Top Ten IC Design Houses Ride Wave of Seasonal Consumer Demand and Continued AI Boom to See 17.8% Increase in Quarterly Revenue in 3Q23

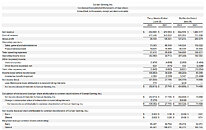

TrendForce reports that 3Q23 has been a historic quarter for the world's leading IC design houses as total revenue soared 17.8% to reach a record-breaking US$44.7 billion. This remarkable growth is fueled by a robust season of stockpiling for smartphones and laptops, combined with a rapid acceleration in the shipment of generative AI chips and components. NVIDIA, capitalizing on the AI boom, emerged as the top performer in revenue and market share. Notably, analog IC supplier Cirrus Logic overtook US PMIC manufacturer MPS to snatch the tenth spot, driven by strong demand for smartphone stockpiling.

NVIDIA's revenue soared 45.7% to US$16.5 billion in the third quarter, bolstered by sustained demand for generative AI and LLMs. Its data center business—accounting for nearly 80% of its revenue—was a key driver in this exceptional growth.

NVIDIA's revenue soared 45.7% to US$16.5 billion in the third quarter, bolstered by sustained demand for generative AI and LLMs. Its data center business—accounting for nearly 80% of its revenue—was a key driver in this exceptional growth.