Sunday, November 18th 2012

APUs Make Up Nearly 75% of AMD's Processor Sales

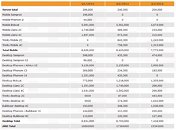

Despite losing in market share to Intel, AMD has reason to cheer as its APU gambit is beginning to pay off. According to the latest architecture- and core count-specific sales figures for AMD given out by Mercury Research detailing Q3-2013 in context of two preceding quarters, APUs make for nearly 75% of AMD's processor sales, and the company's recently-launched "Trinity" line of desktop and mobile APUs are off to a flying start.

The most popular chips in AMD's stable are its "Bobcat" Zacate series low-power APUs, which are being built into entry-level computing devices such as netbooks, nettops, and all-in-one desktops. The chips make up 39 percent of AMD's sales in Q3, followed by another APU line, the A-Series "Trinity", which is available in desktop and mobile variants, offers a combination of a fast integrated graphics processor with up to four CPU cores, and makes up 26.1 percent of AMD's sales. AMD's A-Series "Llano" can still be bought in the market, and makes up 7.4 percent of AMD's sales in Q3.The picture is rather dull over at AMD's non-APU processor lineup, based on Bulldozer and K10/10.5 architectures. Vishera numebrs are not included in the research, as they are very recently launched. Despite being the older architecture, AMD's K10/K10.5 architecture, which makes up Phenom II series processors, outsold Bulldozer by nearly two times. Non-APU processor make up a little over a fourth of AMD's sales. Given this, it wouldn't be far-fetched to think that AMD is better off consolidating its resources to developing its APU line.The research even included AMD's sales (in units, not revenue) across the desktop, server, and mobile lines. While the desktop and mobile lines are evenly matched, the server line has an insignificant 1.3 sales percentage. The finer numbers are tabled above.

Source:

3DCenter.org

The most popular chips in AMD's stable are its "Bobcat" Zacate series low-power APUs, which are being built into entry-level computing devices such as netbooks, nettops, and all-in-one desktops. The chips make up 39 percent of AMD's sales in Q3, followed by another APU line, the A-Series "Trinity", which is available in desktop and mobile variants, offers a combination of a fast integrated graphics processor with up to four CPU cores, and makes up 26.1 percent of AMD's sales. AMD's A-Series "Llano" can still be bought in the market, and makes up 7.4 percent of AMD's sales in Q3.The picture is rather dull over at AMD's non-APU processor lineup, based on Bulldozer and K10/10.5 architectures. Vishera numebrs are not included in the research, as they are very recently launched. Despite being the older architecture, AMD's K10/K10.5 architecture, which makes up Phenom II series processors, outsold Bulldozer by nearly two times. Non-APU processor make up a little over a fourth of AMD's sales. Given this, it wouldn't be far-fetched to think that AMD is better off consolidating its resources to developing its APU line.The research even included AMD's sales (in units, not revenue) across the desktop, server, and mobile lines. While the desktop and mobile lines are evenly matched, the server line has an insignificant 1.3 sales percentage. The finer numbers are tabled above.

46 Comments on APUs Make Up Nearly 75% of AMD's Processor Sales

I love my APU's, amazing chips for the money. Gimmie more.

desktop trinity is really GOOD. they are selling pretty-well here in my country.

I built a friend a A8-5600K based system and he plays TF2, CS:GO, and L4D @ 1920 x 1080 no problem.

In the 90s when GPUs where establishing themselves. There were tons of companies much like now how there is so many companies doing ARM. The herd of the GPU companies started thinning out and the stronger companies started buying up the weak ones.

Intel had the foresight and bought Real3D in 1999 but the GPU wasnt as mature at that time. When AMD made ATI a offer they couldnt refuse in 2006 the GPU was well established in the direction its currently headed.

Fortunately AMD is benefiting for getting into the GPU market at a later date but unfortunately it made a big dent in its pocket-book.

Samething between AMD & Intel is taking place now but in the server/hpc market where both are buying companies and IPs to up one another in the future and squeeze the competition out of the future market.

Steamroller will be a performance processor too.

Performance processors are the i7 3770k and up. AMD has nothing in that segment. I am wondering, however, how a quad-channel APU would fare. Especially if the memory controller is able to do single-, dual-, tri-, and quad-channel... That would totally rock.

Both Bulldozer and Piledriver were marketed towards enthusiasts. Normal people don't need hexacores and octocores or motherboards with crossfire.Piledriver competes with the i7 3xxxk, on par and beats often too. Maybe not in gaming but in almost everything else.

Piledriver is definitely not midrange.

I wouldn't call that insignificant - server hardware always composes the minority of stuff sold, however it commands the highest margins. I mean, every company is going to purchase a couple opf server CPUs for dozens (or even hundred or more) desktop/mobile CPUs. Home users aren't going to purchase server CPUs at all, they will go for desktop/mobile products only.