Apr 25th, 2025 05:21 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- RX 9000 series GPU Owners Club (534)

- Help getting a mini pc (13)

- What's your latest tech purchase? (23598)

- 5090 Supply (1)

- I dont understand the phone OS world..... (50)

- Which is the best replacement for Microsoft Office? (30)

- Choosing an Internal HDD (21)

- TPU's Nostalgic Hardware Club (20280)

- To distill or not distill what say ye? (102)

- Your PC ATM (35363)

Popular Reviews

- NVIDIA GeForce RTX 5060 Ti 8 GB Review - So Many Compromises

- Crucial CUDIMM DDR5-6400 128 GB CL52 Review

- Colorful iGame B860M Ultra V20 Review

- ASUS GeForce RTX 5060 Ti TUF OC 16 GB Review

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- ASRock X870E Taichi Lite Review

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- ASUS GeForce RTX 5080 TUF OC Review

Controversial News Posts

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (182)

- NVIDIA Sends MSRP Numbers to Partners: GeForce RTX 5060 Ti 8 GB at $379, RTX 5060 Ti 16 GB at $429 (127)

- NVIDIA Launches GeForce RTX 5060 Series, Beginning with RTX 5060 Ti This Week (115)

- Nintendo Confirms That Switch 2 Joy-Cons Will Not Utilize Hall Effect Stick Technology (105)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (99)

- Sony Increases the PS5 Pricing in EMEA and ANZ by Around 25 Percent (84)

- NVIDIA PhysX and Flow Made Fully Open-Source (77)

- Windows Notepad Gets Microsoft Copilot Integration (75)

News Posts matching #2021

Return to Keyword Browsing

Samsung Updating Odyssey G9 Premium Gaming Monitor - MiniLED Technology, First DisplayHDR 2000 Certification?

A listing has surfaced on Chinese website Taobao featuring what is being described as the 2021 update for the ultra-premium Samsung Odyssey G9 gaming monitor. It keeps the DNA of the Odyssey G9 - that means the 49" VA panel, 5120×1440 resolution and 1000R curvature remain. The devil, as always, is in the details; the new monitor is expected to feature a MiniLED backlight solution featuring 2048 dimming zones, which should enable a contrast ratio of 4,000:1 and an eventual, first-of-its-kind DisplayHDR 2000 certification by VESA. The current maximum under the standard stands at DisplayHDR 1400, so it's quite the jump for maximum HDR quality.

E3 2021 Announced As An Online Only Event

It's "Game On." for E3, as The Entertainment Software Association (ESA) officially unveils plans for a reimagined, all-virtual E3 2021 that will engage video game fans everywhere. With early commitments from Nintendo, Xbox, Capcom, Konami, Ubisoft, Take-Two Interactive, Warner Bros. Games, Koch Media, and more to come, E3 2021 will take place June 12 through June 15.

Developers will be showcasing their latest news and games directly to fans around the world. The ESA will be working with media partners globally to help amplify and make this content available to everyone for free. While maintaining E3's longstanding position as a central destination for industry networking — where new partnerships and connections between video game publishers, developers and media are made — the digital format for E3 2021 means more people than ever can participate. The ESA looks forward to coming back together to celebrate E3 2022 in person, in the meantime see you online this June!

Developers will be showcasing their latest news and games directly to fans around the world. The ESA will be working with media partners globally to help amplify and make this content available to everyone for free. While maintaining E3's longstanding position as a central destination for industry networking — where new partnerships and connections between video game publishers, developers and media are made — the digital format for E3 2021 means more people than ever can participate. The ESA looks forward to coming back together to celebrate E3 2022 in person, in the meantime see you online this June!

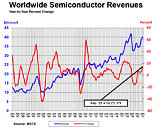

Global Semiconductor Sales Up 14.7% Year-to-Year in February, Says SIA

The Semiconductor Industry Association (SIA) today announced global semiconductor industry sales were $39.6 billion for the month of February 2021, an increase of 14.7% over the February 2020 total of $34.5 billion, but 1.0% less than the January 2021 total of $40.0 billion. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 98% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

"Global semiconductor sales during the first two months of the year have outpaced sales from early in 2020, when the pandemic began to spread in parts of the world," said John Neuffer, SIA president and CEO. "Sales into the China market saw the largest year-to-year growth, largely because sales there were down substantially early last year."

"Global semiconductor sales during the first two months of the year have outpaced sales from early in 2020, when the pandemic began to spread in parts of the world," said John Neuffer, SIA president and CEO. "Sales into the China market saw the largest year-to-year growth, largely because sales there were down substantially early last year."

