Apr 6th, 2025 15:57 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- A dozen drivers for HD4670, and which do I choose? (7)

- How I made an Ultimate Cooling Guide (19)

- What local LLM-s you use? (148)

- I have a bricked XFX Radeon RX 580 8GB GPU. HELP! (12)

- Do you use Linux? (560)

- TPU's F@H Team (20422)

- 9070XT or 7900XT (27)

- Share your AIDA 64 cache and memory benchmark here (3046)

- The easiest way to connect the BOOTSEL test metal terminal and the GND terminal.... (0)

- All Intel DG1 needs special bios? (30)

Popular Reviews

- ASUS Prime X870-P Wi-Fi Review

- UPERFECT UStation Delta Max Review - Two Screens In One

- PowerColor Radeon RX 9070 Hellhound Review

- Corsair RM750x Shift 750 W Review

- DDR5 CUDIMM Explained & Benched - The New Memory Standard

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- Pwnage Trinity CF Review

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (124)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (97)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (92)

News Posts matching #Gartner

Return to Keyword Browsing

AMD Believes EPYC CPUs & Instinct GPUs Will Accelerate AI Advancements

If you're looking for innovative use of AI technology, look to the cloud. Gartner reports, "73% of respondents to the 2024 Gartner CIO and Tech Executive Survey have increased funding for AI." And IDC says that AI: "will have a cumulative global economic impact of $19.9 trillion through 2030." But end users aren't running most of those AI workloads on their own hardware. Instead, they are largely relying on cloud service providers and large technology companies to provide the infrastructure for their AI efforts. This approach makes sense since most organizations are already heavily reliant the cloud. According to O'Reilly, more than 90% of companies are using public cloud services. And they aren't moving just a few workloads to the cloud. That same report shows a 175% growth in cloud-native interest, indicating that companies are committing heavily to the cloud.

As a result of this demand for infrastructure to power AI initiatives, cloud service providers are finding it necessary to rapidly scale up their data centers. IDC predicts: "the surging demand for AI workloads will lead to a significant increase in datacenter capacity, energy consumption, and carbon emissions, with AI datacenter capacity projected to have a compound annual growth rate (CAGR) of 40.5% through 2027." While this surge creates massive opportunities for service providers, it also introduces some challenges. Providing the computing power necessary to support AI initiatives at scale, reliably and cost-effectively is difficult. Many providers have found that deploying AMD EPYC CPUs and Instinct GPUs can help them overcome those challenges. Here's a quick look at three service providers who are using AMD chips to accelerate AI advancements.

As a result of this demand for infrastructure to power AI initiatives, cloud service providers are finding it necessary to rapidly scale up their data centers. IDC predicts: "the surging demand for AI workloads will lead to a significant increase in datacenter capacity, energy consumption, and carbon emissions, with AI datacenter capacity projected to have a compound annual growth rate (CAGR) of 40.5% through 2027." While this surge creates massive opportunities for service providers, it also introduces some challenges. Providing the computing power necessary to support AI initiatives at scale, reliably and cost-effectively is difficult. Many providers have found that deploying AMD EPYC CPUs and Instinct GPUs can help them overcome those challenges. Here's a quick look at three service providers who are using AMD chips to accelerate AI advancements.

HBM Industry Revenue Could Double by 2025 - Growth Driven by Next-gen AI GPUs Cited

Samsung, SK hynix, and Micron are considered to be the top manufacturing sources of High Bandwidth Memory (HBM)—the HBM3 and HBM3E standards are becoming increasingly in demand, due to a widespread deployment of GPUs and accelerators by generative AI companies. Taiwan's Commercial Times proposes that there is an ongoing shortage of HBM components—but this presents a growth opportunity for smaller manufacturers in the region. Naturally, the big name producers are expected to dive in head first with the development of next generation models. The aforementioned financial news article cites research conducted by the Gartner group—they predict that the HBM market will hit an all-time high of $4.976 billion (USD) by 2025.

