Samsung Electronics Announces Second Quarter 2021 Results

Samsung Electronics today reported financial results for the second quarter ended June 30, 2021. Total consolidated revenue was KRW 63.67 trillion, a 20% increase from the previous year and a record for the second quarter. Operating profit increased 34% from the previous quarter to KRW 12.57 trillion as market conditions improved in the memory market, operations normalized at the Austin foundry fab, and as effective global supply chain management (SCM) helped maintain solid profitability for the finished product businesses.

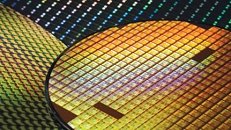

The Semiconductor business saw a significant improvement in earnings as memory shipments exceeded previous guidance and price increases were higher than expected, while the Company strengthened its cost competitiveness. For the Display Panel Business, a one-off gain and an increase in overall prices boosted profits.

The Semiconductor business saw a significant improvement in earnings as memory shipments exceeded previous guidance and price increases were higher than expected, while the Company strengthened its cost competitiveness. For the Display Panel Business, a one-off gain and an increase in overall prices boosted profits.