COMPUTEX 2021 Physical Show Cancelled, Will be Held Online Only

TAITRA, the COMPUTEX organizer, has announced that the physical COMPUTEX event has been cancelled (surprising maybe some three or four people in the world). The organizer cites ongoing COVID-19 concerns (including the world's current state of vaccination levels) that would put the safety of attendees on the line, and has thus elected to forego the physical event and focus only on an online capacity.

However, even as the physical event has been cancelled, TAITRA doubled down on the virtual COMPUTEX event. Marketed #COMPUTEXVirtual, the event is scheduled to run for a full month, from May 31st to June 30th, in what marks COMPUTEX's first attempt at doing a large-scale virtual event. TAITRA had this to say on their decision: "With another wave of coronavirus pandemic across the world, it doesn't look like we are close to the end. The majority of the show's stakeholders, including international exhibitors, visitors, and media, cannot join the show due to border control. Therefore, the organizers of COMPUTEX have decided to cancel the onsite exhibition this year."

However, even as the physical event has been cancelled, TAITRA doubled down on the virtual COMPUTEX event. Marketed #COMPUTEXVirtual, the event is scheduled to run for a full month, from May 31st to June 30th, in what marks COMPUTEX's first attempt at doing a large-scale virtual event. TAITRA had this to say on their decision: "With another wave of coronavirus pandemic across the world, it doesn't look like we are close to the end. The majority of the show's stakeholders, including international exhibitors, visitors, and media, cannot join the show due to border control. Therefore, the organizers of COMPUTEX have decided to cancel the onsite exhibition this year."

TSMC to Enter 4 nm Node Volume Production in Q4 of 2021

TSMC, the world leader in semiconductor manufacturing, has reportedly begun with plans to start volume production of the 4 nm node by the end of this year. According to the sources over at DigiTimes, Taiwan's leading semiconductor manufacturer could be on the verge of starting volume production of an even smaller node. The new 4 nm node is internally referred to as a part of the N5 node generation. The N5 generation covers N5 (regular 5 nm), N5P (5 nm+), and N4 process that is expected to debut soon. And perhaps the most interesting thing is that the 4 nm process will be in high-volume production in Q4, with Apple expected to be one of the major consumers of the N5 node family.

DigiTimes reports that Apple will use the N5P node for the upcoming Apple A15 SoCs for next-generation iPhones, while the more advanced N4 node will find itself as a base of the new Macs equipped with custom Apple Silicon SoCs. To find out more, we have to wait for the official product launches and see just how much improvement new nodes bring.

DigiTimes reports that Apple will use the N5P node for the upcoming Apple A15 SoCs for next-generation iPhones, while the more advanced N4 node will find itself as a base of the new Macs equipped with custom Apple Silicon SoCs. To find out more, we have to wait for the official product launches and see just how much improvement new nodes bring.

Qualcomm Extends the Leadership of its 7-Series with the Snapdragon 780G 5G Mobile Platform

Qualcomm Technologies, Inc. announced the latest addition to its 7-series portfolio, the Qualcomm Snapdragon 780G 5G Mobile Platform. Snapdragon 780G is designed to deliver powerful AI performance and brilliant camera capture backed by the Qualcomm Spectra 570 triple ISP and 6th generation Qualcomm AI Engine, allowing users to capture, enhance, and share their favorite moments seamlessly. This platform enables a selection of premium-tier features for the first time in the 7-series, making next generation experiences more broadly accessible.

"Since introducing the Snapdragon 7-series three years ago, more than 350 devices have launched based on 7-series mobile platforms. Today, we are continuing this momentum by introducing the Snapdragon 780G 5G Mobile Platform," said Kedar Kondap, vice president, product management, Qualcomm Technologies, Inc. "Snapdragon 780G was designed to bring in-demand, premium experiences to more users around the world."

"Since introducing the Snapdragon 7-series three years ago, more than 350 devices have launched based on 7-series mobile platforms. Today, we are continuing this momentum by introducing the Snapdragon 780G 5G Mobile Platform," said Kedar Kondap, vice president, product management, Qualcomm Technologies, Inc. "Snapdragon 780G was designed to bring in-demand, premium experiences to more users around the world."