This estimate is almost double that of projected revenues (just over $2 billion) generated by the HBM market in 2023—the explosive growth of generative AI applications has "boosted" demand for the most performant memory standards. The Commercial Times report states that SK Hynix is the current HBM3E leader, with Micron and Samsung trailing behind—industry experts believe that stragglers will need to "expand HBM production capacity" in order to stay competitive. SK Hynix has shacked up with NVIDIA—the GH200 Grace Hopper platform was unveiled last summer; outfitted with the South Korean firm's HBM3e parts. In a similar timeframe, Samsung was named as AMD's preferred supplier of HBM3 packages—as featured within the recently launched Instinct MI300X accelerator. NVIDIA's HBM3E deal with SK Hynix is believed to extend to the internal makeup of Blackwell GB100 data-center GPUs. The HBM4 memory standard is expected to be the next major battleground for the industry's hardest hitters.

This estimate is almost double that of projected revenues (just over $2 billion) generated by the HBM market in 2023—the explosive growth of generative AI applications has "boosted" demand for the most performant memory standards. The Commercial Times report states that SK Hynix is the current HBM3E leader, with Micron and Samsung trailing behind—industry experts believe that stragglers will need to "expand HBM production capacity" in order to stay competitive. SK Hynix has shacked up with NVIDIA—the GH200 Grace Hopper platform was unveiled last summer; outfitted with the South Korean firm's HBM3e parts. In a similar timeframe, Samsung was named as AMD's preferred supplier of HBM3 packages—as featured within the recently launched Instinct MI300X accelerator. NVIDIA's HBM3E deal with SK Hynix is believed to extend to the internal makeup of Blackwell GB100 data-center GPUs. The HBM4 memory standard is expected to be the next major battleground for the industry's hardest hitters.

Worldwide Semiconductor Revenue Declined 11% in 2023, Intel Reclaims No. 1 Spot

Worldwide semiconductor revenue in 2023 totaled $533 billion, a decrease of 11.1% from 2022, according to preliminary results by Gartner, Inc.

"While the cyclicality in the semiconductor industry was present again in 2023, the market suffered a difficult year with memory revenue recording one of its worst declines in history," said Alan Priestley, VP Analyst at Gartner. "The underperforming market also negatively impacted several semiconductor vendors. Only 9 of the top 25 semiconductor vendors posted revenue growth in 2023, with 10 experiencing double-digit declines."

The combined semiconductor revenue of the top 25 semiconductor vendors declined 14.1% in 2023, accounting for 74.4% of the market, down from 77.2% in 2022.

"While the cyclicality in the semiconductor industry was present again in 2023, the market suffered a difficult year with memory revenue recording one of its worst declines in history," said Alan Priestley, VP Analyst at Gartner. "The underperforming market also negatively impacted several semiconductor vendors. Only 9 of the top 25 semiconductor vendors posted revenue growth in 2023, with 10 experiencing double-digit declines."

The combined semiconductor revenue of the top 25 semiconductor vendors declined 14.1% in 2023, accounting for 74.4% of the market, down from 77.2% in 2022.

Global Semiconductor Revenue Grows by 25% in 2021, Surpassing $500 Billion for the First Time

Global semiconductor sales revenue grew by a more than comfortable 25% in 2021, hitting a new record above $500 Billion for the first time. The data, part of Gartner's preliminary report on the state of the industry in 2021, bookends yet another year plagued with shortages and too little supply for the thirst of the consumer and business sectors. Naturally, supply constraints have led to higher ASP (Average Selling Prices) for the hardware that does get manufactured and distributed, as we've seen all too well in the graphics card market.

"As the global economy bounced back in 2021, shortages appeared throughout the semiconductor supply chain, particularly in the automotive industry," said Andrew Norwood, research vice president at Gartner. "The resulting combination of strong demand as well as logistics and raw material price increases drove semiconductors' average selling price higher (ASP), contributing to overall revenue growth in 2021.

"As the global economy bounced back in 2021, shortages appeared throughout the semiconductor supply chain, particularly in the automotive industry," said Andrew Norwood, research vice president at Gartner. "The resulting combination of strong demand as well as logistics and raw material price increases drove semiconductors' average selling price higher (ASP), contributing to overall revenue growth in 2021.

Gartner: Worldwide Semiconductor Revenue Grew 25.1% in 2021, Exceeding $500 Billion For the First Time

Worldwide semiconductor revenue increased 25.1% in 2021 to total $583.5 billion, crossing the $500 billion threshold for the first time, according to preliminary results by Gartner, Inc.

