Wednesday, July 10th 2013

Lenovo Overtakes HP as the Top PC Vendor While U.S. Shipments Stabilize: IDC

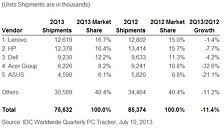

Worldwide PC shipments totaled 75.6 million units in the second quarter of 2013 (2Q13), down -11.4% compared to the same quarter in 2012 but slightly better than expected, according to the International Data Corporation (IDC) Worldwide Quarterly PC Tracker. Total shipments were effectively right on forecasts of 75.4 million and growth of -11.7%, although Europe, Middle East, and Africa (EMEA) and Asia/Pacific (excluding Japan)(APeJ) were a few points below expectations with the difference made up in the United States.

The numbers reflect a market that is still struggling with the transition to touch-based systems running Windows 8 as well as justifying ultrabook prices in the face of economic pressures and competition from tablets and other devices. A silver lining is that a number of vendors and regions seemed to be focused on inventory reduction during the second quarter, which could reflect planned launches of new models as well as lower inventory going into the second half of the year. However, it also reflects some caution among vendors and the channels in the face of remaining challenges for PCs and more than a year of declining shipments.

"With second quarter growth so close to forecast, we are still looking for some improvement in growth during the second half of the year," said Jay Chou, Senior Analyst, IDC Worldwide PC Tracker. "Slower growth in Europe and China reflect the risks, while the improved U.S. outlook reflects potential improvement. Still, the weakness in emerging markets is a threat to a core long-term growth area. In addition, while efforts by the PC ecosystem to bring down price points and embrace touch computing should make PCs more attractive, a lot still needs to be done in launching attractive products and addressing competition from devices like tablets."

One positive sign is that HP and Dell saw growth improve over recent quarters, possibly indicating stronger performance in coming quarters and reflecting more commercial replacements as we get closer to the end of Windows XP support. Market leader Lenovo also grew faster than the market (as well as faster than HP and Dell) although Lenovo growth slipped below zero at -1.4% and was down from prior quarters. Slow growth for Lenovo reflects the company's focus on China, which represents over 50% of Lenovo shipments, and where short-term economic and inventory hurdles cut into 2Q13 shipments.

"The U.S. market is beginning to reflect some of the Windows XP to Windows 7 transition we've been expecting in the commercial PC space, as evidenced by the strong growth in the enterprise-focused Dell PC business," said Bob O'Donnell, Program Vice President, Clients and Displays. "We're also starting to see more stabilization in shipments, which we think is a reflection of PC lifetimes finally starting to even out after a long period of gradual increase. The end result should be more PC replacements, even if consumers and companies are selective in making replacements and wait until PCs are older before replacing them."

Regional Highlights

United States - Posting a decline in shipments of just -1.9% was a substantial improvement from double-digit declines in three of the past four quarters. While positive, this recovery was enabled by lower volume in 2Q12 and supported by a marked reduction in old inventory that enabled a more aggressive channel uptake. Additionally, wider selections of Windows 8 models offered by top vendors and migration from Window XP to Win7 helped to push volume higher than anticipated. Dell managed to climb above 3.8 million units for the first time since 2011, gaining a few points of share in the U.S. PC market. HP maintained its leadership position, growing roughly even with the market. These two vendors represented nearly 50% of total U.S. PC shipments in 2Q13.

EMEA - The PC market in EMEA maintained negative trends as expected in the second quarter. Shipments remained constrained amid continued weakness in consumer demand, while softness persisted in the commercial market, as anticipated, due to unfavorable economic conditions and lack of major renewals. Portable PC shipments contracted the most, impacted by slow demand, which continued to focus on tablets, while high inventory levels inhibited sell-in during the first two months of the quarter leading vendors to focus on stock depletion. June did not bring much boost in sell-in levels, as high inventory persisted in some countries, while orders from retailers remained cautious ahead of an uncertain outlook for the back-to-school period. As a result, the traditionally stronger June replenishment did not occur, and vendors and channel players remained focused on tighter inventory control instead.