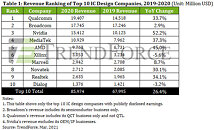

Revenue of Top 10 IC Design (Fabless) Companies for 2020 Undergoes 26.4% Increase YoY, Says TrendForce

The emergence of the COVID-19 pandemic in 1H20 seemed at first poised to devastate the IC design industry. However, as WFH and distance education became the norm, TrendForce finds that the demand for notebook computers and networking products also spiked in response, in turn driving manufacturers to massively ramp up their procurement activities for components. Fabless IC design companies that supply such components therefore benefitted greatly from manufacturers' procurement demand, and the IC design industry underwent tremendous growth in 2020. In particular, the top three IC design companies (Qualcomm, Broadcom, and Nvidia) all posted YoY increases in their revenues, with Nvidia registering the most impressive growth, at a staggering 52.2% increase YoY, the highest among the top 10 companies.

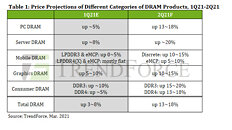

TrendForce: Consumer DRAM Pricing to Increase 20% in 2Q2021 Due to Increased Demand

According to TrendForce, we technology enthusiasts will have other rising prices to contend with throughout 2021, adding to the already ballooning discrete GPU and latest-gen CPUs from the leading manufacturer. The increased demand due to the COVID pandemic stretched the usual stocks to their limits, and due to the tremendous, multiple-month lead times between semiconductor orders and their fulfillment from manufacturers, the entire supply infrastructure was spread too thin for the increased worldwide needs. This leads to increased component pricing, which in turn leads to higher ASP pricing for DRAM. Adding to that equation, of course, is the fact that companies are now more careful, and are placing bigger orders so as to be able to weather these sudden demand changes.

TrendForce says that DRAM pricing has already increased 3-8% in 1Q2021, and that market adjustments will lead to an additional increase somewhere between 13-18% for contract pricing. Server pricing is projected to increase by 20%; graphics DRAM is expected to increase 10-15% in the same time-span, thus giving us that strange stomach churn that comes from having to expect even further increases in graphics card end-user pricing; and overall DRAM pricing for customers is expected to increase by 20% due to the intensifying shortages. What a time to be a system builder.

TrendForce says that DRAM pricing has already increased 3-8% in 1Q2021, and that market adjustments will lead to an additional increase somewhere between 13-18% for contract pricing. Server pricing is projected to increase by 20%; graphics DRAM is expected to increase 10-15% in the same time-span, thus giving us that strange stomach churn that comes from having to expect even further increases in graphics card end-user pricing; and overall DRAM pricing for customers is expected to increase by 20% due to the intensifying shortages. What a time to be a system builder.

Intel CEO Pat Gelsinger Announces "Intel Unleashed" Webcast on March 23rd

Recently appointed Intel CEO Pat Gelsinger has announced via Twitter that the company will be holding a webcast on March 23rd - likely in the toes of Rocket Lake's actual release, which is expected towards the end of the month. The webcast, titled "Intel Unleashed", seems to serve as the premier event with Pat Gelsinger firmly entrenched on Intel's reins, and should be a tour de force for Intel's strengths, planned execution on product development and release, and growth opportunities - and, if we're being honest, a frontal recognizance of Intel's current weaknesses. for now, the only information Pat Gelsinger put forwards is that this is a business update, and that "exciting things" are coming in 2021.

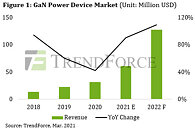

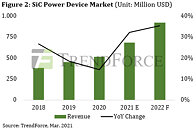

Strong Growth Expected for Third-Generation Semiconductors in 2021, Says TrendForce

The third-generation semiconductor industry was impaired by the US-China trade war and the COVID-19 pandemic successively from 2018 to 2020, according to TrendForce's latest investigations. During this period, the semiconductor industry on the whole saw limited upward momentum, in turn leading to muted growth for the 3rd gen semiconductor segment as well. However, this segment is likely to enter a rapid upturn owing to high demand from automotive, industrial, and telecom applications. In particular, the GaN power device market will undergo the fastest growth, with a $61 million revenue, a 90.6% YoY increase, projected for 2021.

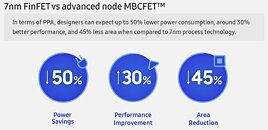

Samsung Demonstrates 256 Gb 3 nm MBCFET Chip at ISSCC 2021

During the IEEE International Solid-State Circuits Conference (ISSCC), Samsung Foundry has presented a new step towards smaller and more efficient nodes. The new chip that was presented is a 256 Gb memory chip, based on SRAM technology. However, all of that doesn't sound interesting, until we mention the technology that is behind it. Samsung has for the first time manufactured a chip using the company's gate-all-around field-effect transistor (GAAFET) technology on the 3 nm semiconductor node. Formally, there are two types of GAAFET technology: the regular GAAFET that uses nanowires as fins of the transistor, and MBCFET (multi-bridge channel FET) that uses thicker fins that come in a form of a nanosheet.

