Apr 13th, 2025 17:00 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- Memory integrity (1)

- Advice on GPU upgrade (9)

- should global c-state be "enabled" instead of auto on am5 x3d processors? (26)

- i need help with a ebay rx580 8gb 2048sp (12)

- GTX1080 Phoenix GLH broken? monitor signal but black screen? (3)

- Regarding fan noise (6)

- Upgrade for a GTX-1060 video card to a X570 AM4 MB w/ a Ryzen 9 3900X (18)

- Overclocking Micron F-die RAM (1)

- works and stops, random colored screens, Biostar RX560 896SPs (5)

- Dell Latitude 5420 - i7 1185G7 (6)

Popular Reviews

- Thermaltake TR100 Review

- The Last Of Us Part 2 Performance Benchmark Review - 30 GPUs Compared

- TerraMaster F8 SSD Plus Review - Compact and quiet

- ASUS GeForce RTX 5080 TUF OC Review

- Zotac GeForce RTX 5070 Ti Amp Extreme Review

- ASRock Z890 Taichi OCF Review

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

Controversial News Posts

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (181)

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- Microsoft Introduces Copilot for Gaming (124)

- NVIDIA Sends MSRP Numbers to Partners: GeForce RTX 5060 Ti 8 GB at $379, RTX 5060 Ti 16 GB at $429 (123)

- Nintendo Confirms That Switch 2 Joy-Cons Will Not Utilize Hall Effect Stick Technology (105)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (99)

- NVIDIA PhysX and Flow Made Fully Open-Source (77)

News Posts matching #Bitmain

Return to Keyword BrowsingD-Central Technologies Unveils Bitaxe Supra v401 and Introduces the Compact NerdAxe Ultra Expansion Board

D-Central Technologies proudly announces the launch of its latest innovations in Bitcoin mining hardware, the Bitaxe Supra v401 and the NerdAxe Ultra. These cutting-edge devices are set to revolutionize the Bitcoin mining landscape with their advanced features and unparalleled performance.

"The latest Bitaxe Supra v401 and NerdAxe Ultra set a new standard in Bitcoin mining accessibility", Jonathan Bertrand, CEO, D-Central Technologies

"The latest Bitaxe Supra v401 and NerdAxe Ultra set a new standard in Bitcoin mining accessibility", Jonathan Bertrand, CEO, D-Central Technologies

2Q22 Output Value Growth at Top 10 Foundries Falls to 3.9% QoQ, Says TrendForce

According to TrendForce research, due to steady weakening of overall demand for consumer electronics, inventory pressure has increased among downstream distributors and brands. Although there are still sporadic shortages of specific components, the curtain has officially fallen on a two-year wave of shortages in general, and brands have gradually suspended stocking in response to changes in market conditions. However, stable demand for automotive and industrial equipment is key to supporting the ongoing growth of foundry output value. At the same time, since the creation of a marginal amount of new capacity in 2Q22 led to growth in wafer shipments and a price hike for certain wafers, this drove output value among top ten foundries to reach US$33.20 billion in 2Q22. Quarterly growth fell to 3.9% on a weakening consumer market.

A prelude to inventory correction was officially revealed in 3Q22. In addition to intensifying severity in the initial wave of order slashing for LDDI/TDDI, and TV SoC, diminishing order volume also extended to non-Apple smartphone APs and peripheral IC PMIC, CIS, and consumer electronics PMICs, and mid-to-low-end MCUs, posing a challenge for foundry capacity utilization. However, the launch of the new iPhone in 3Q22 is expected to prop up a certain amount of stocking momentum for the sluggish market. Therefore, top ten foundry revenue in 3Q22 is expected to maintain a growth trend driven by high-priced processes and quarterly growth rate is expected to be slightly higher than in 2Q22.

A prelude to inventory correction was officially revealed in 3Q22. In addition to intensifying severity in the initial wave of order slashing for LDDI/TDDI, and TV SoC, diminishing order volume also extended to non-Apple smartphone APs and peripheral IC PMIC, CIS, and consumer electronics PMICs, and mid-to-low-end MCUs, posing a challenge for foundry capacity utilization. However, the launch of the new iPhone in 3Q22 is expected to prop up a certain amount of stocking momentum for the sluggish market. Therefore, top ten foundry revenue in 3Q22 is expected to maintain a growth trend driven by high-priced processes and quarterly growth rate is expected to be slightly higher than in 2Q22.

Bitcoin Drops Below the $40,000-mark, Raises Hopes of Graphics Card Availability

The most popular cryptocurrency by market-cap, Bitcoin, has dropped in value to below the USD $40,000-mark, to $38,429 as of this writing. This amounts to a whopping 43% drop in value from its November 2021 peak of roughly $67,600. Ethereum has also seen an 8% fall over the past 24 hours, as has the value of several other cryptocurrencies. While we won't get into the nuts and bolts of Bitcoin volatility or hand out any financial advice, this could have an impact on graphics card availability owing to a multitude of reasons.