Japan - Although the market continued to shrink and consumer sentiment remained weak, market growth came in as expected.

Asia/Pacific (excluding Japan) - Although countries outside of China were fairly in line with forecasts, with India maintaining an encouraging trajectory, overall PC shipments in the region fell slightly below forecast due to China. Weak sell-in to China during April and May constrained shipments. Although June shipments in China improved, expectations for the third quarter are being lowered to reflect remaining inventory as well as economic pressures.

Vendor Highlights

Lenovo took the top PC vendor title, continuing its streak of gains following channel expansion and solid product development. In 2Q13, Lenovo continued to make impressive gains outside of APeJ. However, the headwinds in China continued to affect its home turf significantly. Lenovo ended the quarter with a double-digit decline in Asia/Pacific (excluding Japan). Overall growth has slowed from prior quarters, and slipped into negative territory this quarter, but still outpaced the market and top competitors.

HP slipped to second place, but growth improved from recent quarters. The company received a strong boost from shipments to India as part of large education projects. Shipments continued to decline significantly in EMEA, although the company's U.S. business stabilized a bit after a significant decline in the first quarter of 2013.

Dell despite ongoing uncertainty surrounding its restructuring, the firm performed above market with a decline of -4.5%. As with HP, this was a significant improvement from the past year that was aided by improving growth in the United States. The firm continued to seek opportunities at all levels of the pricing spectrum and managed to perform above market in all key regions except Asia/Pacific (excluding Japan).

Acer Group continued to see substantial declines in shipments across regions as the company was strongly impacted by weak consumer demand. Although it has been aggressive in expanding more premium offerings to offset falling mini notebook sales, Acer has been hampered by slow demand for pricier ultrabooks.

ASUS shipments were constrained by inventory clearance challenges in key regions. Despite its focus on innovative designs, its relative weakness in the commercial space coupled with an intrinsically depressed consumer market led the vendor to see a decline of over 20%.

The numbers reflect a market that is still struggling with the transition to touch-based systems running Windows 8 as well as justifying ultrabook prices in the face of economic pressures and competition from tablets and other devices. A silver lining is that a number of vendors and regions seemed to be focused on inventory reduction during the second quarter, which could reflect planned launches of new models as well as lower inventory going into the second half of the year. However, it also reflects some caution among vendors and the channels in the face of remaining challenges for PCs and more than a year of declining shipments.

"With second quarter growth so close to forecast, we are still looking for some improvement in growth during the second half of the year," said Jay Chou, Senior Analyst, IDC Worldwide PC Tracker. "Slower growth in Europe and China reflect the risks, while the improved U.S. outlook reflects potential improvement. Still, the weakness in emerging markets is a threat to a core long-term growth area. In addition, while efforts by the PC ecosystem to bring down price points and embrace touch computing should make PCs more attractive, a lot still needs to be done in launching attractive products and addressing competition from devices like tablets."

One positive sign is that HP and Dell saw growth improve over recent quarters, possibly indicating stronger performance in coming quarters and reflecting more commercial replacements as we get closer to the end of Windows XP support. Market leader Lenovo also grew faster than the market (as well as faster than HP and Dell) although Lenovo growth slipped below zero at -1.4% and was down from prior quarters. Slow growth for Lenovo reflects the company's focus on China, which represents over 50% of Lenovo shipments, and where short-term economic and inventory hurdles cut into 2Q13 shipments.

"The U.S. market is beginning to reflect some of the Windows XP to Windows 7 transition we've been expecting in the commercial PC space, as evidenced by the strong growth in the enterprise-focused Dell PC business," said Bob O'Donnell, Program Vice President, Clients and Displays. "We're also starting to see more stabilization in shipments, which we think is a reflection of PC lifetimes finally starting to even out after a long period of gradual increase. The end result should be more PC replacements, even if consumers and companies are selective in making replacements and wait until PCs are older before replacing them."