Samsung has demonstrated the first SRAM chip that uses MBCFET technology today. The chip in question is a 256 Gb chip with an area of 56 mm². The achievement Samsung is proud of is that the chip uses 230 mV less power for writes, compared to the standard approach, as the MBCFET transistors allow the company to have many different power-saving techniques. The new 3 nm MBCFET process is expected to get into high-volume production sometime in 2022, however, we are yet to see demos of logic chips besides SRAM like we see today. Nonetheless, even the demonstration of SRAM is big progress, and we are eager to see what the company manages to build with the new technology.

Samsung has demonstrated the first SRAM chip that uses MBCFET technology today. The chip in question is a 256 Gb chip with an area of 56 mm². The achievement Samsung is proud of is that the chip uses 230 mV less power for writes, compared to the standard approach, as the MBCFET transistors allow the company to have many different power-saving techniques. The new 3 nm MBCFET process is expected to get into high-volume production sometime in 2022, however, we are yet to see demos of logic chips besides SRAM like we see today. Nonetheless, even the demonstration of SRAM is big progress, and we are eager to see what the company manages to build with the new technology.

GLOBALFOUNDRIES 22FDX RF Solution Provides the Basis for Next-Gen mmWave Automotive Radar

GLOBALFOUNDRIES (GF ), the global leader in specialty semiconductor manufacturing, and Bosch will partner to develop and manufacture next-generation automotive radar technology.

Bosch chose GF as its partner to develop a mmWave automotive radar system-on-chip (SoC) for Advanced Driver Assistance Systems (ADAS) applications, manufactured using GF's 22FDX RF solution. ADAS applications help drivers stay safe by keeping a vehicle in the correct lane, warning of collisions, initiating emergency braking, assisting with parking, and more.

Bosch chose GF as its partner to develop a mmWave automotive radar system-on-chip (SoC) for Advanced Driver Assistance Systems (ADAS) applications, manufactured using GF's 22FDX RF solution. ADAS applications help drivers stay safe by keeping a vehicle in the correct lane, warning of collisions, initiating emergency braking, assisting with parking, and more.

Globalfoundries Investing $1.4 billion in Fabrication Capacity Expansion, Anticipate IPO

Globalfoundries has announced they are in the early stages of a massive $1.4 billion investment in their manufacturing capabilities, which aims to increase overall production of semiconductor chips. One third of this development investment will be pre-paid by Globalfoundries' customers, who by investing this way, are also pre-allocating Globalfoundries' future supply - it's a way for the company to receive funds for not-yet-produced wafers, enabling it to proceed with these expansion plans. The company usually reserves $700 million yearly for capacity expansions and technology improvements, so this $1.4 billion figure essentially doubles that.

That doubling comes at a time where existing capacity throughout the semiconductor industry is showing not to be sufficient for global demand. The plans will see Globalfoundries increase its wafer production capability by 13% this year, and 20% in 2022. The increased funding for developmental expenses will be allocated equally between the company's three manufacturing plants already installed in Dresden, Malta (New York) and Singapore. Globalfoundries' 2020 revenue ended up at $5.7 billion, a cutback from 2017's $6.176 billion. The company, however, projects its revenue to increase 9-10% in 2021 due to the current unprecedented demand for its fabrication technologies. The company is also looking to capitalize on this demand in another way: by bringing its IPO forward. Where before the company planned to go public in 2022 or even 2023, the increased current demand and prospective YoY growth places the company in a good place for such a move.

That doubling comes at a time where existing capacity throughout the semiconductor industry is showing not to be sufficient for global demand. The plans will see Globalfoundries increase its wafer production capability by 13% this year, and 20% in 2022. The increased funding for developmental expenses will be allocated equally between the company's three manufacturing plants already installed in Dresden, Malta (New York) and Singapore. Globalfoundries' 2020 revenue ended up at $5.7 billion, a cutback from 2017's $6.176 billion. The company, however, projects its revenue to increase 9-10% in 2021 due to the current unprecedented demand for its fabrication technologies. The company is also looking to capitalize on this demand in another way: by bringing its IPO forward. Where before the company planned to go public in 2022 or even 2023, the increased current demand and prospective YoY growth places the company in a good place for such a move.