"As the global economy bounced back in 2021, shortages appeared throughout the semiconductor supply chain, particularly in the automotive industry," said Andrew Norwood, research vice president at Gartner. "The resulting combination of strong demand as well as logistics and raw material price increases drove semiconductors' average selling price higher (ASP), contributing to overall revenue growth in 2021.

"As the global economy bounced back in 2021, shortages appeared throughout the semiconductor supply chain, particularly in the automotive industry," said Andrew Norwood, research vice president at Gartner. "The resulting combination of strong demand as well as logistics and raw material price increases drove semiconductors' average selling price higher (ASP), contributing to overall revenue growth in 2021.

Gartner Says Worldwide Smartphone Sales Declined 5% in Fourth Quarter of 2020

Global sales of smartphones to end users declined 5.4% in the fourth quarter of 2020, according to Gartner, Inc. Smartphone sales declined 12.5% in full year 2020.

"The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020," said Anshul Gupta, senior research director at Gartner. "Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter."

"The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020," said Anshul Gupta, senior research director at Gartner. "Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter."

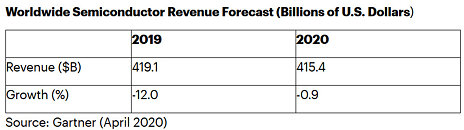

Gartner Forecasts Worldwide Semiconductor Revenue to Decline 0.9% in 2020 Due to Coronavirus Impact

Due to the impact of the coronavirus on semiconductor supply and demand, worldwide semiconductor revenue is forecast to decline 0.9% in 2020, according to Gartner, Inc. This is down from the previous quarter's forecast of 12.5% growth.

"The wide spread of COVID-19 across the world and the resulting strong actions by governments to contain the spread will have a far more severe impact on demand than initially predicted," said Richard Gordon, research practice vice president at Gartner. "This year's forecast could have been worse, but growth in memory could prevent a steep decline."

"The wide spread of COVID-19 across the world and the resulting strong actions by governments to contain the spread will have a far more severe impact on demand than initially predicted," said Richard Gordon, research practice vice president at Gartner. "This year's forecast could have been worse, but growth in memory could prevent a steep decline."

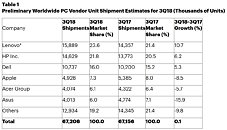

PC Shipments Were Flat in Q3 2018, and That's Good News. Also: Microsoft Surpasses Acer in the US

According to preliminary data published by Gartner, worldwide PC shipments totaled 67.2 million units in the third quarter of 2018, which marks a 0.1 percent increase from the third quarter of 2017. The study shows how the global market "has shown modest stability for two consecutive quarters" something quite impressive given that for some time now PC shipments have relentlessly decreased. Lenovo has surpassed HP and has secured the top spot driven by its joing venture with Fujitsu, says Gartner. Only those companies and Dell have managed to grow compared to the same quarter last year, while Acer, Asus, and Apple have reduced their shipments in this quarter.

Mikako Kitagawa, principal analyst at gartner, mentioned the possible impact of Intel problems in the short term: "the Intel CPU shortage could influence the PC market moving forward with price increases and changes to the vendor landscape. While this shortage will have some short-term impacts, Gartner does not see any lasting impact on overall PC demand." In fact, this analyst points out how Intel will prioritize high-end CPUs and business PCs CPUs, with AMD picking up if Intel cannot supply enough CPUs.

Mikako Kitagawa, principal analyst at gartner, mentioned the possible impact of Intel problems in the short term: "the Intel CPU shortage could influence the PC market moving forward with price increases and changes to the vendor landscape. While this shortage will have some short-term impacts, Gartner does not see any lasting impact on overall PC demand." In fact, this analyst points out how Intel will prioritize high-end CPUs and business PCs CPUs, with AMD picking up if Intel cannot supply enough CPUs.

Gartner Says Worldwide PC Shipments Grew For the First Time in Six Years

Worldwide PC shipments totaled 62.1 million units in the second quarter of 2018, a 1.4 percent increase from the second quarter of 2017, according to preliminary results by Gartner, Inc. This is the first quarter of year-over-year global PC shipment growth since the first quarter of 2012.

