Today, ASML Holding NV (ASML) has published its 2024 third-quarter results.

"Our third-quarter total net sales came in at €7.5 billion, above our guidance, driven by more DUV and Installed Base Management sales. The gross margin came in at 50.8%, within guidance. While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness. Regarding Logic, the competitive foundry dynamics have resulted in a slower ramp of new nodes at certain customers, leading to several fab push outs and resulting changes in litho demand timing, in particular EUV. In Memory, we see limited capacity additions, with the focus still on technology transitions supporting the HBM and DDR5 AI-related demand."

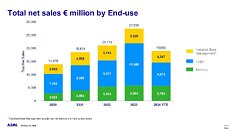

"We expect fourth-quarter total net sales between €8.8 billion and €9.2 billion with a gross margin between 49% and 50% which includes the recognition of the first two High NA systems upon customer acceptance, reflecting progress on imaging, overlay and contrast. ASML expects R&D costs of around €1.1 billion and SG&A costs of around €300 million. We expect full-year 2024 total net sales of around €28 billion. Based on the recent market dynamics as mentioned above, we expect our 2025 total net sales to grow to a range between €30 billion and €35 billion, which is the lower half of the range that we provided at our 2022 Investor Day. We expect a gross margin between 51% and 53%, which is below the range we then provided, mainly related to the delayed timing of EUV demand," said ASML President and Chief Executive Officer Christophe Fouquet.

Update dividend and share buyback program

An interim dividend of €1.52 per ordinary share will be made payable on November 7, 2024.

In the third quarter, we did not purchase any shares under the current 2022-2025 share buyback program.

Details of the share buyback program as well as transactions pursuant thereto, and details of the dividend are published on ASML's website.

Quarterly video interview and investor call

With this press release, ASML has published a video interview in which CFO Roger Dassen discusses the 2024 third-quarter results and outlook for 2024 and 2025. This video and the transcript can be viewed on our website.

An investor call for both investors and the media will be hosted by CEO Christophe Fouquet and CFO Roger Dassen on October 16, 2024 at 15:00 Central European Time / 09:00 US Eastern Time. Details can be found on our website.

View at TechPowerUp Main Site | Source

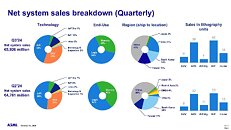

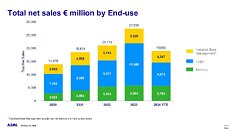

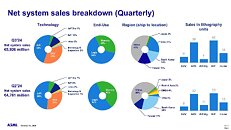

- Q3 total net sales of €7.5 billion, gross margin of 50.8%, net income of €2.1 billion

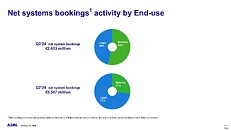

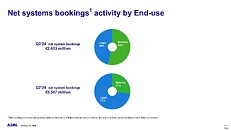

- Quarterly net bookings in Q3 of €2.6 billion of which €1.4 billion is EUV

- ASML expects Q4 2024 total net sales between €8.8 billion and €9.2 billion, and a gross margin between 49% and 50%

- ASML expects 2024 total net sales of around €28 billion

- ASML expects 2025 total net sales to be between €30 billion and €35 billion, with a gross margin between 51% and 53%

"Our third-quarter total net sales came in at €7.5 billion, above our guidance, driven by more DUV and Installed Base Management sales. The gross margin came in at 50.8%, within guidance. While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness. Regarding Logic, the competitive foundry dynamics have resulted in a slower ramp of new nodes at certain customers, leading to several fab push outs and resulting changes in litho demand timing, in particular EUV. In Memory, we see limited capacity additions, with the focus still on technology transitions supporting the HBM and DDR5 AI-related demand."

"We expect fourth-quarter total net sales between €8.8 billion and €9.2 billion with a gross margin between 49% and 50% which includes the recognition of the first two High NA systems upon customer acceptance, reflecting progress on imaging, overlay and contrast. ASML expects R&D costs of around €1.1 billion and SG&A costs of around €300 million. We expect full-year 2024 total net sales of around €28 billion. Based on the recent market dynamics as mentioned above, we expect our 2025 total net sales to grow to a range between €30 billion and €35 billion, which is the lower half of the range that we provided at our 2022 Investor Day. We expect a gross margin between 51% and 53%, which is below the range we then provided, mainly related to the delayed timing of EUV demand," said ASML President and Chief Executive Officer Christophe Fouquet.

Update dividend and share buyback program

An interim dividend of €1.52 per ordinary share will be made payable on November 7, 2024.

In the third quarter, we did not purchase any shares under the current 2022-2025 share buyback program.

Details of the share buyback program as well as transactions pursuant thereto, and details of the dividend are published on ASML's website.

Quarterly video interview and investor call

With this press release, ASML has published a video interview in which CFO Roger Dassen discusses the 2024 third-quarter results and outlook for 2024 and 2025. This video and the transcript can be viewed on our website.

An investor call for both investors and the media will be hosted by CEO Christophe Fouquet and CFO Roger Dassen on October 16, 2024 at 15:00 Central European Time / 09:00 US Eastern Time. Details can be found on our website.

View at TechPowerUp Main Site | Source