Intel Kills Extended Warranty Program for Overclocking

Some time ago, Intel has introduced the Performance Tuning Protection Plan (PTPP), which was used as a warranty for any damage that has occurred during overclocking. Customers of PTPP, mainly buyers of Intel Core processors having a "K" tag were able to get a replacement processor whenever they damaged their CPU by overclocking it. When it comes to the pricing of such a service, typical plans were spanning from $19.99 to $29.99, depending on the processor you had. However, there will no longer be such a program, as Intel is discontinuing its PTPP extended overclocking warranty. The company has updated its site to refer to End-Of-Life (EOL) page displaying a quote below.

ADATA Explains Changes with XPG SX8200 Pro SSD

ADATA has recently been in a spot of controversy when it comes to their XPG SX8200 Pro solid-state drive (SSD). The company has reportedly shipped many different configurations of the SSD with different drive controller clock speeds and different NAND flash. According to the original report, ADATA has first shipped the SX8200 Pro SSD with Silicon Motion SM2262ENG SSD controller, running at 650 MHz with IMFT 64-layer TLC NAND Flash. However, it was later reported that the SSD was updated to use the Silicon Motion SM2262G SSD controller, clocked at 575 MHz. With this report, many users have gotten concerned and started to question the company's practices. However, ADATA later ensured everyone that performance is within the specifications and there is no need to worry.

Today, we have another report about the ADATA XPG SX8200 Pro SSD. According to a Redditor, ADATA has once again updated its SSD with a different kind of NAND Flash, however, this time the report indicated that performance was impacted. Tom's Hardware has made a table of changes showing as many as five revisions of the SSD, all with different configurations of SSD controllers and NAND Flash memory. We have contacted ADATA to clarify the issues that have emerged, and this is the official response that the company gave us.

Today, we have another report about the ADATA XPG SX8200 Pro SSD. According to a Redditor, ADATA has once again updated its SSD with a different kind of NAND Flash, however, this time the report indicated that performance was impacted. Tom's Hardware has made a table of changes showing as many as five revisions of the SSD, all with different configurations of SSD controllers and NAND Flash memory. We have contacted ADATA to clarify the issues that have emerged, and this is the official response that the company gave us.

Industry Specialists Expect Chip Shortages to Last Until 2022

Industry specialists with various analysis groups have stated that they expect the world's current chip supply shortages to not only fail to be mitigated in the first half of 2021, but that they might actually last well into 2022. It's not just a matter of existing chip supply being diverted by scalpers, miners, or other secondary-market funnels; it's a matter of fundamental lack of resources and production capacity to meet demand throughout various quadrants of the semiconductor industry. With the increased demand due to COVID-19 and the overall increasingly complex design of modern chips - and increased abundance of individual chips within the same products - foundries aren't being able to scale their capacity to meet growing demand.

As we know, the timeframe between start and finish of a given semiconductor chip can sometimes take months. And foundries have had to extend their lead times (the time between a client placing an order and that order being fulfilled) already. This happens as a way to better plan out their capacity allocation, and due to the increased complexity of installing, testing, and putting to production increasingly complex chip designs and fabrication technologies. And analysts with J.P. Morgan and Susquehanna that are in touch with the pulse of the semiconductor industry say that current demand levels are 10% to 30% higher than those that can be satisfied by the fabrication and supply subsystems for fulfilling that demand.

As we know, the timeframe between start and finish of a given semiconductor chip can sometimes take months. And foundries have had to extend their lead times (the time between a client placing an order and that order being fulfilled) already. This happens as a way to better plan out their capacity allocation, and due to the increased complexity of installing, testing, and putting to production increasingly complex chip designs and fabrication technologies. And analysts with J.P. Morgan and Susquehanna that are in touch with the pulse of the semiconductor industry say that current demand levels are 10% to 30% higher than those that can be satisfied by the fabrication and supply subsystems for fulfilling that demand.

