Cryptocurrency Market Bleeds Trillions in Less Than 24 Hours; Did the Bubble Pop?

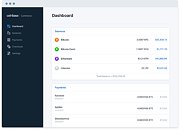

The cryptocurrency market is experiencing another major shakedown in pricing, with the overall crypto market valuation dropping by more than a trillion dollars in less than 24 hours. As of time of writing, leading cryptocurrency by market cap Bitcoin has lost more than 30% in value, dropping to $31,000. Ethereum is down by 40% to $2,424, and memecoin Dogecoin has fallen by 45% - one would think a memecoin would have had its value dropped to zero from the instant of its conception, but that's not the world we live in.

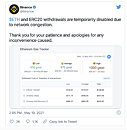

As the market tries to staunch the bleeding, major cryptocurrency platforms Coinbase and Binance are down, citing "network congestion" issues stemming from the unexpected volatility. As investors see their attempts to sell neutered by these network congestion issues, this seems like a way to reduce the amount of cryptocurrencies available in the market, which would feed the descending value cycle even more. Whether or not this is the bubble popping, it's yet another foundational shock to the trust that was already achieved by these platforms and the cryptocurrency market as a whole. How this will affect market availability and demand for graphics cards and hardware is anyone's guess, but even if it does, it'll take some time until we see availability in the main and secondary channels.

As the market tries to staunch the bleeding, major cryptocurrency platforms Coinbase and Binance are down, citing "network congestion" issues stemming from the unexpected volatility. As investors see their attempts to sell neutered by these network congestion issues, this seems like a way to reduce the amount of cryptocurrencies available in the market, which would feed the descending value cycle even more. Whether or not this is the bubble popping, it's yet another foundational shock to the trust that was already achieved by these platforms and the cryptocurrency market as a whole. How this will affect market availability and demand for graphics cards and hardware is anyone's guess, but even if it does, it'll take some time until we see availability in the main and secondary channels.