060 Ti 16 GB at $429 (124)

- Nintendo Confirms That Switch 2 Joy-Cons Will Not Utilize Hall Effect Stick Technology (105)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (99)

- Sony Increases the PS5 Pricing in EMEA and ANZ by Around 25 Percent (85)

- NVIDIA PhysX and Flow Made Fully Open-Source (77)

- NVIDIA Pushes GeForce RTX 5060 Ti Launch to Mid-April, RTX 5060 to May (77)