All regions experienced some growth compared with a year ago. While the results are a positive result for the PC industry, Gartner analysts said this sign of market stability is not enough to declare a PC industry recovery just yet.

"PC shipment growth in the second quarter of 2018 was driven by demand in the business market, which was offset by declining shipments in the consumer segment," said Mikako Kitagawa, principal analyst at Gartner. "In the consumer space, the fundamental market structure, due to changes on PC user behavior, still remains, and continues to impact market growth. Consumers are using their smartphones for even more daily tasks, such as checking social media, calendaring, banking and shopping, which is reducing the need for a consumer PC.

All regions experienced some growth compared with a year ago. While the results are a positive result for the PC industry, Gartner analysts said this sign of market stability is not enough to declare a PC industry recovery just yet.

"PC shipment growth in the second quarter of 2018 was driven by demand in the business market, which was offset by declining shipments in the consumer segment," said Mikako Kitagawa, principal analyst at Gartner. "In the consumer space, the fundamental market structure, due to changes on PC user behavior, still remains, and continues to impact market growth. Consumers are using their smartphones for even more daily tasks, such as checking social media, calendaring, banking and shopping, which is reducing the need for a consumer PC.

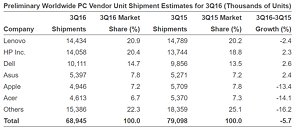

Worldwide PC Shipments Declined 5.7 Percent in Q3-2016: Gartner

Worldwide PC shipments totaled 68.9 million units in the third quarter of 2016, a 5.7 percent decline from the third quarter of 2015, according to preliminary results by Gartner, Inc. This was the eighth consecutive quarter of PC shipment decline, the longest duration of decline in the history of the PC industry. PC manufacturers faced many challenges, which included weak back-to-school demand, and ongoing low demand in the consumer market, especially in emerging markets.

"There are two fundamental issues that have impacted PC market results: the extension of the lifetime of the PC caused by the excess of consumer devices, and weak PC consumer demand in emerging markets," said Mikako Kitagawa, principal analyst at Gartner. "According to our 2016 personal technology survey, the majority of consumers own, and use, at least three different types of devices in mature markets. Among these devices, the PC is not a high priority device for the majority of consumers, so they do not feel the need to upgrade their PCs as often as they used to. Some may never decide to upgrade to a PC again.

"There are two fundamental issues that have impacted PC market results: the extension of the lifetime of the PC caused by the excess of consumer devices, and weak PC consumer demand in emerging markets," said Mikako Kitagawa, principal analyst at Gartner. "According to our 2016 personal technology survey, the majority of consumers own, and use, at least three different types of devices in mature markets. Among these devices, the PC is not a high priority device for the majority of consumers, so they do not feel the need to upgrade their PCs as often as they used to. Some may never decide to upgrade to a PC again.

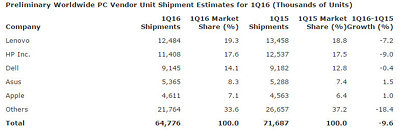

Worldwide PC Shipments Down 9.6% in First Quarter of 2016, According to Gartner

Worldwide PC shipments totaled 64.8 million units in the first quarter of 2016, a 9.6 percent decline from the first quarter of 2015, according to preliminary results by Gartner, Inc. This was the sixth consecutive quarter of PC shipment declines, and the first time since 2007 that shipment volume fell below 65 million units.

"The deterioration of local currencies against the U.S. dollar continued to play a major role in PC shipment declines. Our early results also show there was an inventory buildup from holiday sales in the fourth quarter of 2015," said Mikako Kitagawa, principal analyst at Gartner.

"The deterioration of local currencies against the U.S. dollar continued to play a major role in PC shipment declines. Our early results also show there was an inventory buildup from holiday sales in the fourth quarter of 2015," said Mikako Kitagawa, principal analyst at Gartner.

