Redesigned Apple MacBook Pro Coming This Summer with up to 64 GB of RAM and 10-Core Processor

According to Bloomberg, which first predicted the arrival of Apple custom processors in MacBooks, we have another piece of information regarding Apple's upcoming MacBook Pro lineup, set to arrive this summer. As you are aware, MacBook Pro right now comes in two different variants. The first is a smaller 13-inch design that is powered by Apple's M1 chip, while the second is a 16-inch design powered by an Intel Core processor. However, it seems like that will no longer be the case when the next-generation lineup arrives. Starting this summer, all of the MacBook Pro models will have Apple's custom silicon powering these devices, which bring Intel's presence to an end.

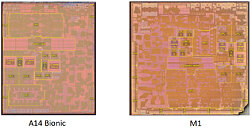

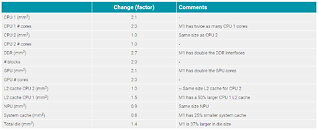

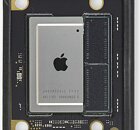

And the successor to the now-famous M1 chip seems to be very good. As per the report, Apple is upgrading the architecture and the total core count. There are two different chips, codenamed Jade C-Chop and Jade C-Die. Both are 10-core designs, equipped with two small and eight big cores. The difference between the two is the total number of graphics cores enabled. The smaller version will have 16 graphics cores, while the bigger one will have 32 graphics cores. On the SoC, there will be an updated Neural Engine, for better AI processing. These new processors will come with up to 64 GB of RAM in selected configurations as well. The report also notes the arrival of HDMI port, SD card slot, and MagSafe for charging.

And the successor to the now-famous M1 chip seems to be very good. As per the report, Apple is upgrading the architecture and the total core count. There are two different chips, codenamed Jade C-Chop and Jade C-Die. Both are 10-core designs, equipped with two small and eight big cores. The difference between the two is the total number of graphics cores enabled. The smaller version will have 16 graphics cores, while the bigger one will have 32 graphics cores. On the SoC, there will be an updated Neural Engine, for better AI processing. These new processors will come with up to 64 GB of RAM in selected configurations as well. The report also notes the arrival of HDMI port, SD card slot, and MagSafe for charging.