As of this writing, we see the GeForce RTX 3080 commanding a scalper price of roughly $1,500 (brand new), for the LHR variant (lower crypto-mining performance), while non-LHR cards that are used, start around $1,900. If the fall in cryptocurrencies continues, we could see increased availability of used graphics cards from crypto miners, as gamers would be willing to buy a used RTX 30-series or RX 6000 series graphics card that's still within its warranty period (of 2 years).

As of this writing, we see the GeForce RTX 3080 commanding a scalper price of roughly $1,500 (brand new), for the LHR variant (lower crypto-mining performance), while non-LHR cards that are used, start around $1,900. If the fall in cryptocurrencies continues, we could see increased availability of used graphics cards from crypto miners, as gamers would be willing to buy a used RTX 30-series or RX 6000 series graphics card that's still within its warranty period (of 2 years).

TSMC to Execute Bitmain's Orders for 5nm Crypto-Mining ASICs from Q3-2021

TSMC will be manufacturing next-generation 5 nm ASICs for Bitmain. The company designs purpose-built machines for mining crypto-currency, using ASICs. DigiTimes reports that the 5 nm volume production could kick off form Q3-2021. Bitmain's latest Antminer ASIC-based mining machines announced last month were purported to be up to 32 times faster than a GeForce RTX 3080 at mining Ethereum. Recent history has shown that whenever ASICs catch up or beat GPUs at mining, prices of GPUs tend to drop. With no 5 nm GPUs on the horizon for Q3-2021, one really can expect market pressure from crypto-miners to drop off when Antminers gain traction.

Bitmain Releases Antminer E9 Ethereum ASIC With Performance of 32 RTX 3080 Cards

Antminer has recently announced their most powerful Ethereum miner yet the E9 with performance of 3 GH/s as the price of Ethereum reaches all-time highs. The Chinese manufacturer advertises that this is equivalent to 32 NVIDIA RTX 3080 cards while coming in with significantly less power consumption and likely a lower price. The Antminer E9 achieves its 3 GH/s mining speed with a power consumption of just 2556 W which gives it an efficiency of 0.85 J/M which would make it one of the most efficient Ethereum miners available. While the ASIC appears to offer significant advantages it is unlikely to meet the global demand for global Ethereum miners and is unlikely to affect global GPU shortages. Bitmain did not announce specific pricing or availability information for the Antminer E9 ASIC.

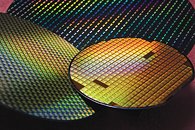

TSMC is Ramping Up 7nm Production, 5nm Next Year

At their technology symposium in Taipei, TSMC CEO CC Wei has made remarks, dismissing speculation that their 7 nanometer yield rate was not as good as expected. Rather the company is ramping up production capacity for 7 nm quickly, up 9% from 10.5 million wafers in 2017, to 12 million wafers in 2018. They plan to tape out more than 50 chip designs in 2018, with the majority of the tape outs for AI, GPU and crypto applications, followed by 5G and application processors.

Most of their orders for the 7 nanometer node come from big players like AMD, Bitmain, NVIDIA and Qualcomm. Apple's A12 processor for upcoming iPhones is also a major driver for TSMC's 7 nanometer growth. These orders will be fulfilled in early 2019, so it'll be a bit longer before we have 7 nm processors for the masses.

Next-gen 5 nanometer production will kick off next year, followed by mass production in late 2019 or early 2020. The company will invest as much as USD 25 billion in their new production facilities for this process node.

Most of their orders for the 7 nanometer node come from big players like AMD, Bitmain, NVIDIA and Qualcomm. Apple's A12 processor for upcoming iPhones is also a major driver for TSMC's 7 nanometer growth. These orders will be fulfilled in early 2019, so it'll be a bit longer before we have 7 nm processors for the masses.

Next-gen 5 nanometer production will kick off next year, followed by mass production in late 2019 or early 2020. The company will invest as much as USD 25 billion in their new production facilities for this process node.

Bitmain Intros Antminer E3 for Ethereum, GPU Prices Could Finally Cool Down

It was only a matter of time before ASICs turned the tide on GPU-accelerated crypto-currency mining. Bitmain announced the Antminer E3, an ASIC miner purpose-built for Ethereum mining. Priced at $800 (or less than the price of an AMD Radeon RX 580 in January), this ASIC draws about 800W of power, and offers a hash-rate of 180 MH/s. To put that into perspective, an RX 580 only has about 30 MH/s, and draws around 200W at typical mining load. Bitmain has begun accepting orders for the Antminer E3, with shipping to commence in July. At its price, no GPU in the market can match the economics of this ASIC, and hence, VGA prices could begin to cool down, and GPU miners could find it hard to hodl on to their overpriced VGAs.

NVIDIA, AMD to Face Worsening Investment Outlook as Bitmain Preps to Launch Ethereum ASIC

Analyst firm Susquehanna has cut AMD and NVIDIA's share price targets on the wake of confirmed reports on Bitmain's upcoming Ethereum ASIC. There's been talks about such a product for months - and some actual silicon steering as well that might support it. Susquehanna, through analyst Christopher Rolland in a note to clients Monday, cited their travels in Asia as a source of information.

