Thursday, April 26th 2018

AMD Reports First Quarter 2018 Financial Results

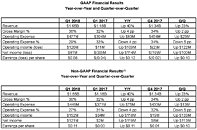

AMD (NASDAQ:AMD) today announced revenue for the first quarter of 2018 of $1.65 billion, operating income of $120 million, net income of $81 million, and diluted earnings per share of $0.08. On a non-GAAP basis, operating income was $152 million, net income was $121 million, and diluted earnings per share was $0.11.

"The first quarter was an outstanding start to 2018 with 40 percent year-over-year revenue growth," said Dr. Lisa Su, AMD president and CEO. "PC, gaming and datacenter adoption of our new, high-performance products continues to accelerate. We are excited about our long-term roadmaps and focused on delivering sustained revenue growth and profitability."Q1 2018 Results

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the second quarter of 2018, AMD expects revenue to be approximately $1.725 billion, plus or minus $50 million, an increase of 50 percent year-over-year, and non-GAAP gross margin of approximately 37 percent.

"The first quarter was an outstanding start to 2018 with 40 percent year-over-year revenue growth," said Dr. Lisa Su, AMD president and CEO. "PC, gaming and datacenter adoption of our new, high-performance products continues to accelerate. We are excited about our long-term roadmaps and focused on delivering sustained revenue growth and profitability."Q1 2018 Results

- All AMD financial results are reported under the new revenue recognition accounting standard, ASC 606, with prior period financial results adjusted for comparison purposes.

- Revenue was $1.65 billion, up 40 percent year-over-year and 23 percent quarter-over-quarter, driven primarily by higher revenue in the Computing and Graphics segment.

- Gross margin was 36 percent, up 4 percentage points year-over-year and 2 percentage points quarter-over-quarter. The gross margin percentage increase was driven by a greater percentage of revenue from Ryzen , Radeon and EPYC products.

- On a GAAP basis, operating income was $120 million compared to operating income of $11 million a year ago and an operating loss of $2 million in the prior quarter.

- Net income was $81 million compared to net losses of $33 million a year ago and $19 million in the prior quarter. Diluted earnings per share was $0.08, compared to losses per share of $0.04 a year ago and $0.02 in the prior quarter.

- On a non-GAAP(1) basis, operating income was $152 million compared to operating income of $34 million a year ago and $19 million in the prior quarter.

- Non-GAAP net income was $121 million compared to net income of $2 million a year ago and $8 million in the prior quarter. Non-GAAP diluted earnings per share was $0.11, compared to break even from a year ago and diluted earnings per share of $0.01 in the prior quarter.

- Cash and cash equivalents were $1.04 billion at the end of the quarter.

- Computing and Graphics segment revenue was $1.12 billion, up 95 percent year-over-year and 23 percent quarter-over-quarter, primarily driven by strong sales of Radeon and Ryzen products.

- Client processor average selling price (ASP) increased year-over-year and quarter-over-quarter due to a greater percentage of revenue from our Ryzen products.

- GPU ASP increased year-over-year and quarter-over-quarter driven by a greater percentage of revenue from our new Radeon products.

- Operating income was $138 million, compared to an operating loss of $21 million a year ago and operating income of $33 million in the prior quarter. Operating income improvement was driven by higher revenue.

- Enterprise, Embedded and Semi-Custom (EESC) segment revenue was $532 million, down 12 percent year-over-year due to lower semi-custom revenue, partially offset by higher server and embedded revenue. EESC segment revenue was up 23 percent quarter-over-quarter, driven by semi-custom, embedded and EPYC processor revenue.

- Operating income was $14 million, compared to operating income of $55 million a year ago and an operating loss of $13 million in the prior quarter. The year-over-year decrease was primarily due to a licensing gain that occurred in Q1 2017. The quarter-over-quarter increase was primarily due to higher revenue.

- All Other operating loss was $32 million compared with operating losses of $23 million a year ago and $22 million in the prior quarter.

- AMD continued returning innovation and excitement to the PC market with the introduction of new consumer-focused desktop processors.

- AMD introduced the first AMD Ryzen desktop APUs, combining the high-performance Radeon "Vega" graphics architecture with revolutionary "Zen" CPU cores on a single chip.

- AMD also delivered the next products in the Company's strong multi-generational roadmap with the launch of its 2nd Generation Ryzen desktop CPUs just over one year after bringing the first Ryzen processors to market. The new 2nd Generation Ryzen processors can deliver up to 15% higher gaming performance compared to 1st Generation Ryzen processors, with the Ryzen 7 2700X processor delivering the highest multiprocessing performance available on a mainstream desktop PC.

- Adoption of AMD products for the datacenter continued with new AMD EPYC processor-powered platforms and deployments

- Dell EMC introduced three new PowerEdge platforms powered by AMD EPYC 7000 series server processors.

- Yahoo Japan Corporation and Packet joined the expanding list of global businesses deploying EPYC processors to enhance the performance and efficiency of their datacenters.

- Supercomputing leader Cray announced that it added EPYC processors to its Cray CS500 line of HPC offerings.

- AMD brought the powerful "Zen" architecture to a variety of new embedded markets with the launch of EPYC Embedded and Ryzen Embedded processors.

- AMD released new Radeon Software Adrenalin Edition updates to optimize the performance of some of the most popular PC games and improve the eSports experience for Radeon graphics card owners.

- AMD and Microsoft announced support for Radeon FreeSync technology in Microsoft's Xbox One S and Xbox One X consoles, bringing the exceptional tear-free gaming experience to a broader base of gamers.

- Adobe announced a new version of Adobe Premiere Pro CC with native support for AMD Radeon Pro SSG graphics to dramatically accelerate 4K and 8K workflows for popular native camera formats.

- Steam launched support for AMD TrueAudio Next in Steam Audio, offering Steam users a more immersive audio experience.

- AMD was included in Fast Company's "World's Most Innovative Companies" 2018 edition, ranking in the top ten Most Innovative Companies in the Consumer Electronics sector.

AMD's outlook statements are based on current expectations. The following statements are forward-looking, and actual results could differ materially depending on market conditions and the factors set forth under "Cautionary Statement" below.

For the second quarter of 2018, AMD expects revenue to be approximately $1.725 billion, plus or minus $50 million, an increase of 50 percent year-over-year, and non-GAAP gross margin of approximately 37 percent.

15 Comments on AMD Reports First Quarter 2018 Financial Results

Congratulations AMD. Keep it up.

over the next 3 quarters we may see lower numbers thanks to the new asic miner, and more reasonable card pricing.

It could be worse yes, but is it so much better? Intel still holds the performance crown in an absolute sense, and Nvidia is bigger than ever. Its really not much different from 2012; the compelling options exist in the mid range, not in the high end where AMD still isn't really competing, rather offering the cost effective alternative like they always have.