Regional Highlights

United States - Posting a decline in shipments of just -1.9% was a substantial improvement from double-digit declines in three of the past four quarters. While positive, this recovery was enabled by lower volume in 2Q12 and supported by a marked reduction in old inventory that enabled a more aggressive channel uptake. Additionally, wider selections of Windows 8 models offered by top vendors and migration from Window XP to Win7 helped to push volume higher than anticipated. Dell managed to climb above 3.8 million units for the first time since 2011, gaining a few points of share in the U.S. PC market. HP maintained its leadership position, growing roughly even with the market. These two vendors represented nearly 50% of total U.S. PC shipments in 2Q13.

EMEA - The PC market in EMEA maintained negative trends as expected in the second quarter. Shipments remained constrained amid continued weakness in consumer demand, while softness persisted in the commercial market, as anticipated, due to unfavorable economic conditions and lack of major renewals. Portable PC shipments contracted the most, impacted by slow demand, which continued to focus on tablets, while high inventory levels inhibited sell-in during the first two months of the quarter leading vendors to focus on stock depletion. June did not bring much boost in sell-in levels, as high inventory persisted in some countries, while orders from retailers remained cautious ahead of an uncertain outlook for the back-to-school period. As a result, the traditionally stronger June replenishment did not occur, and vendors and channel players remained focused on tighter inventory control instead.

Japan - Although the market continued to shrink and consumer sentiment remained weak, market growth came in as expected.

Asia/Pacific (excluding Japan) - Although countries outside of China were fairly in line with forecasts, with India maintaining an encouraging trajectory, overall PC shipments in the region fell slightly below forecast due to China. Weak sell-in to China during April and May constrained shipments. Although June shipments in China improved, expectations for the third quarter are being lowered to reflect remaining inventory as well as economic pressures.

Vendor Highlights

Lenovo took the top PC vendor title, continuing its streak of gains following channel expansion and solid product development. In 2Q13, Lenovo continued to make impressive gains outside of APeJ. However, the headwinds in China continued to affect its home turf significantly. Lenovo ended the quarter with a double-digit decline in Asia/Pacific (excluding Japan). Overall growth has slowed from prior quarters, and slipped into negative territory this quarter, but still outpaced the market and top competitors.

HP slipped to second place, but growth improved from recent quarters. The company received a strong boost from shipments to India as part of large education projects. Shipments continued to decline significantly in EMEA, although the company's U.S. business stabilized a bit after a significant decline in the first quarter of 2013.

Dell despite ongoing uncertainty surrounding its restructuring, the firm performed above market with a decline of -4.5%. As with HP, this was a significant improvement from the past year that was aided by improving growth in the United States. The firm continued to seek opportunities at all levels of the pricing spectrum and managed to perform above market in all key regions except Asia/Pacific (excluding Japan).

Acer Group continued to see substantial declines in shipments across regions as the company was strongly impacted by weak consumer demand. Although it has been aggressive in expanding more premium offerings to offset falling mini notebook sales, Acer has been hampered by slow demand for pricier ultrabooks.

ASUS shipments were constrained by inventory clearance challenges in key regions. Despite its focus on innovative designs, its relative weakness in the commercial space coupled with an intrinsically depressed consumer market led the vendor to see a decline of over 20%.

4 Comments on Lenovo Overtakes HP as the Top PC Vendor While U.S. Shipments Stabilize: IDC

Going from double digit declines to single digit declines is hardly growth. The next couple of years won't be pretty.

I like Lenovo (at least their small Thinkpads), so I support this.

People and companies would still buy if the industry would deliver much more performance. Rolling out parts which are only 5-10% faster is not enough anymore to make people upgrade as often as they used to do.

The PC industry should adopt to the new situation and push on the performance area (where the competition are still far behind).