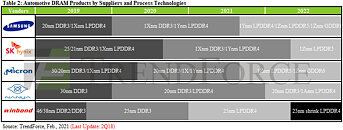

Explosive Growth in Automotive DRAM Demand Projected to Surpass 30% CAGR in Next Three Years, Says TrendForce

Driven by such factors as the continued development of autonomous driving technologies and the build-out of 5G infrastructure, the demand for automotive memories will undergo a rapid growth going forward, according to TrendForce's latest investigations. Take Tesla, which is the automotive industry leader in the application of autonomous vehicle technologies, as an example. Tesla has adopted GDDR5 DRAM products from the Model S and X onward because it has also adopted Nvidia's solutions for CPU and GPU. The GDDR5 series had the highest bandwidth at the time to complement these processors. The DRAM content has therefore reached at least 8 GB for vehicles across all model series under Tesla. The Model 3 is further equipped with 14 GB of DRAM, and the next-generation of Tesla vehicles will have 20 GB. If content per box is used as a reference for comparison, then Tesla far surpasses manufacturers of PCs and smartphones in DRAM consumption. TrendForce forecasts that the average DRAM content of cars will continue to grow in the next three years, with a CAGR of more than 30% for the period.

Gartner Says Worldwide Smartphone Sales Declined 5% in Fourth Quarter of 2020

Global sales of smartphones to end users declined 5.4% in the fourth quarter of 2020, according to Gartner, Inc. Smartphone sales declined 12.5% in full year 2020.

"The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020," said Anshul Gupta, senior research director at Gartner. "Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter."

"The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020," said Anshul Gupta, senior research director at Gartner. "Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter."

Qualcomm Announces World's First 10 Gigabit 5G Modem-RF System

Qualcomm Technologies, Inc. today announced the Snapdragon X65 5G Modem-RF System, its fourth-generation 5G modem-to-antenna solution. It is the world's first 10 Gigabit 5G and the first 3GPP release 16 modem-RF system, which is currently sampling to OEMs and targeting commercial device launches in 2021. Snapdragon X65 is the Company's biggest leap in 5G solutions since the commercialization of its first modem-RF system. It is designed to support the fastest 5G speeds currently available with fiber-like wireless performance and makes best use of available spectrum for ultimate network flexibility, capacity and coverage. In addition to the Snapdragon X65, Qualcomm Technologies also announced the Snapdragon X62 5G Modem-RF System, a modem-to-antenna solution optimized for mainstream adoption of mobile broadband applications.

Apple Reports First Quarter Results

Apple today announced financial results for its fiscal 2021 first quarter ended December 26, 2020. The Company posted all-time record revenue of $111.4 billion, up 21 percent year over year, and quarterly earnings per diluted share of $1.68, up 35 percent. International sales accounted for 64 percent of the quarter's revenue.

"This quarter for Apple wouldn't have been possible without the tireless and innovative work of every Apple team member worldwide," said Tim Cook, Apple's CEO. "We're gratified by the enthusiastic customer response to the unmatched line of cutting-edge products that we delivered across a historic holiday season. We are also focused on how we can help the communities we're a part of build back strongly and equitably, through efforts like our Racial Equity and Justice Initiative as well as our multi-year commitment to invest $350 billion throughout the United States."

"This quarter for Apple wouldn't have been possible without the tireless and innovative work of every Apple team member worldwide," said Tim Cook, Apple's CEO. "We're gratified by the enthusiastic customer response to the unmatched line of cutting-edge products that we delivered across a historic holiday season. We are also focused on how we can help the communities we're a part of build back strongly and equitably, through efforts like our Racial Equity and Justice Initiative as well as our multi-year commitment to invest $350 billion throughout the United States."

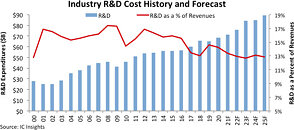

Industry R&D Spending To Rise 4% After Hitting Record in 2020: IC Insights

Research and development spending by semiconductor companies worldwide is forecast to grow 4% in 2021 to $71.4 billion after rising 5% in 2020 to a record high of $68.4 billion, according to IC Insights' new 2021 edition of The McClean Report—A Complete Analysis and Forecast of the Integrated Circuit Industry. Total R&D spending by semiconductor companies is expected to rise by a compound annual growth rate (CAGR) of 5.8% between 2021 and 2025 to $89.3 billion.

When the world was hit by the Covid-19 virus health crisis in 2020, wary semiconductor suppliers kept a lid on R&D spending increases, even though total semiconductor industry revenue grew by a surprising 8% in the year despite the economic fallout from the deadly pandemic. Semiconductor R&D expenditures as a percentage of worldwide industry sales slipped to 14.2% in 2020 compared to 14.6% in 2019, when research and development spending declined 1% and total semiconductor revenue fell 12%. Figure 1 plots semiconductor R&D spending levels and the spending-to-sales ratios over the past two decades and IC Insights' forecast through 2025.