This has brought confirmations that "(...) Bitmain has already developed an ASIC [application-specific integrated circuit] for mining Ethereum, and is readying the supply chain for shipments in 2Q18." And it doesn't seem Bitmain is the only company eyeing the doors of yet another extremely lucrative ASIC mining market: "While Bitmain is likely to be the largest ASIC vendor (currently 70-80% of Bitcoin mining ASICs) and the first to market with this product, we have learned of at least three other companies working on Ethereum ASICs, all at various stages of development."

This has brought confirmations that "(...) Bitmain has already developed an ASIC [application-specific integrated circuit] for mining Ethereum, and is readying the supply chain for shipments in 2Q18." And it doesn't seem Bitmain is the only company eyeing the doors of yet another extremely lucrative ASIC mining market: "While Bitmain is likely to be the largest ASIC vendor (currently 70-80% of Bitcoin mining ASICs) and the first to market with this product, we have learned of at least three other companies working on Ethereum ASICs, all at various stages of development."

TSMC To Receive Strong Revenue Boost on the Back of Extra ASIC Sales in 2018

TSMC is the world's sole ASIC manufacturer for Bitmain - the world's largest ASIC vendor by far, commanding some 70% of the ASIC market share. DigiTimes is reporting that ASIC manufacturing will be a major part of bridging the 10-15% increase in revenue that TSMC's chairman Morris Chang expects for 2018, which will be mostly fed by high-performance computing (HPC), car-use electronics and Internet of Things (IoT) products.

One other interesting tidbit that DigiTimes is reporting on is that Bitmain might be increasing its ASIC orders from TSMC to bring a new Ethereum ASIC miner to market. Dubbed the F3, reports around the internet have placed these ASICs as leveraging TSMC's 28 nm process in a three-mainboard system. Each mainboard is reported to pack six purpose-built ASIC processors, each paired with 12GB of DDR3 memory. Whether or not this makes sense based on Ethereum's Casper update (moving from a Proof of Work to a Proof of Stake mechanism) remains to be seen. Considering the amount of work and investment that would be required towards the development of an Ethereum ASIC, though (a natively ASIC-resistant algorithm) may very well be an indicator that Casper may be longer off in the horizon than previously thought. Let's hope this is true, though; an Ethereum-geared ASIC, even if short-lived, would certainlydraw demand away from GPUs to these purpose-built systems, and there's been nary a time in the PC world where such an event was as needed as it is today.

One other interesting tidbit that DigiTimes is reporting on is that Bitmain might be increasing its ASIC orders from TSMC to bring a new Ethereum ASIC miner to market. Dubbed the F3, reports around the internet have placed these ASICs as leveraging TSMC's 28 nm process in a three-mainboard system. Each mainboard is reported to pack six purpose-built ASIC processors, each paired with 12GB of DDR3 memory. Whether or not this makes sense based on Ethereum's Casper update (moving from a Proof of Work to a Proof of Stake mechanism) remains to be seen. Considering the amount of work and investment that would be required towards the development of an Ethereum ASIC, though (a natively ASIC-resistant algorithm) may very well be an indicator that Casper may be longer off in the horizon than previously thought. Let's hope this is true, though; an Ethereum-geared ASIC, even if short-lived, would certainlydraw demand away from GPUs to these purpose-built systems, and there's been nary a time in the PC world where such an event was as needed as it is today.

Apr 13th, 2025 17:00 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- Memory integrity (1)

- Advice on GPU upgrade (9)

- should global c-state be "enabled" instead of auto on am5 x3d processors? (26)

- i need help with a ebay rx580 8gb 2048sp (12)

- GTX1080 Phoenix GLH broken? monitor signal but black screen? (3)

- Regarding fan noise (6)

- Upgrade for a GTX-1060 video card to a X570 AM4 MB w/ a Ryzen 9 3900X (18)

- Overclocking Micron F-die RAM (1)

- works and stops, random colored screens, Biostar RX560 896SPs (5)

- Dell Latitude 5420 - i7 1185G7 (6)

Popular Reviews

- Thermaltake TR100 Review

- The Last Of Us Part 2 Performance Benchmark Review - 30 GPUs Compared

- TerraMaster F8 SSD Plus Review - Compact and quiet

- ASUS GeForce RTX 5080 TUF OC Review

- Zotac GeForce RTX 5070 Ti Amp Extreme Review

- ASRock Z890 Taichi OCF Review

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

Controversial News Posts

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (181)

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- Microsoft Introduces Copilot for Gaming (124)

- NVIDIA Sends MSRP Numbers to Partners: GeForce RTX 5060 Ti 8 GB at $379, RTX 5060 Ti 16 GB at $429 (123)

- Nintendo Confirms That Switch 2 Joy-Cons Will Not Utilize Hall Effect Stick Technology (105)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (99)

- NVIDIA PhysX and Flow Made Fully Open-Source (77)