Samsung Starts Mass Producing Industry's First 32-Layer 3D V-NAND Flash Memory

Samsung Electronics Co., Ltd., the world leader in advanced memory technology, today announced that it has begun mass producing the industry's first three-dimensional (3D) V-NAND flash memory using 32 vertically stacked cell layers, which is its second generation V-NAND offering. Samsung's 32-layer 3D V-NAND - also referred to as Vertical NAND - requires a higher level of design technology to stack the cell arrays than the previous 24-layer V-NAND, yet delivers much greater production efficiency because Samsung can use essentially the same equipment it used for production of the first generation V-NAND.

In addition, Samsung has just launched a line-up of premium SSDs based on its 2nd generation V-NAND flash memory with 128 gigabyte (GB), 256GB, 512GB and 1TB storage options. After introducing 3D V-NAND-based SSDs to data centers last year, Samsung is now extending its V-NAND SSD line-up to high-end PC applications, in expanding its market base. "We increased the availability of our 3D V-NAND by introducing an extensive V-NAND SSD line-up that covers the PC market in addition to data centers," said Young-Hyun Jun, executive vice president, memory sales and marketing, Samsung Electronics. "Look for us to provide a consistent, timely supply of high-performance, high-density V-NAND SSDs as well as core V-NAND chips for IT customers globally, contributing to fast market adoption of 3D NAND technology."

In addition, Samsung has just launched a line-up of premium SSDs based on its 2nd generation V-NAND flash memory with 128 gigabyte (GB), 256GB, 512GB and 1TB storage options. After introducing 3D V-NAND-based SSDs to data centers last year, Samsung is now extending its V-NAND SSD line-up to high-end PC applications, in expanding its market base. "We increased the availability of our 3D V-NAND by introducing an extensive V-NAND SSD line-up that covers the PC market in addition to data centers," said Young-Hyun Jun, executive vice president, memory sales and marketing, Samsung Electronics. "Look for us to provide a consistent, timely supply of high-performance, high-density V-NAND SSDs as well as core V-NAND chips for IT customers globally, contributing to fast market adoption of 3D NAND technology."

Windows XP EOL Helping PC Sales in Q1: Gartner

Worldwide PC shipments totaled 76.6 million units in the first quarter of 2014, a 1.7 percent decline from the first quarter of 2013, according to preliminary results by Gartner. The severity of the decline eased compared with the past seven quarters. "The end of XP support by Microsoft on April 8 has played a role in the easing decline of PC shipments," said Mikako Kitagawa, principal analyst at Gartner. "All regions indicated a positive effect since the end of XP support stimulated the PC refresh of XP systems. Professional desktops, in particular, showed strength in the quarter. Among key countries, Japan was greatly affected by the end of XP support, registering a 35 percent year-over-year increase in PC shipments. The growth was also boosted by sales tax change. We expect the impact of XP migration worldwide to continue throughout 2014."

"While the PC market remains weak, it is showing signs of improvement compared to last year. The PC professional market generally improved in regions such as EMEA. The U.S. saw the gradual recovery of PC spending as the impact of tablets faded." Ms. Kitagawa said. The PC market continued to be tough for many vendors. Economies of scale matter tremendously in this high-volume, low-profit market, which is forcing some vendors, such as Sony, out of the market. In contrast, all of the top five vendors, except Acer, registered year-over-year shipment growth. The top thee vendors - Lenovo, HP and Dell - have all confirmed the importance of the PC business as part of their overall business strategies.

"While the PC market remains weak, it is showing signs of improvement compared to last year. The PC professional market generally improved in regions such as EMEA. The U.S. saw the gradual recovery of PC spending as the impact of tablets faded." Ms. Kitagawa said. The PC market continued to be tough for many vendors. Economies of scale matter tremendously in this high-volume, low-profit market, which is forcing some vendors, such as Sony, out of the market. In contrast, all of the top five vendors, except Acer, registered year-over-year shipment growth. The top thee vendors - Lenovo, HP and Dell - have all confirmed the importance of the PC business as part of their overall business strategies.

Gartner Says PC Shipments Down 6.9 Percent in Q4 2013

Worldwide PC shipments totaled 82.6 million units in the fourth quarter of 2013, a 6.9 percent decline from the fourth quarter of 2012, according to preliminary results by Gartner, Inc. This is the seventh consecutive quarter of shipment decline.