When the world was hit by the Covid-19 virus health crisis in 2020, wary semiconductor suppliers kept a lid on R&D spending increases, even though total semiconductor industry revenue grew by a surprising 8% in the year despite the economic fallout from the deadly pandemic. Semiconductor R&D expenditures as a percentage of worldwide industry sales slipped to 14.2% in 2020 compared to 14.6% in 2019, when research and development spending declined 1% and total semiconductor revenue fell 12%. Figure 1 plots semiconductor R&D spending levels and the spending-to-sales ratios over the past two decades and IC Insights' forecast through 2025.

16-Core Intel Alder Lake-S Processor Appears with DDR5 Memory

Intel has just launched its Rocket Lake-S desktop lineup of processors during this year's CES 2021 virtual event. However, the company is under constant pressure from the competition and it seems like it will not stop with that launch for this year. Today, thanks to the popular leaker @momomo_us on Twitter, we have the first SiSoftware entries made from the anonymous Alder Lake-S system. Dubbed a heterogeneous architecture, Alder Lake is supposed to be Intel's first desktop attempt at making big.LITTLE style of processors for general consumers. It is supposed to feature Intel 10 nm Golden Cove CPU "big" cores & Gracemont "small" CPU cores.

The SiSoftware database entry showcases a prototype system that has 16 cores and 32 threads running at the base frequency of 1.8 GHz and a boost speed of 4 GHz. There is 12.5 MB of L2 cache (split into 10 pairs of 1.25 MB) and 30 MB of level-three (L3) cache present on the processor. There is also an Alder Lake-S mobile graphics controller that runs at 1.5 GHz. Intel Xe gen 12.2 graphics is responsible for the video output. When it comes to memory, Alder Lake-S is finally bringing the newest DDR5 standard with a new motherboard chipset and socket called LGA 1700.

The SiSoftware database entry showcases a prototype system that has 16 cores and 32 threads running at the base frequency of 1.8 GHz and a boost speed of 4 GHz. There is 12.5 MB of L2 cache (split into 10 pairs of 1.25 MB) and 30 MB of level-three (L3) cache present on the processor. There is also an Alder Lake-S mobile graphics controller that runs at 1.5 GHz. Intel Xe gen 12.2 graphics is responsible for the video output. When it comes to memory, Alder Lake-S is finally bringing the newest DDR5 standard with a new motherboard chipset and socket called LGA 1700.

AMD Talks Zen 4 and RDNA 3, Promises to Offer Extremely Competitive Products

AMD is always in development mode and just when they launch a new product, the company is always gearing up for the next-generation of devices. Just a few months ago, back in November, AMD has launched its Zen 3 core, and today we get to hear about the next steps that the company is taking to stay competitive and grow its product portfolio. In the AnandTech interview with Dr. Lisa Su, and The Street interview with Rick Bergman, the EVP of AMD's Computing and Graphics Business Group, we have gathered information about AMD's plans for Zen 4 core development and RDNA 3 performance target.

Starting with Zen 4, AMD plans to migrate to the AM5 platform, bringing the new DDR5 and USB 4.0 protocols. The current aim of Zen 4 is to be extremely competitive among competing products and to bring many IPC improvements. Just like Zen 3 used many small advances in cache structures, branch prediction, and pipelines, Zen 4 is aiming to achieve a similar thing with its debut. The state of x86 architecture offers little room for improvement, however, when the advancement is done in many places it adds up quite well, as we could see with 19% IPC improvement of Zen 3 over the previous generation Zen 2 core. As the new core will use TSMC's advanced 5 nm process, there is a possibility to have even more cores found inside CCX/CCD complexes. We are expecting to see Zen 4 sometime close to the end of 2021.

Starting with Zen 4, AMD plans to migrate to the AM5 platform, bringing the new DDR5 and USB 4.0 protocols. The current aim of Zen 4 is to be extremely competitive among competing products and to bring many IPC improvements. Just like Zen 3 used many small advances in cache structures, branch prediction, and pipelines, Zen 4 is aiming to achieve a similar thing with its debut. The state of x86 architecture offers little room for improvement, however, when the advancement is done in many places it adds up quite well, as we could see with 19% IPC improvement of Zen 3 over the previous generation Zen 2 core. As the new core will use TSMC's advanced 5 nm process, there is a possibility to have even more cores found inside CCX/CCD complexes. We are expecting to see Zen 4 sometime close to the end of 2021.

TrendForce: TSMC to Mass-Produce Select Intel Products, CPUs Starting 2021

According to a market analysis from TrendForce, Intel's manufacturing efforts with TSMC will go way beyond a potential TSMC technology licensing for that company's manufacturing technology to be employed in Intel's own fabs. The market research firm says that Intel will instead procure wafers directly from TSMC, starting on 2H2021, in the order of 20-25% of total production for some of its non-CPU products. But the manufacturing deal is said to go beyond that, with TSMC picking up orders for Intel's Core i3 CPUs in the company's 5 nm manufacturing node - one that Intel will take years to scale down to on its own manufacturing capabilities.

According to TrendForce, that effort will scale upwards with TSMC manufacturing certain allotments of Intel's midrange and high-end CPUs using the semiconductor manufacturer's 3 nm technology in 2022. TrendForce believes that increased outsourcing of Intel's product lines will allow the company to not only continue its existence as a major IDM, but also maintain and prioritize in-house production lines for chips with high margins, while more effectively spending CAPEX on advanced R&D due to savings on fabrication technology scaling - fewer in-house chips means lower needs for investment in capacity increases, which would allow the company to sink the savings into further R&D. The move would also allow Intel to close the gap with rival AMD's manufacturing advantages in a more critical, timely manner.

According to TrendForce, that effort will scale upwards with TSMC manufacturing certain allotments of Intel's midrange and high-end CPUs using the semiconductor manufacturer's 3 nm technology in 2022. TrendForce believes that increased outsourcing of Intel's product lines will allow the company to not only continue its existence as a major IDM, but also maintain and prioritize in-house production lines for chips with high margins, while more effectively spending CAPEX on advanced R&D due to savings on fabrication technology scaling - fewer in-house chips means lower needs for investment in capacity increases, which would allow the company to sink the savings into further R&D. The move would also allow Intel to close the gap with rival AMD's manufacturing advantages in a more critical, timely manner.

Dell Technologies Reimagines Work with New PCs, Monitors and Software Experiences

Dell Technologies (NYSE:DELL) unveiled new products and software that reimagine work so anyone can perform at their best. With a new portfolio of intelligent, collaborative and sustainable devices, Dell is transforming work experiences to give people greater flexibility to work from anywhere.

"People's expectations of their technology continue to evolve. It's why we push beyond barriers to create devices that offer better experiences and are more integrated into our lives," said Ed Ward, senior vice president, Client Product Group, Dell Technologies. "Our new intelligent PCs make it possible for us to work smarter and collaborate easier, so we can give our best selves in all that we do. Secure, sustainable and smart: that's the way forward for PCs."

"People's expectations of their technology continue to evolve. It's why we push beyond barriers to create devices that offer better experiences and are more integrated into our lives," said Ed Ward, senior vice president, Client Product Group, Dell Technologies. "Our new intelligent PCs make it possible for us to work smarter and collaborate easier, so we can give our best selves in all that we do. Secure, sustainable and smart: that's the way forward for PCs."

Apr 25th, 2025 05:21 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- RX 9000 series GPU Owners Club (534)

- Help getting a mini pc (13)

- What's your latest tech purchase? (23598)

- 5090 Supply (1)

- I dont understand the phone OS world..... (50)

- Which is the best replacement for Microsoft Office? (30)

- Choosing an Internal HDD (21)

- TPU's Nostalgic Hardware Club (20280)

- To distill or not distill what say ye? (102)

- Your PC ATM (35363)

Popular Reviews

- NVIDIA GeForce RTX 5060 Ti 8 GB Review - So Many Compromises

- Crucial CUDIMM DDR5-6400 128 GB CL52 Review

- Colorful iGame B860M Ultra V20 Review

- ASUS GeForce RTX 5060 Ti TUF OC 16 GB Review

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- ASRock X870E Taichi Lite Review

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- ASUS GeForce RTX 5080 TUF OC Review

Controversial News Posts

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (182)

- NVIDIA Sends MSRP Numbers to Partners: GeForce RTX 5060 Ti 8 GB at $379, RTX 5060 Ti 16 GB at $429 (127)

- NVIDIA Launches GeForce RTX 5060 Series, Beginning with RTX 5060 Ti This Week (115)

- Nintendo Confirms That Switch 2 Joy-Cons Will Not Utilize Hall Effect Stick Technology (105)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (99)

- Sony Increases the PS5 Pricing in EMEA and ANZ by Around 25 Percent (84)

- NVIDIA PhysX and Flow Made Fully Open-Source (77)

- Windows Notepad Gets Microsoft Copilot Integration (75)