"Although PC shipments continued to decline in the worldwide market in the fourth quarter, we increasingly believe markets, such as the U.S., have bottomed out as the adjustment to the installed base slows," said Mikako Kitagawa, principal analyst at Gartner. "Strong growth in tablets continued to negatively impact PC growth in emerging markets. In emerging markets, the first connected device for consumers is most likely a smartphone, and their first computing device is a tablet. As a result, the adoption of PCs in emerging markets will be slower as consumers skip PCs for tablets."

"Although PC shipments continued to decline in the worldwide market in the fourth quarter, we increasingly believe markets, such as the U.S., have bottomed out as the adjustment to the installed base slows," said Mikako Kitagawa, principal analyst at Gartner. "Strong growth in tablets continued to negatively impact PC growth in emerging markets. In emerging markets, the first connected device for consumers is most likely a smartphone, and their first computing device is a tablet. As a result, the adoption of PCs in emerging markets will be slower as consumers skip PCs for tablets."

OCZ Technology to Display New Enterprise Storage Solutions at Gartner's Symposium/ITX

OCZ Technology Group, Inc., a leading provider of high-performance solid-state drives (SSDs) for computing devices and systems, will display its enterprise storage solutions at the Gartner Symposium/ITXpo, Booth #1044, Walt Disney World Dolphin Resort, Lake Buena Vista, Florida, from October 21st through October 25th. The Gartner Symposium/ITXpo is an annual gathering of CIOs and senior IT executives seeking the latest tools, technologies, and information to improve IT capabilities and data center effectiveness.

For SAN acceleration of I/O intensive workloads, OCZ will present its leading Z-Drive R4 PCIe SSDs supporting both full-height (FH) and half-height (HH) configurations, enabling the CPU with direct access (zero-latency storage) and instant boot capabilities. The FH (3/4 length) RM88 model enables an industry best 2.8GB/s of sequential throughput, 410K of random IOPS performance, and usable MLC NAND flash capacities from 800GB to 3.2TB. The HH (half-length) RM84 model is also a performance leader enabling 2GB/s of sequential throughput, 250K of random IOPS performance and usable capacities from 300GB to 1.2TB.

For SAN acceleration of I/O intensive workloads, OCZ will present its leading Z-Drive R4 PCIe SSDs supporting both full-height (FH) and half-height (HH) configurations, enabling the CPU with direct access (zero-latency storage) and instant boot capabilities. The FH (3/4 length) RM88 model enables an industry best 2.8GB/s of sequential throughput, 410K of random IOPS performance, and usable MLC NAND flash capacities from 800GB to 3.2TB. The HH (half-length) RM84 model is also a performance leader enabling 2GB/s of sequential throughput, 250K of random IOPS performance and usable capacities from 300GB to 1.2TB.

Gartner Says Worldwide PC Shipments Declined 8 Percent in Third Quarter of 2012

Worldwide PC shipments totaled 87.5 million units in the third quarter of 2012, a decline of 8.3 percent compared with the third quarter of 2011, according to preliminary results by Gartner, Inc.

"A continuing slowdown in consumer PC shipments played a big part in the overall PC market decline," said Mikako Kitagawa, principal analyst at Gartner. "The third quarter was also a transitional quarter before Microsoft's Windows 8 operating system release, so shipments were less vigorous as vendors and their channel partners liquidated inventory.

"A continuing slowdown in consumer PC shipments played a big part in the overall PC market decline," said Mikako Kitagawa, principal analyst at Gartner. "The third quarter was also a transitional quarter before Microsoft's Windows 8 operating system release, so shipments were less vigorous as vendors and their channel partners liquidated inventory.

JEDEC Updates Universal Flash Storage (UFS) Standard

JEDEC Solid State Technology Association, the global leader in the development of standards for the microelectronics industry, today announced the publication of key updates to its Universal Flash Storage (UFS) standard. Specifically tailored for mobile applications and computing systems requiring high performance and low power consumption, the new UFS v1.1 standard is an update to the v1.0 standard published in 2011, incorporating feedback from industry UFS technology implementers. JESD220A Universal Flash Storage v1.1 contains important amendments and references to the latest related MIPI Alliance specifications, and may be downloaded free of charge from the JEDEC website here.

JEDEC has also published a complementary standard, JESD223A UFS Host Controller Interface (HCI) v1.1. JESD223A defines a standard host controller interface on which system designers can create a common host controller software driver layer to work with UFS host controller hardware from different manufacturers. The HCI functionality also enables higher performance and power efficiency by minimizing the involvement of the host processor in the operation of the Flash storage subsystem. JESD223A Universal Flash Storage Host Controller Interface v1.1 may also be downloaded free of charge here.

JEDEC has also published a complementary standard, JESD223A UFS Host Controller Interface (HCI) v1.1. JESD223A defines a standard host controller interface on which system designers can create a common host controller software driver layer to work with UFS host controller hardware from different manufacturers. The HCI functionality also enables higher performance and power efficiency by minimizing the involvement of the host processor in the operation of the Flash storage subsystem. JESD223A Universal Flash Storage Host Controller Interface v1.1 may also be downloaded free of charge here.

Gartner Says PC Shipments Will Grow 4.4 Percent in 2012

Worldwide PC shipments are on pace to total 368 million units in 2012, a 4.4 percent increase from 2011, according to the latest forecast by Gartner, Inc. PC shipments are forecast to see higher growth by the end of 2013, when shipments are expected to reach more than 400 million units.

"PC shipments will remain weak in 2012, as the PC market plays catch up in bringing a new level of innovation that consumers want to see in devices they purchase," said Ranjit Atwal, research director at Gartner. "The real question is whether Windows 8 and ultrabooks will create the compelling offering that gets the earlier adopter of devices excited about PCs again."

"PC shipments will remain weak in 2012, as the PC market plays catch up in bringing a new level of innovation that consumers want to see in devices they purchase," said Ranjit Atwal, research director at Gartner. "The real question is whether Windows 8 and ultrabooks will create the compelling offering that gets the earlier adopter of devices excited about PCs again."

Apr 6th, 2025 15:57 EDT

change timezone

Latest GPU Drivers

New Forum Posts

- A dozen drivers for HD4670, and which do I choose? (7)

- How I made an Ultimate Cooling Guide (19)

- What local LLM-s you use? (148)

- I have a bricked XFX Radeon RX 580 8GB GPU. HELP! (12)

- Do you use Linux? (560)

- TPU's F@H Team (20422)

- 9070XT or 7900XT (27)

- Share your AIDA 64 cache and memory benchmark here (3046)

- The easiest way to connect the BOOTSEL test metal terminal and the GND terminal.... (0)

- All Intel DG1 needs special bios? (30)

Popular Reviews

- ASUS Prime X870-P Wi-Fi Review

- UPERFECT UStation Delta Max Review - Two Screens In One

- PowerColor Radeon RX 9070 Hellhound Review

- Corsair RM750x Shift 750 W Review

- DDR5 CUDIMM Explained & Benched - The New Memory Standard

- Upcoming Hardware Launches 2025 (Updated Apr 2025)

- Sapphire Radeon RX 9070 XT Pulse Review

- Sapphire Radeon RX 9070 XT Nitro+ Review - Beating NVIDIA

- AMD Ryzen 7 9800X3D Review - The Best Gaming Processor

- Pwnage Trinity CF Review

Controversial News Posts

- MSI Doesn't Plan Radeon RX 9000 Series GPUs, Skips AMD RDNA 4 Generation Entirely (146)

- NVIDIA GeForce RTX 5060 Ti 16 GB SKU Likely Launching at $499, According to Supply Chain Leak (124)

- Microsoft Introduces Copilot for Gaming (124)

- AMD Radeon RX 9070 XT Reportedly Outperforms RTX 5080 Through Undervolting (119)

- NVIDIA Reportedly Prepares GeForce RTX 5060 and RTX 5060 Ti Unveil Tomorrow (115)

- Over 200,000 Sold Radeon RX 9070 and RX 9070 XT GPUs? AMD Says No Number was Given (100)

- NVIDIA GeForce RTX 5050, RTX 5060, and RTX 5060 Ti Specifications Leak (97)

- Nintendo Switch 2 Launches June 5 at $449.99 with New Hardware and Games (92)